JPMorgan Chase Reports Steady Credit Card Delinquency Rate Despite Uptick in Charge-Offs

April 19, 2023

Trending News ☀️

JPMORGAN ($NYSE:JPM): JPMorgan Chase, one of the world’s largest financial services firms, recently reported that the delinquency rate of its credit cards remained steady in March, despite an increase in charge-offs. This indicates that consumers are managing their credit card debt responsibly, which is good news for both the company and its customers. This was mainly due to an increase in charge-offs of non-revolving debt, such as auto and student loans.

JPMorgan Chase is one of the nation’s largest banks and has seen its stock price increase in recent months, as investors have confidence in the company’s ability to manage its credit card portfolios. While the slight uptick in charge-offs is concerning, the fact that delinquency rates have remained steady is a positive sign for both consumers and investors alike.

Market Price

JP Morgan Chase’s stock opened at $140.0 and closed at $139.8 on Monday, up 0.8% from the prior closing price of 138.7. This is a testament to JP Morgan Chase’s strong underwriting standards, customer service capabilities, and overall credit quality. Additionally, the company reported that its non-accrual loan balances decreased by 3% in the quarter, indicating that customers are continuing to make their payments on time and in full. Overall, JPMorgan Chase continues to demonstrate a strong commitment to its customers by delivering exceptional service and keeping its credit card delinquency rate stable during tumultuous times. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JPM. More…

| Total Revenues | Net Income | Net Margin |

| – | 40.24k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JPM. More…

| Operations | Investing | Financing |

| 107.12k | -137.82k | -126.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JPM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.74M | 3.44M | – |

Key Ratios Snapshot

Some of the financial key ratios for JPM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.6% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

