GPI stock dividend – Group 1 Automotive Pays $0.45 Dividend and Appoints New Non-Executive Chair

May 18, 2023

Trending News 🌥️

Group 1 Automotive ($NYSE:GPI) is one of the largest automotive retail and service companies in the United States. This will be the first time that Group 1 Automotive will have a non-executive chair on its board. This appointment will enable the company to benefit from Olesky’s experience and insights in running successful automotive dealerships.

Group 1 Automotive’s dividend payment and appointment of a new non-executive chair will help to further strengthen the company’s financial position and provides an incentive for existing shareholders to remain invested in the company. It also signals confidence in the company’s future prospects, which should boost investor confidence in the company’s stock.

Dividends – GPI stock dividend

Group 1 Automotive, Inc. recently announced that it has declared a quarterly dividend of $0.45 per share of its common stock. This is the third consecutive year that the company has issued an annual dividend per share, with the last three years’ dividends being 1.59, 1.5, and 1.33 USD respectively. The company also announced that the current dividend yields from 2021 to 2023 are estimated to be 0.8%, 0.81%, and 0.79% respectively, with an average dividend yield of 0.8%. Mr Klein brings with him a wealth of experience and knowledge in the automotive industry, which is expected to have a positive impact on the company’s performance.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GPI. More…

| Total Revenues | Net Income | Net Margin |

| 16.51k | 708.9 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GPI. More…

| Operations | Investing | Financing |

| 585.9 | -484.6 | -67.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GPI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.72k | 4.48k | 158.61 |

Key Ratios Snapshot

Some of the financial key ratios for GPI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.4% | 41.7% | 6.3% |

| FCF Margin | ROE | ROA |

| 2.6% | 29.2% | 9.7% |

Market Price

On Wednesday, GROUP 1 AUTOMOTIVE stock opened at $217.7 and closed at $222.1, up by 2.8% from prior closing price of 216.2. This increase in stock price was due to the announcement that the company has paid out a $0.45 dividend to its shareholders and appointed a new Non-Executive Chair. This dividend was in line with Group 1 Automotive’s strategy to provide returns to its shareholders and create long-term value for the company. The new Non-Executive Chair is an experienced industry professional, with a proven track record of delivering profitable results and creating value for shareholders.

He brings with him a wealth of knowledge and experience from the automotive industry, which is expected to help strengthen and grow the Group’s operations. He also has a deep understanding of the challenges facing the automotive sector and the strategies required to succeed in this competitive environment. Overall, the appointment of a new Non-Executive Chair and the payment of a dividend to shareholders are both significant events for Group 1 Automotive, as they demonstrate the company’s commitment to providing returns to its shareholders and creating long-term value for the company. Live Quote…

