GPI Intrinsic Value – Group 1 Automotive Reports Record Breaking Earnings and Revenue

April 27, 2023

Trending News 🌥️

Group 1 Automotive ($NYSE:GPI) recently reported record-breaking earnings and revenue in their most recent financial report. The company reported Non-GAAP earnings per share of $10.93, exceeding the estimates of $9.88 by $1.05, and revenue of $4.13 billion, surpassing the estimated amount of $3.92 billion by $210 million. Group 1 Automotive is committed to offering quality service and vehicles to their customers, and these record-breaking financial results are a testament to that commitment. They have been able to stay ahead of the competition in terms of sales and customer satisfaction, and the continued success is a testament to the value they offer.

Share Price

The stock opened at $220.0 and closed at $221.1, up by 0.4% from its previous closing price of 220.2. This marks a new milestone for the company and investors are expecting further gains as the company continues to grow. The strong performance of the company was driven by increased demand for its products and services, along with cost-cutting initiatives that resulted in higher margins.

Additionally, GROUP 1 AUTOMOTIVE saw an increase in sales across all its major markets, which contributed to the company’s overall growth. Investors will be keenly watching what the company does next as it continues to expand its presence in the automotive industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GPI. More…

| Total Revenues | Net Income | Net Margin |

| 16.22k | 751.5 | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GPI. More…

| Operations | Investing | Financing |

| 585.9 | -484.6 | -67.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GPI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.72k | 4.48k | 157.58 |

Key Ratios Snapshot

Some of the financial key ratios for GPI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.4% | 41.5% | 6.7% |

