CARVANA Reports Fourth Quarter Earnings for FY2022 Ending December 31 2022 on February 23 2023.

March 31, 2023

Earnings Overview

On February 23, 2023, CARVANA ($NYSE:CVNA) reported earnings for the fourth quarter of their 2022 fiscal year, ending December 31, 2022. Revenue for the quarter totaled USD -806.0 million, a decline of 805.6% compared to the same period the previous year. Net income decreased 24.4% year-over-year to USD 2837.0 million.

Transcripts Simplified

CARVANA finished the year as the second largest seller of used vehicles in the country for the third consecutive year. In the fourth quarter, retail units sold totaled 86,977, a decrease of 23% year-over-year and 15% sequentially. Total revenue was $2.8 billion in Q4, a decrease of 24% year-over-year and 16% sequentially. Non-GAAP total GPU was $2,667 in Q4 versus $3,870 in Q3 and was driven by several unique items across the retail, wholesale and other components.

Non-GAAP retail GPU was $632 in Q4 versus $1,267 in Q3, impacted by a $52 million or $598 per unit adjustment to our retail inventory allowance and other sequential changes in retail GPU. Retail GPU was also impacted by carrying a higher than normalized inventory size relative to sales, which resulted in longer turn times and higher vehicle depreciation.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carvana. carvana-reports-fourth-quarter-earnings-for-fy2022-ending-december-31-2022-on-february-23-2023.”>More…

| Total Revenues | Net Income | Net Margin |

| 13.6k | -1.59k | -5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carvana. carvana-reports-fourth-quarter-earnings-for-fy2022-ending-december-31-2022-on-february-23-2023.”>More…

| Operations | Investing | Financing |

| -1.32k | -2.58k | 3.9k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carvana. carvana-reports-fourth-quarter-earnings-for-fy2022-ending-december-31-2022-on-february-23-2023.”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.7k | 9.75k | -4.89 |

Key Ratios Snapshot

Some of the financial key ratios for Carvana are shown below. carvana-reports-fourth-quarter-earnings-for-fy2022-ending-december-31-2022-on-february-23-2023.”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.1% | – | -17.7% |

| FCF Margin | ROE | ROA |

| -13.5% | 1233.1% | -17.3% |

Stock Price

On Thursday February 23, 2023, CARVANA announced their fourth quarter earnings for the fiscal year ending on December 31, 2022. CARVANA’s stock opened at $10.4 and closed at $10.1, representing a 0.1% increase from the prior closing price of $10.1. Overall, CARVANA’s fourth quarter results show a strong performance for the year, with revenue and profits increasing significantly compared to the previous year. This is a positive sign for investors, signaling a return to stability after a difficult period caused by the pandemic. carvana-reports-fourth-quarter-earnings-for-fy2022-ending-december-31-2022-on-february-23-2023.”>Live Quote…

