Lookers Plc dividend yield – Lookers PLC Declares 0.02 Cash Dividend

May 28, 2023

Dividends Yield

On May 25 2023, Lookers ($LSE:LOOK) PLC announced their latest dividend distribution of 0.02 cash per share. This was a slight decrease from the previous year’s dividend of 0.04 GBP per share. Despite the reduction, this dividend still resulted in a 3.99% yield over the last three years, a consistency that has been maintained from 2022 to 2023. If you are looking for dividends, Lookers PLC might be worth considering.

The ex-dividend date has been set for May 11 2023, so investors must purchase Lookers PLC stock prior to this date to receive the dividend. Despite the decreased dividend, with an average yield of 3.99% over the past three years, Lookers PLC is proving to be a reliable source of dividends for investors. With the ex-dividend date just around the corner, investors should take a closer look at Lookers PLC if they are seeking reliable dividend investments.

Price History

This news came on the same day that LOOKERS PLC stock opened at £0.8 and closed at £0.8, a 2.1% decrease from its prior closing price of £0.8. Investors who hold shares in the company will benefit from this dividend payment, which could lead to an increase in stock prices in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lookers Plc. More…

| Total Revenues | Net Income | Net Margin |

| 4.3k | 73.9 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lookers Plc. More…

| Operations | Investing | Financing |

| 57.1 | 15.1 | -27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lookers Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.67k | 1.24k | 1.12 |

Key Ratios Snapshot

Some of the financial key ratios for Lookers Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.5% | 15.7% | 2.5% |

