Carvana Stock Fair Value – CARVANA Offers Exchange Deal to Outstanding Note Holders

April 20, 2023

Trending News ☀️

Recently, the company has been offering an exchange deal to its outstanding note holders. The exchange offer was announced in response to the decline of Carvana ($NYSE:CVNA)’s stock following its aggressive expansion. The offer provides note holders with an opportunity to exchange their existing notes for new notes or cash. This exchange offer was designed to reduce the amount of outstanding debt and improve the company’s overall financial performance.

Additionally, Carvana hopes that the deal will attract more investors and increase the value of its stock. Furthermore, it should also help the company to better manage its overall financial position. Overall, Carvana’s exchange offer is a great opportunity for note holders to receive cash or new notes in exchange for their existing notes. This could be a great way for investors to get in on the ground floor of Carvana’s growth as well as potentially benefit from an increase in the company’s stock value. It remains to be seen how successful this exchange offer will be, but it is a move towards strengthening the company’s financial stability.

Stock Price

The deal would allow CARVANA to restructure its debt obligations and provide more flexibility for future financial plans. The news sent CARVANA stock spiraling, with shares opening at $8.6 and closing at the same price, a 1.9% decrease from its previous closing price of $8.8. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carvana. CARVANA_Offers_Exchange_Deal_to_Outstanding_Note_Holders”>More…

| Total Revenues | Net Income | Net Margin |

| 13.6k | -1.59k | -5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carvana. CARVANA_Offers_Exchange_Deal_to_Outstanding_Note_Holders”>More…

| Operations | Investing | Financing |

| -1.32k | -2.58k | 3.9k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carvana. CARVANA_Offers_Exchange_Deal_to_Outstanding_Note_Holders”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.7k | 9.75k | -4.89 |

Key Ratios Snapshot

Some of the financial key ratios for Carvana are shown below. CARVANA_Offers_Exchange_Deal_to_Outstanding_Note_Holders”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.1% | – | -17.7% |

