Exploring the Technical Aspects of ACV Auctions

April 6, 2023

Trending News 🌥️

ACV ($NASDAQ:ACVA) Auctions Inc is an online platform for buyers and sellers of used vehicles. The company provides a wide range of services, such as end-to-end vehicle inspection, detailed condition reports, digital title transfer, and secure payment processing. This article will provide a technical analysis of ACV Auctions Inc, exploring its strengths and weaknesses in the used car market. ACV Auctions Inc has found success by making the purchasing process more efficient and secure. The company uses state of the art technology to facilitate the process of vehicle inspections and records management. This allows it to provide detailed information on the condition of a vehicle and protect the rights of buyers and sellers.

Additionally, ACV Auctions Inc has developed a secure payment system to protect customers from fraud. The company has also developed an auction platform that allows buyers to bid on vehicles in real time. This system allows buyers to quickly find the perfect vehicle at the right price. It also provides sellers with a larger pool of potential buyers, allowing them to maximize the value they receive for their vehicle. Finally, ACV Auctions Inc has also implemented advanced analytics tools to help buyers and sellers make informed decisions. This data, combined with the company’s wide range of services, helps create a seamless purchasing experience for customers. Overall, ACV Auctions Inc has found success by providing a safe and efficient platform for buyers and sellers of used vehicles. The company’s ability to combine secure payment processing with detailed inspection reports and real-time auctions make it an attractive option for buyers and sellers alike. With its advanced analytics tools, ACV Auctions Inc is well positioned to continue its growth in the used car market.

Stock Price

ACV Auctions Inc. has been making waves in the stock market this week, with their stock trading at a 3.3% increase from last closing price of $12.0 to open on Wednesday at $12.1 and close at $12.3. It is clear that investors are taking notice of the technical aspects of ACV Auctions. Through this platform, users are able to search, bid and purchase vehicles, as well as manage their business operations. This technology has been embraced by the automotive industry and has attracted a wide range of buyers and sellers. The company also provides a range of other services such as vehicle inspections, vehicle history reports, and financial services. These services provide users with the ability to make informed decisions and create a more efficient experience when purchasing a used vehicle.

ACV Auctions is well positioned to take advantage of the increasing trend towards digital commerce in the automotive industry. Their innovative platform and services have enabled them to become a key player in the space and create a more convenient and efficient way for buyers and sellers to transact. The company has also seen success in international markets, providing their services to customers in Japan, Canada, and Mexico. As ACV Auctions continues to develop and expand their technology, it is clear that the stock market is taking notice of the technical prowess and potential of this company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Acv Auctions. More…

| Total Revenues | Net Income | Net Margin |

| 421.53 | -102.19 | -24.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Acv Auctions. More…

| Operations | Investing | Financing |

| -75.17 | -282.98 | 72.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Acv Auctions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 914.92 | 429.2 | 3.07 |

Key Ratios Snapshot

Some of the financial key ratios for Acv Auctions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 58.0% | – | -24.0% |

