East West Bancorp Reports Higher-Than-Expected Earnings, Lower-Than-Expected Revenue

April 21, 2023

Trending News 🌥️

The company exceeded analyst expectations for GAAP earnings per share, coming in at $2.27, which was $0.07 higher than the forecast.

However, revenue fell short of the expectations by about $13.85 million. This news comes as a surprise as East West Bancorp ($NASDAQ:EWBC) has been performing well in recent years. It provides a range of retail banking services including deposit accounts, credit cards, loans, wealth management, and other financial services. It also provides international banking services through its subsidiaries in Hong Kong and other Asian countries. Overall, the company’s performance is a positive sign for the industry and investors alike. While revenue was lower than expected, the company’s GAAP earnings per share still outperformed analyst expectations. This could indicate a potential for long-term growth and profitability for East West Bancorp going forward.

Market Price

East West Bancorp, a leading financial services provider, reported higher-than-expected earnings and lower-than-expected revenue for the quarter on Thursday. The stock opened at $53.0 and closed at $55.6, down by 0.1% from the prior closing price of $55.7. Despite the decline in the stock, the company managed to beat analyst estimates of earnings per share (EPS) by more than 10%. The strong performance in its core banking business was the key driver of the higher-than-expected earnings.

However, the company’s revenue was lower than expected due to weak mortgage banking and wealth management businesses. Despite the drop in revenue, East West Bancorp remains confident that it can deliver a strong performance going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for EWBC. More…

| Total Revenues | Net Income | Net Margin |

| – | 1.13k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for EWBC. More…

| Operations | Investing | Financing |

| 2.07k | -4.58k | 2.11k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for EWBC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 64.11k | 58.13k | – |

Key Ratios Snapshot

Some of the financial key ratios for EWBC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