| FCF Margin | ROE | ROA |

| -13.5% | 1233.1% | -17.3% |

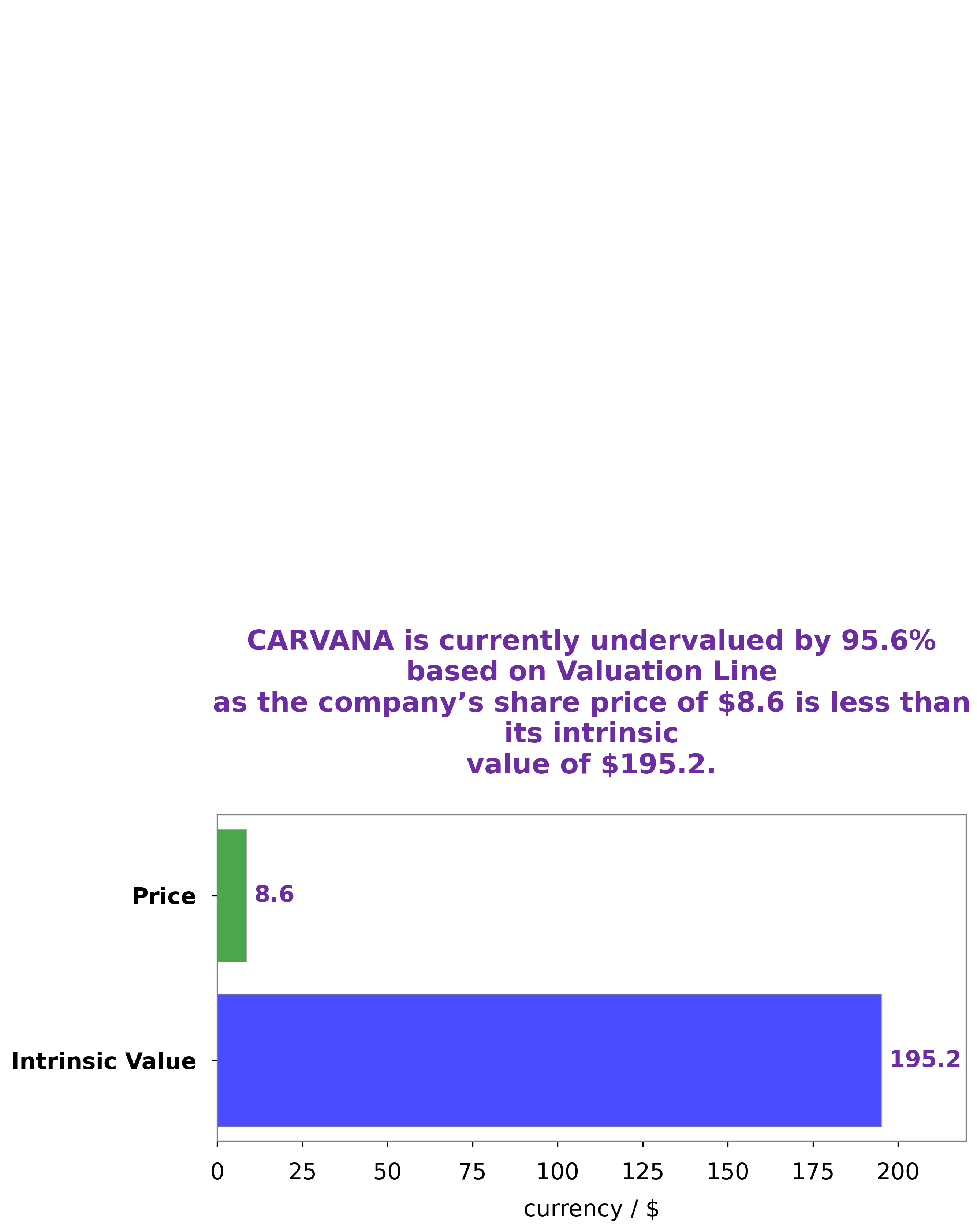

Analysis – Carvana Stock Fair Value

At GoodWhale, we have conducted an analysis of CARVANA‘s wellbeing and have come to the conclusion that the fair value of a CARVANA share is approximately $195.2. This calculation was made using our proprietary Valuation Line Tool. We believe that CARVANA is currently undervalued by a staggering 95.6%, as their current stock is being traded at just $8.6. This presents a great opportunity for investors who are willing to invest in a potentially undervalued company. More…

Peers

There is fierce competition between Carvana Co and its competitors Vroom Inc, Shift Technologies Inc, and CarMax Inc. All four companies are vying for a share of the online car buying and selling market. Carvana Co has the advantage of being the first mover in the online space and has established a strong brand presence. However, its competitors are not far behind and are quickly catching up. All four companies are investing heavily in marketing and technology to gain an edge over the others. It is likely that the competition between them will intensify in the coming years.

– Vroom Inc ($NASDAQ:VRM)

Vroom Inc is an online used car retailer headquartered in New York City. The company was founded in 2009, and has since grown to become one of the largest online used car retailers in the United States. Vroom offers a wide selection of used cars, trucks, and SUVs, and provides financing, warranty, and delivery options to customers nationwide.

Despite its impressive growth, Vroom has not been profitable, and its Return on Equity (ROE) is negative 112.63%. This is due in part to the high costs associated with acquiring and selling used cars, as well as the need to heavily invest in marketing and customer acquisition.

Vroom’s market cap is 147.78M as of 2022. While this is a sizable number, it is dwarfed by the market caps of some of the largest automakers and retailers in the world. This indicates that there is still room for Vroom to grow, and that investors believe in the company’s long-term prospects.

– Shift Technologies Inc ($NASDAQ:SFT)

Founded in 2013, Shift Technologies Inc is a technology company that provides an online platform for buying and selling used cars. The company has a market cap of $45.76M and a return on equity of 6532.78%. Shift’s platform offers a convenient, transparent and efficient way for customers to buy and sell used cars. The company operates in the United States and Canada.

– CarMax Inc ($NYSE:KMX)

CarMax is the largest retailer of used cars in the United States. The company was founded in 1993 and is headquartered in Richmond, Virginia. CarMax operates over 200 used car dealerships across the country. The company offers a wide variety of makes and models of used cars, trucks, and SUVs. CarMax also offers financing and extended warranties on its vehicles.

CarMax has a market cap of $9.59 billion as of 2022 and a return on equity of 16.04%. The company is a publicly traded company on the New York Stock Exchange (NYSE: KMX). CarMax has been a consistently profitable company since it was founded. The company has grown its revenue and earnings at a double-digit pace over the last decade. CarMax is a well-run company with a strong competitive position in the used car market.

Summary

Investors in Carvana have had a tumultuous period of late. After extending their exchange offer for outstanding notes, their stock has seen a slight dip. Analysts are viewing the news cautiously, noting that the decision appears to be part of a larger plan to restructure the company’s debt.

They are also watching to see how the company decides to fund its future growth. The market outlook for Carvana is cautiously optimistic, with some expecting the company to reach profitability soon and become a stronger player in the automotive retail industry.

Recent Posts