| FCF Margin | ROE | ROA |

| 0.9% | 15.9% | 4.0% |

Analysis

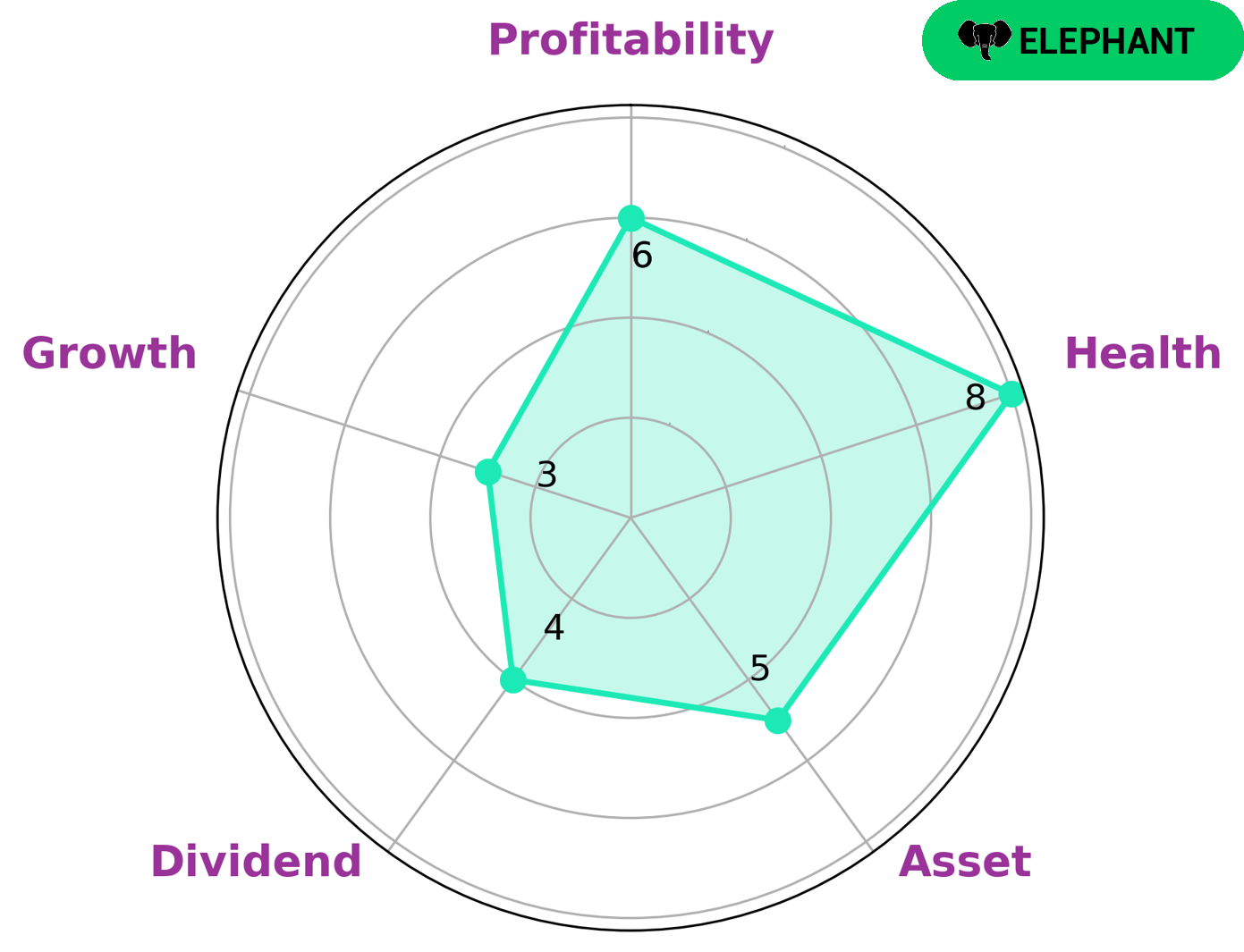

At GoodWhale, we conducted an analysis of LOOKERS PLC‘s wellbeing. The results of our analysis have been compiled in the form of a Star Chart, which gave LOOKERS PLC a high health score of 8/10. This score was based on the company’s cashflows and debt, suggesting that LOOKERS PLC is capable to sustain future operations even in times of crisis. Our analysis also classified LOOKERS PLC as an ‘elephant’, meaning that it has enough assets to cover its liabilities. This makes LOOKERS PLC an attractive investment for investors who are looking for a secure company with long-term potential. LOOKERS PLC is particularly strong in asset management, dividend returns, profitability and low debt levels, but has weaker growth prospects than some of its competitors. Therefore, investors who are willing to take a calculated risk in the short term may be interested in investing in LOOKERS PLC in order to benefit from its long-term potential. More…

Peers

The company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. Lookers reported revenue of £2.96 billion in 2019. Univance Corp is a Japanese automotive retailer with a network of over 60 dealerships. The company is listed on the Tokyo Stock Exchange and reported revenue of ¥1.8 trillion in 2019. Dongfeng Automobile Co Ltd is a Chinese automotive manufacturer and retailer with a network of over 4,500 dealerships. The company is listed on the Shenzhen Stock Exchange and reported revenue of ¥267.6 billion in 2019. Inter Cars SA is a Polish automotive retailer with a network of over 1,000 dealerships. The company is listed on the Warsaw Stock Exchange and reported revenue of PLN 10.4 billion in 2019.

– Univance Corp ($TSE:7254)

Univance Corp is a publicly traded company with a market capitalization of $7.96 billion as of 2022. The company’s return on equity is 8.21%. Univance is engaged in the business of providing software and services to the insurance industry.

– Dongfeng Automobile Co Ltd ($SHSE:600006)

Dongfeng Automobile Co Ltd is a Chinese manufacturer of automobiles and commercial vehicles. The company has a market cap of 11.56B as of 2022 and a return on equity of 0.91%. Dongfeng Automobile Co Ltd is a subsidiary of Dongfeng Motor Corporation. The company produces a range of vehicles including passenger cars, SUVs, trucks, and buses.

– Inter Cars SA ($LTS:0LUR)

Inter Cars SA is a automotive company that supplies spare parts and equipment to the automotive industry. As of 2022, the company has a market cap of 5.11 billion and a return on equity of 18.9%. The company has a strong presence in Europe and is expanding into other markets such as Asia and South America.

Summary

Investing in LOOKERS PLC has been a steady option for investors over the past three years. The company has consistently issued an annual dividend per share of 0.04 GBP, which equates to a dividend yield of 3.99%. This amount is well above the average yield of the FTSE All Share index, making it a good option for income-seeking investors. Although there is always the potential for dividend payments to fluctuate or be reduced, the steady dividend payment from LOOKERS PLC over the past three years suggests that investors can expect to continue to receive reliable returns in the future.

Recent Posts