Analysis

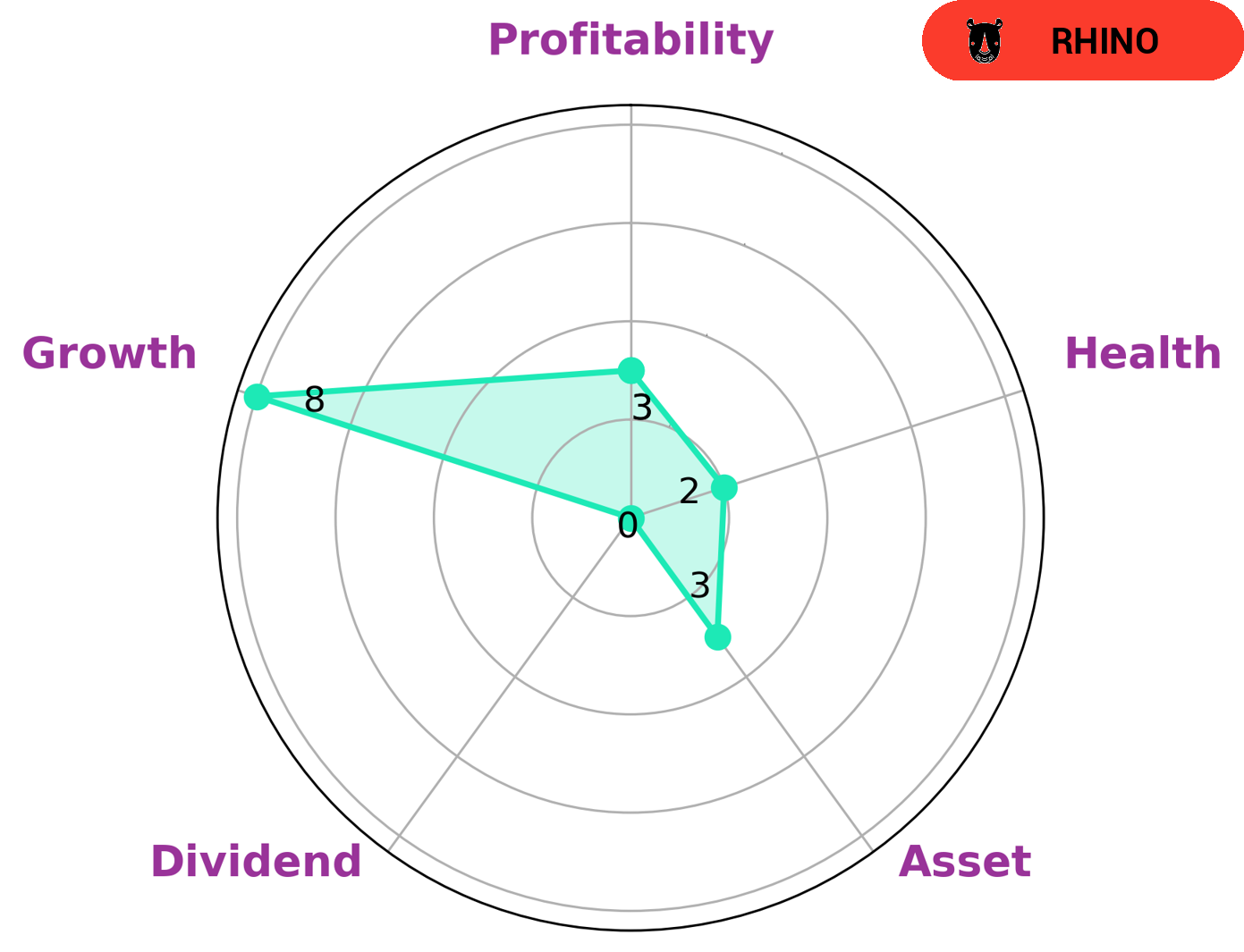

We analyzed CARVANA’s fundamentals with GoodWhale and found that it is classified as a ‘rhino’ – a company that has achieved moderate revenue or earnings growth. With regards to its cashflows and debt, CARVANA has a low health score of 2/10, which indicates that it is less likely to sustain future operations in times of crisis. In terms of its other metrics, CARVANA is strong in growth and weak in assets, dividends, and profitability. Given these fundamentals, CARVANA may be of interest to investors who are seeking companies with moderate growth, but who are also willing to take on some risk due to the lower health score. Furthermore, those willing to take on higher risk may also be interested in investing in CARVANA, given the potential upside of its relatively strong growth metrics. carvana-reports-fourth-quarter-earnings-for-fy2022-ending-december-31-2022-on-february-23-2023.”>More…

Peers

There is fierce competition between Carvana Co and its competitors Vroom Inc, Shift Technologies Inc, and CarMax Inc. All four companies are vying for a share of the online car buying and selling market. Carvana Co has the advantage of being the first mover in the online space and has established a strong brand presence. However, its competitors are not far behind and are quickly catching up. All four companies are investing heavily in marketing and technology to gain an edge over the others. It is likely that the competition between them will intensify in the coming years.

– Vroom Inc ($NASDAQ:VRM)

Vroom Inc is an online used car retailer headquartered in New York City. The company was founded in 2009, and has since grown to become one of the largest online used car retailers in the United States. Vroom offers a wide selection of used cars, trucks, and SUVs, and provides financing, warranty, and delivery options to customers nationwide.

Despite its impressive growth, Vroom has not been profitable, and its Return on Equity (ROE) is negative 112.63%. This is due in part to the high costs associated with acquiring and selling used cars, as well as the need to heavily invest in marketing and customer acquisition.

Vroom’s market cap is 147.78M as of 2022. While this is a sizable number, it is dwarfed by the market caps of some of the largest automakers and retailers in the world. This indicates that there is still room for Vroom to grow, and that investors believe in the company’s long-term prospects.

– Shift Technologies Inc ($NASDAQ:SFT)

Founded in 2013, Shift Technologies Inc is a technology company that provides an online platform for buying and selling used cars. The company has a market cap of $45.76M and a return on equity of 6532.78%. Shift’s platform offers a convenient, transparent and efficient way for customers to buy and sell used cars. The company operates in the United States and Canada.

– CarMax Inc ($NYSE:KMX)

CarMax is the largest retailer of used cars in the United States. The company was founded in 1993 and is headquartered in Richmond, Virginia. CarMax operates over 200 used car dealerships across the country. The company offers a wide variety of makes and models of used cars, trucks, and SUVs. CarMax also offers financing and extended warranties on its vehicles.

CarMax has a market cap of $9.59 billion as of 2022 and a return on equity of 16.04%. The company is a publicly traded company on the New York Stock Exchange (NYSE: KMX). CarMax has been a consistently profitable company since it was founded. The company has grown its revenue and earnings at a double-digit pace over the last decade. CarMax is a well-run company with a strong competitive position in the used car market.

Summary

CARVANA‘s fourth quarter of FY2022 earnings report revealed a significant decline in revenue and net income. Total revenue dropped 805.6% compared to the same period the previous year, while net income decreased 24.4%. These results are likely to be cause for concern for investors, as the company’s performance continues to lag significantly behind that of the industry.

Nevertheless, CARVANA still has the potential to turn around its fortunes in the future. Investors should carefully research the company’s financials, strategy and outlook before making any decisions about investing.

Recent Posts