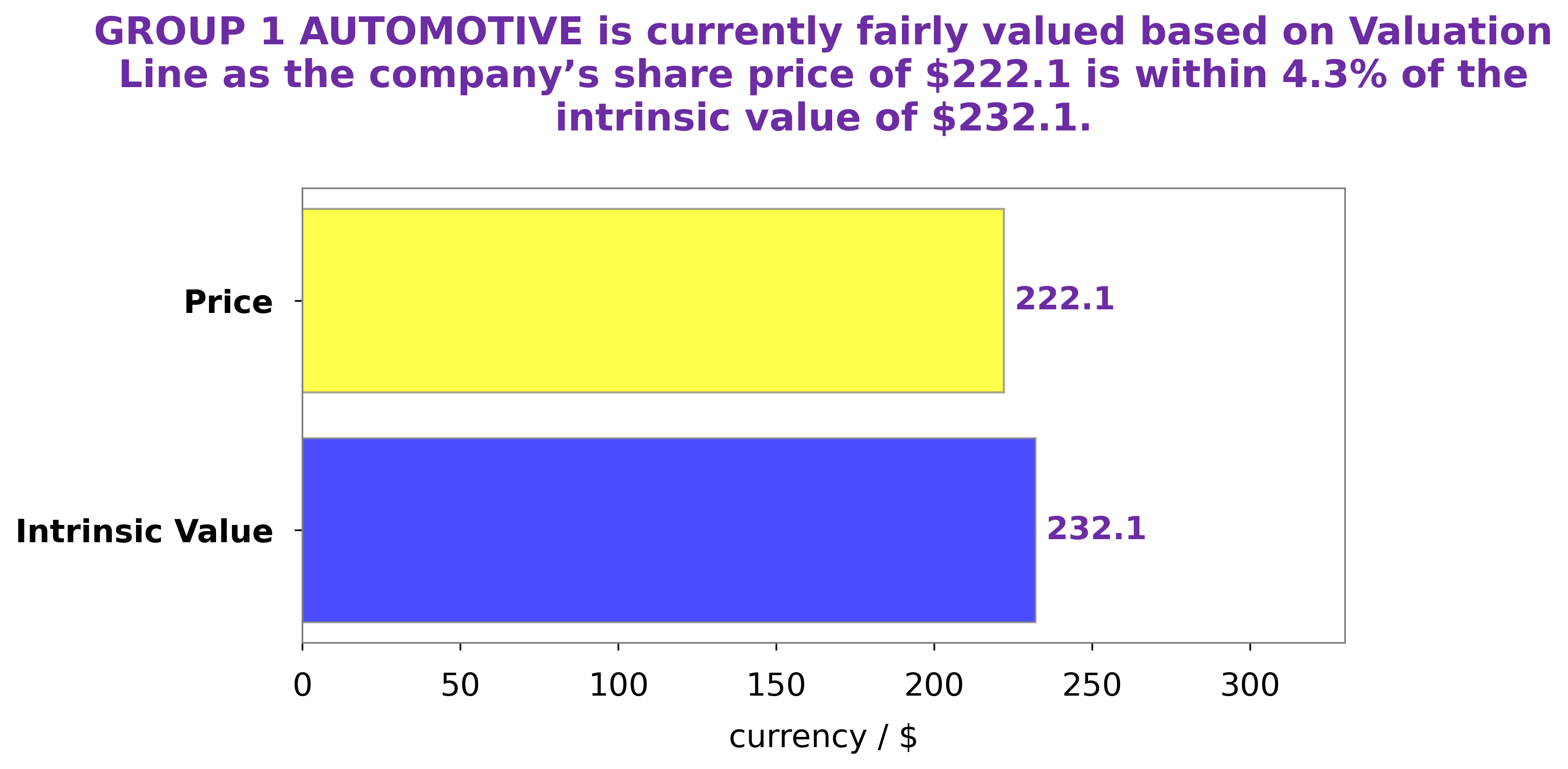

Analysis – GPI Intrinsic Stock Value

GoodWhale has completed an analysis of GROUP 1 AUTOMOTIVE’s fundamentals and we have calculated the fair value of their share to be around $232.1. This figure was determined through our proprietary Valuation Line which takes into account key metrics such as price-to-earnings and price-to-book ratios. Currently, GROUP 1 AUTOMOTIVE is trading at $222.1, which represents a fair price that is undervalued by 4.3%. From an investment perspective, this could be a potentially attractive opportunity for investors looking to capitalize on this potential discount. More…

Peers

Group 1 Automotive Inc is an American automotive retailer. The company sells, services, and finances vehicles through its dealerships in the United States, the United Kingdom, and Brazil. Group 1 Automotive Inc also owns and operates collision centers, parts stores, and auto auctions. The company was founded in 1995 and is headquartered in Houston, Texas. Penske Automotive Group Inc is an American automotive retailer. The company sells, services, and finances vehicles through its dealerships in the United States, the United Kingdom, and Australia. Penske Automotive Group Inc also owns and operates collision centers, parts stores, and auto auctions. The company was founded in 1999 and is headquartered in Bloomfield Hills, Michigan. AutoNation Inc is an American automotive retailer. The company sells, services, and finances vehicles through its dealerships in the United States. AutoNation Inc also owns and operates collision centers, parts stores, and auto auctions. The company was founded in 1996 and is headquartered in Fort Lauderdale, Florida. Murphy USA Inc is an American oil and gas company. The company owns and operates gas stations and convenience stores in the United States. Murphy USA Inc also owns and operates a refinery. The company was founded in 1996 and is headquartered in El Dorado, Arkansas.

– Penske Automotive Group Inc ($NYSE:PAG)

Penske Automotive Group Inc. is an international transportation services provider. The company operates in three segments: Retail Automotive, Retail Commercial Truck, and Other. The Retail Automotive segment sells new and used vehicles, and provides vehicle maintenance, warranty, paint and collision repair, and other services. The Retail Commercial Truck segment sells new and used trucks, and offers financing, leasing, and rental options. The Other segment provides financing, insurance, and fleet management services. Penske Automotive Group Inc. was founded in 1969 and is headquartered in Bloomfield Hills, Michigan.

– AutoNation Inc ($NYSE:AN)

AutoNation Inc is an American automotive retailer, and it is the largest in the United States by vehicle sales. The company also has a large market share in terms of service and parts sales. AutoNation Inc has a market cap of 5.26B as of 2022, a Return on Equity of 57.65%. The company has been in business since 1996 and is headquartered in Fort Lauderdale, Florida. AutoNation is a publicly-traded company on the New York Stock Exchange (NYSE: AN).

– Murphy USA Inc ($NYSE:MUSA)

Murphy USA Inc is a gas station and convenience store company. The company operates in the United States and Canada. Murphy USA Inc is headquartered in El Dorado, Arkansas. The company was founded in 1996.

Summary

Group 1 Automotive Inc. has declared a dividend of $0.45 per share and has appointed a new non-executive chair. This shows the company’s commitment to rewarding shareholders while also investing in its leadership. From an investing perspective, Group 1 Automotive’s consistent dividend payments and updates to its board of directors suggest it is a financially sound company. With the addition of a new non-executive chair, investors can expect a greater focus on corporate governance and risk management, potentially leading to improved returns over time.

Recent Posts