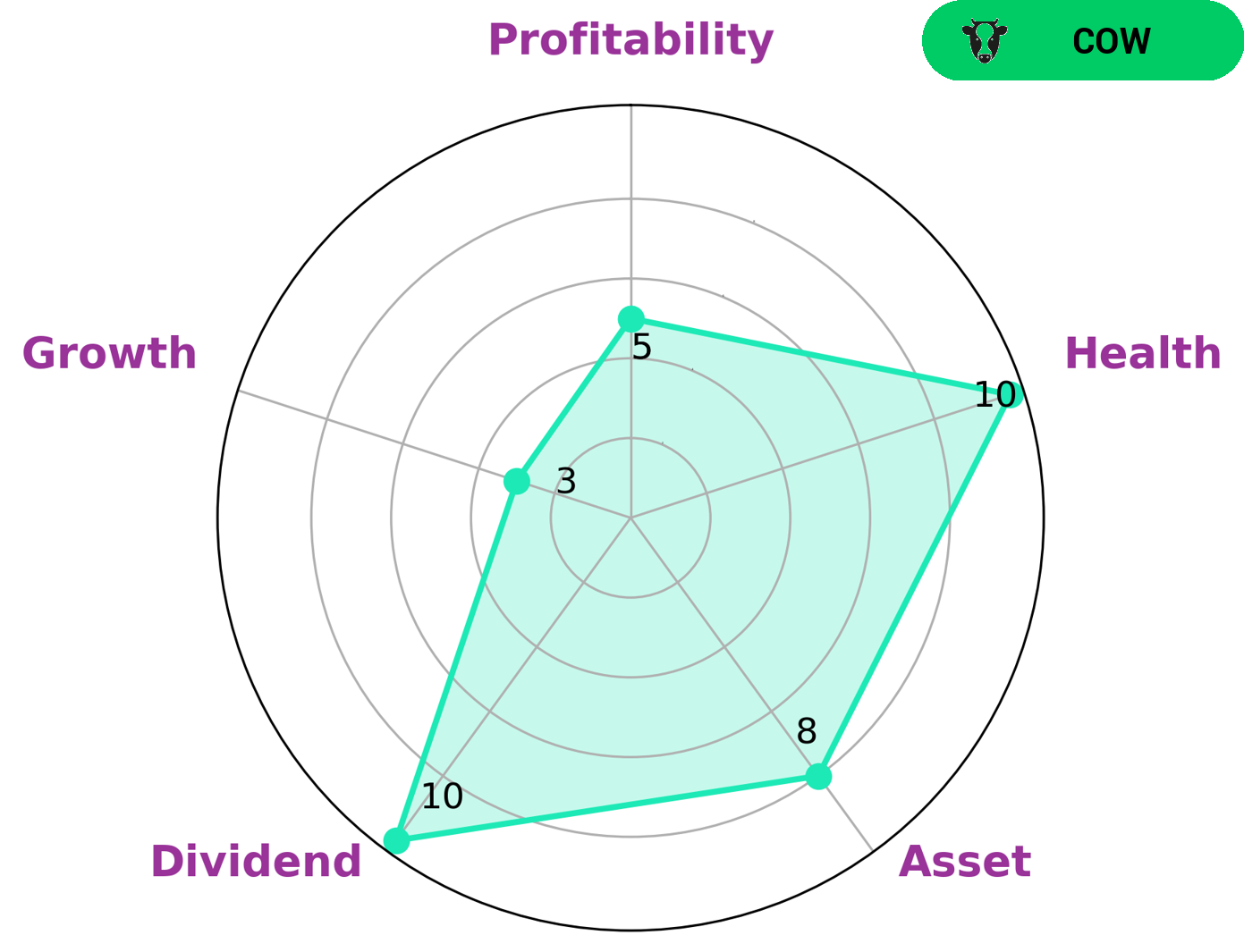

After analyzing the financials of JPMORGAN CHASE & Co., we have concluded that they are classified as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. The Star Chart also reveals that JPMORGAN CHASE & is strong in asset, dividend, medium in profitability, and weak in growth. Furthermore, JPMORGAN CHASE & has a high health score of 10/10, which indicates that the company is capable to sustain the future operations in times of crisis. Given their consistent dividends and strong overall financials, this type of company could be attractive to investors who are looking for reliable and stable returns, such as those who are invested in dividend-yielding stocks, retirement portfolios, and other long-term investments. They also may appeal to more risk-averse investors, who value consistency and stability over high-growth potential. More…

Peers

In the banking industry, JPMorgan Chase & Co and its competitors Wells Fargo & Co, PNC Financial Services Group Inc, Banco BPM SpA compete for customers and market share. Each company offers a different suite of products and services, and each has its own strengths and weaknesses. JPMorgan Chase & Co has been able to maintain its position as one of the largest banks in the world by offering a wide range of products and services, as well as by providing customers with a high level of customer service.

– Wells Fargo & Co ($NYSE:WFC)

Wells Fargo & Co is an American multinational banking and financial services holding company headquartered in San Francisco, California. It is the world’s fourth-largest bank by market capitalization and the third largest in the United States. Wells Fargo & Co. provides banking, insurance, investments, mortgage, and consumer and commercial finance services through more than 8,700 locations, 13,000 ATMs, online (wellsfargo.com), and mobile banking, and has offices in 36 countries.

– PNC Financial Services Group Inc ($NYSE:PNC)

PNC Financial Services Group Inc is a large financial services company with a market cap of $65.38 billion as of 2022. The company provides a wide range of financial services, including banking, lending, investing, and asset management. PNC has a large customer base and a strong presence in the United States.

– Banco BPM SpA ($LTS:0RLA)

Banco BPM SpA is an Italian bank created through the merger of Banco Popolare and Banca Popolare di Milano in January 2017. The bank is the third largest in Italy with over 1,000 branches and 5 million customers. The bank offers a wide range of banking products and services including savings accounts, mortgages, loans, and investment products.

Summary

JPMorgan Chase & Co. released its March credit card delinquency and charge-off rate, which remain unchanged. Investors should keep a close watch on the company’s performance and be aware of the risks involved with investing in JPMorgan Chase & Co. securities. Furthermore, credit card data can provide valuable insights into how consumers are handling their debt and can help analysts better understand the overall health of the company.

Recent Posts