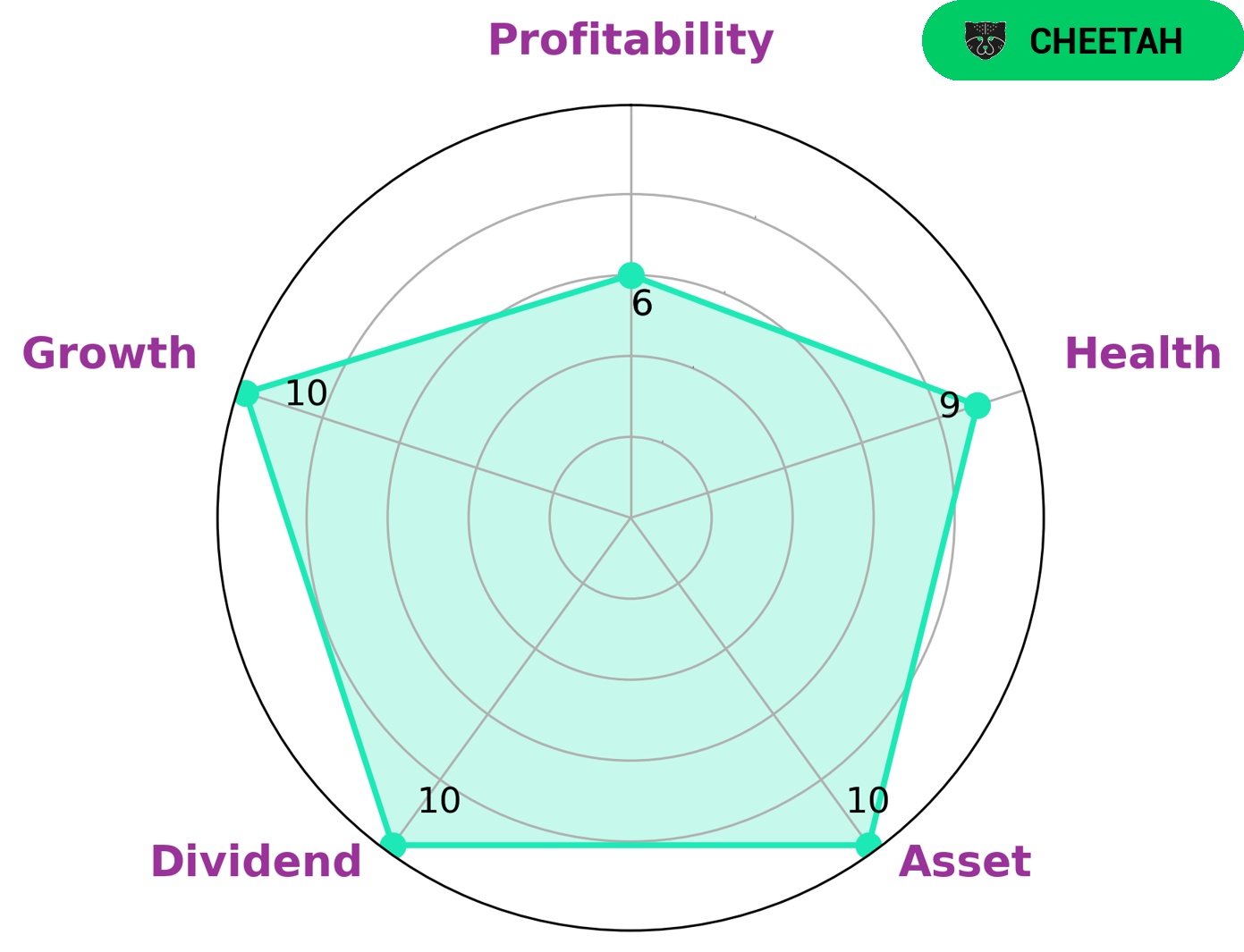

At GoodWhale, we analyze EAST WEST BANCORP’s fundamentals to give investors the best insight into the company. Our Star Chart shows that EAST WEST BANCORP is strong in growth, asset, dividend, and medium in profitability. This leads us to classify EAST WEST BANCORP as ‘cheetah’, a type of company that achieved high revenue or earnings growth but considered less stable due to its lower profitability. This makes EAST WEST BANCORP attractive to some investors who are looking for companies with high potential for appreciation but are willing to accept higher risk. Furthermore, our health score for EAST WEST BANCORP is 9/10. This means that EAST WEST BANCORP has a strong cash flow and debt situation and is capable of riding out any crisis without the risk of bankruptcy. More…

Peers

In the banking industry, East West Bancorp Inc faces stiff competition from Bank of East Asia Ltd, Ping An Bank Co Ltd, and Postal Savings Bank Of China Co Ltd. These companies are all vying for market share in the banking industry, and each has its own strengths and weaknesses. East West Bancorp Inc has to carefully strategize in order to maintain its position in the industry.

– Bank of East Asia Ltd ($SEHK:00023)

Bank of East Asia Ltd is a Hong Kong-based banking and financial services company with a market cap of 22.31B as of 2022. The company provides a range of banking and financial services to retail, corporate, and institutional customers through its network of branches and ATMs in Hong Kong, Macau, Mainland China, Taiwan, the United Kingdom, and the United States.

– Ping An Bank Co Ltd ($SZSE:000001)

As of 2022, Ping An Bank Co Ltd has a market cap of 217.35B. The company is a leading provider of banking and financial services in China. It offers a wide range of products and services, including deposits, loans, credit cards, foreign exchange, and wealth management. The company has a strong presence in both the retail and corporate banking markets. It has a nationwide network of branches and ATMs, and a growing online and mobile banking business. The company is well-positioned to benefit from the continued growth of the Chinese economy.

– Postal Savings Bank Of China Co Ltd ($SEHK:01658)

Postal Savings Bank of China Co., Ltd. operates as a savings bank in China. The Bank offers personal savings, time deposit, and loan products, as well as foreign exchange, settlement, and other related services. Postal Savings Bank of China Co., Ltd. was founded in 2007 and is headquartered in Beijing, China.

Summary

East West Bancorp, a financial holding company, recently reported its quarterly financial results. The results showed that the company’s reported earnings for the quarter exceeded its estimated earnings per share by $0.07.

However, the reported revenue of $659.83 million fell short of the estimated revenue by $13.85 million. Investors should take note of this miss and its potential implications for East West Bancorp’s future financial performance.

Additionally, investing analysis should consider the company’s overall financial health and prospects for future growth before making a decision about investing in East West Bancorp.

Recent Posts