| FCF Margin | ROE | ROA |

| -23.4% | -12.8% | -6.9% |

Analysis

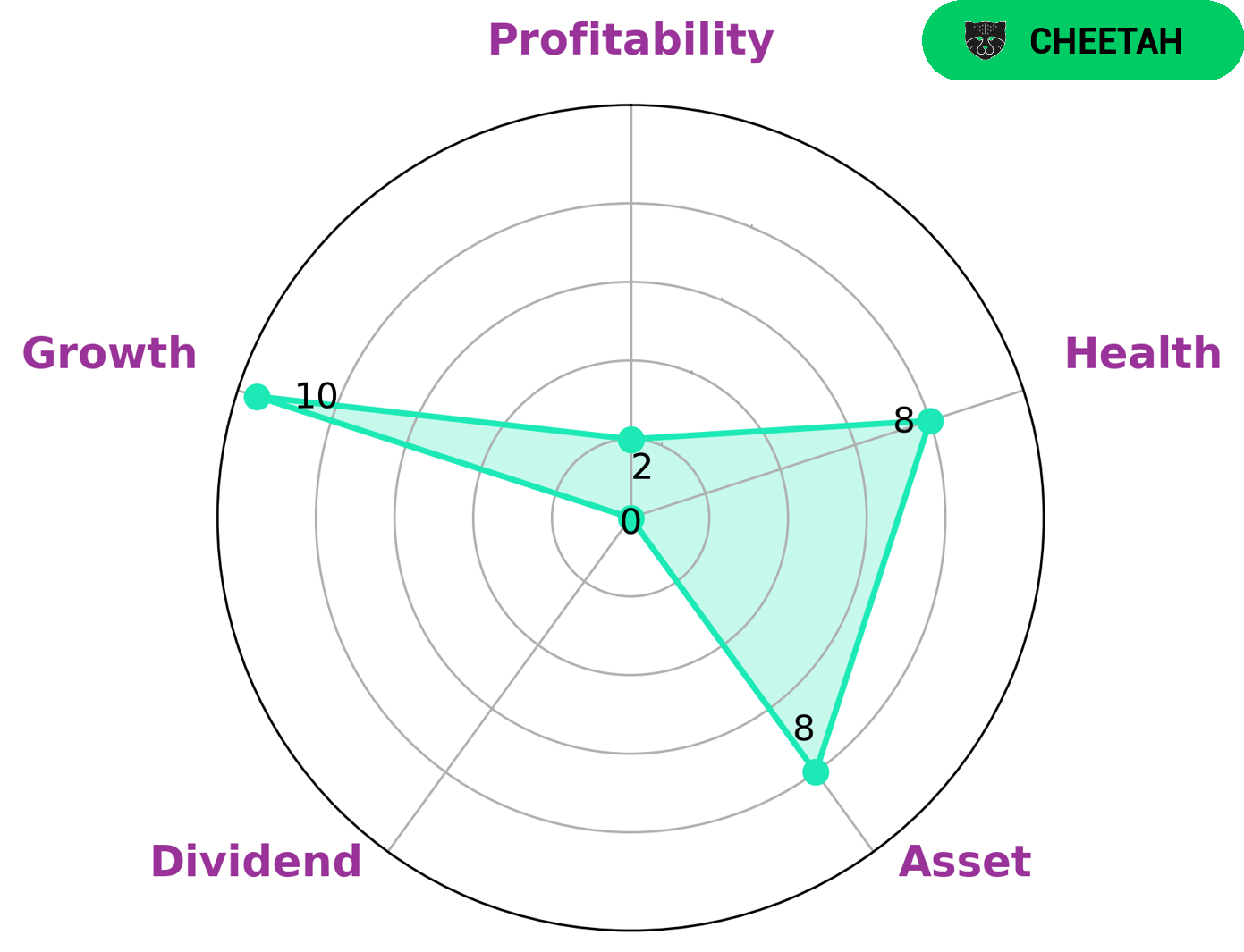

GoodWhale has conducted an analysis of ACV AUCTIONS‘ financials. According to Star Chart, which classifies companies based on their revenue or earnings growth and stability, ACV AUCTIONS is considered a ‘cheetah’ type of company. This denotes a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are interested in such a company are likely looking to benefit from the potential for high returns, as well as potential capital appreciation if their investments pay off. ACV AUCTIONS has a high health score of 8/10 with regard to its cashflows and debt, suggesting it is capable to pay off debt and fund future operations. Although the company is strong in terms of asset growth and shareholder value, it does not offer much in terms of dividend yield or profitability. More…

Peers

ACV Auctions Inc offers a suite of mobile apps and web-based solutions that enable dealerships to buy and sell vehicles from their inventory, as well as conduct mobile vehicle inspections. ACV Auctions Inc competes with ImageWare Systems Inc, Yext Inc, and Matterport Inc.

– ImageWare Systems Inc ($OTCPK:IWSY)

ImageWare Systems Inc is a biometrics company that provides authentication solutions for law enforcement, military, and commercial applications. The company has a market cap of $34.8 million and a return on equity of -72.0%. ImageWare Systems Inc is a publicly traded company on the NasdaqGS exchange under the ticker symbol IWSY.

– Yext Inc ($NYSE:YEXT)

Yext Inc is a publicly traded technology company headquartered in New York City. The company provides a platform that helps businesses manage their online information. Yext’s platform includes a listing management service, review monitoring and management tools, and a suite of marketing automation tools. Yext went public in 2017 and trades on the New York Stock Exchange under the ticker symbol YEXT.

As of 2022, Yext Inc has a market cap of 625.82M and a Return on Equity of -36.68%. Yext Inc provides a platform that helps businesses manage their online information. Yext’s platform includes a listing management service, review monitoring and management tools, and a suite of marketing automation tools.

– Matterport Inc ($NASDAQ:MTTR)

Matterport Inc is a three-dimensional imaging company that creates immersive virtual experiences of real-world places. It offers a platform that enables users to capture, edit, and share 3D models of physical spaces. The company serves customers in a variety of industries, including real estate, hospitality, education, construction, and insurance.

Matterport’s market cap is $744.91M as of 2022. The company has a Return on Equity of -31.08%.

Summary

ACV Auctions Inc. is a publicly traded company that provides online automotive remarketing services to dealers, fleet owners, and OEMs. A technical analysis of the stock reveals strong market sentiment, with positive trends in both volume and momentum. Several key indicators such as Average Daily Trading Volume, Relative Strength Index, and Moving Average Convergence Divergence suggest a continuation of the positive trend. Overall, ACV Auctions Inc. is an attractive stock for investors seeking long-term gains.

Recent Posts