| FCF Margin | ROE | ROA |

| 2.7% | 30.6% | 10.1% |

Analysis – GPI Intrinsic Value

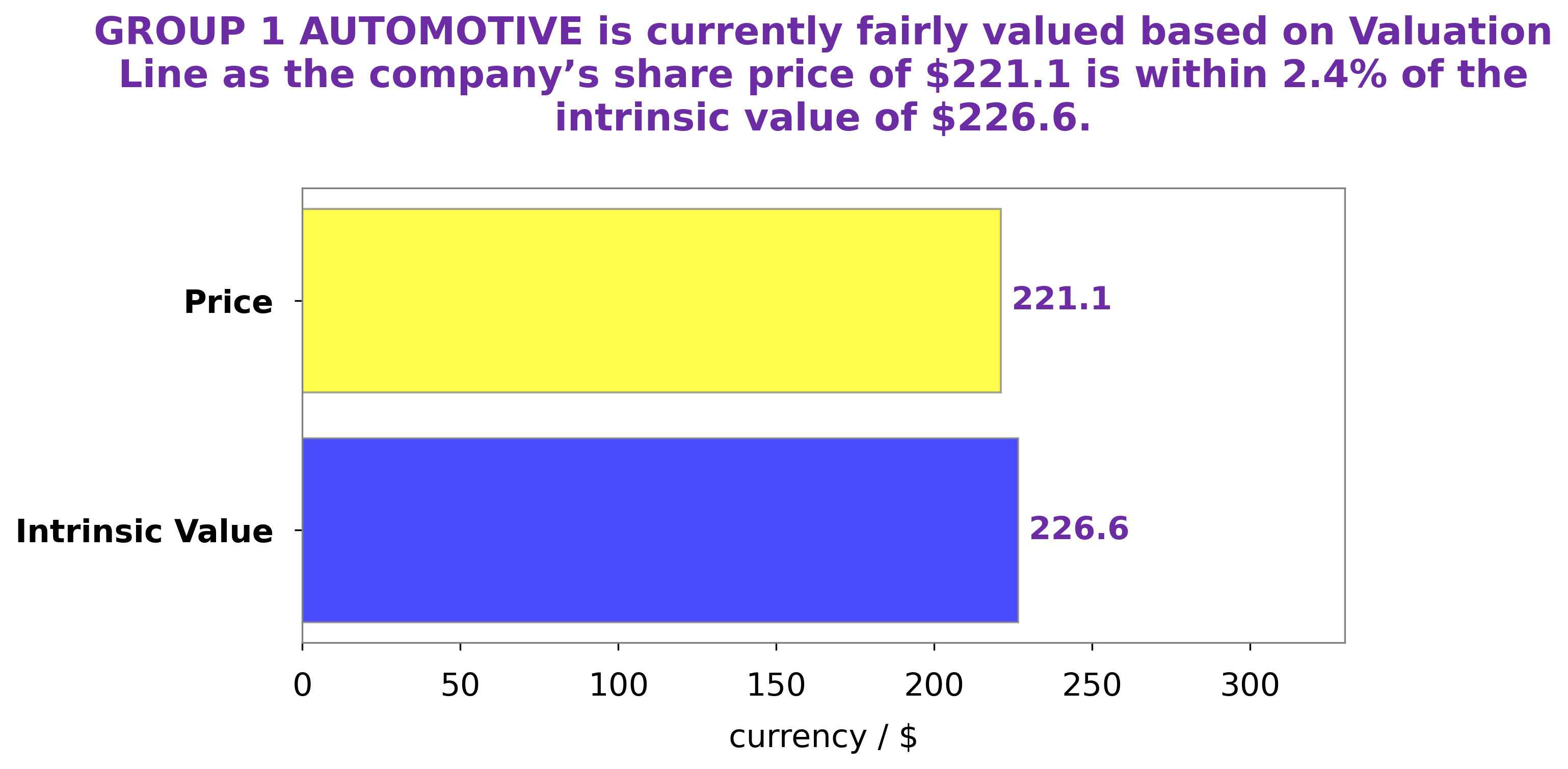

At GoodWhale, we performed a detailed analysis on the financials of GROUP 1 AUTOMOTIVE. Our proprietary Valuation Line determined the fair value of their share to be around $226.6. Currently, GROUP 1 AUTOMOTIVE stock is trading at $221.1, which is slightly undervalued by 2.4%. This presents an opportunity for investors to purchase the stock for a small discount, while still achieving market value in the long run. With our analysis, investors can make informed decisions when it comes to their investments. More…

Peers

Group 1 Automotive Inc is an American automotive retailer. The company sells, services, and finances vehicles through its dealerships in the United States, the United Kingdom, and Brazil. Group 1 Automotive Inc also owns and operates collision centers, parts stores, and auto auctions. The company was founded in 1995 and is headquartered in Houston, Texas. Penske Automotive Group Inc is an American automotive retailer. The company sells, services, and finances vehicles through its dealerships in the United States, the United Kingdom, and Australia. Penske Automotive Group Inc also owns and operates collision centers, parts stores, and auto auctions. The company was founded in 1999 and is headquartered in Bloomfield Hills, Michigan. AutoNation Inc is an American automotive retailer. The company sells, services, and finances vehicles through its dealerships in the United States. AutoNation Inc also owns and operates collision centers, parts stores, and auto auctions. The company was founded in 1996 and is headquartered in Fort Lauderdale, Florida. Murphy USA Inc is an American oil and gas company. The company owns and operates gas stations and convenience stores in the United States. Murphy USA Inc also owns and operates a refinery. The company was founded in 1996 and is headquartered in El Dorado, Arkansas.

– Penske Automotive Group Inc ($NYSE:PAG)

Penske Automotive Group Inc. is an international transportation services provider. The company operates in three segments: Retail Automotive, Retail Commercial Truck, and Other. The Retail Automotive segment sells new and used vehicles, and provides vehicle maintenance, warranty, paint and collision repair, and other services. The Retail Commercial Truck segment sells new and used trucks, and offers financing, leasing, and rental options. The Other segment provides financing, insurance, and fleet management services. Penske Automotive Group Inc. was founded in 1969 and is headquartered in Bloomfield Hills, Michigan.

– AutoNation Inc ($NYSE:AN)

AutoNation Inc is an American automotive retailer, and it is the largest in the United States by vehicle sales. The company also has a large market share in terms of service and parts sales. AutoNation Inc has a market cap of 5.26B as of 2022, a Return on Equity of 57.65%. The company has been in business since 1996 and is headquartered in Fort Lauderdale, Florida. AutoNation is a publicly-traded company on the New York Stock Exchange (NYSE: AN).

– Murphy USA Inc ($NYSE:MUSA)

Murphy USA Inc is a gas station and convenience store company. The company operates in the United States and Canada. Murphy USA Inc is headquartered in El Dorado, Arkansas. The company was founded in 1996.

Summary

Group 1 Automotive delivered strong financial performance in its latest earnings report, easily surpassing market expectations. Non-GAAP EPS of $10.93 came in $1.05 above estimates, while revenue of $4.13B beat estimates by $210M. This indicates that the company is in good health, with strong demand and well-managed costs driving the positive financial results. The company is likely to continue to outperform market expectations and should attract the attention of investors looking for solid returns in the automotive sector.

Recent Posts