CARMAX Reports Surprising Earnings Beat Despite Lower-Than-Expected Revenue

April 12, 2023

Trending News ☀️

CARMAX ($NYSE:KMX), a leading retailer of used cars, recently reported its quarterly earnings results, in which it reported a surprising earnings beat despite lower-than-expected revenue. According to the report, CarMax‘s GAAP earnings per share (EPS) of $0.44 exceeded expectations by $0.24, while its total revenue of $5.72B failed to meet predictions by $380M. CARMAX is a publicly traded company that, as one of the largest used car retailers in the United States, provides customers with a wide selection of certified used cars through its online and physical stores.

Market Price

On Tuesday, CARMAX reported their earnings beat despite lower-than-expected revenue. The stock opened at $69.6 and closed at $72.2, a rise of 9.6% from their last closing price of $65.9. This positive performance was a surprise for analysts and investors, who had expected the company to suffer from the lower-than-expected revenue. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carmax. CARMAX_Reports_Surprising_Earnings_Beat_Despite_Lower-Than-Expected_Revenue”>More…

| Total Revenues | Net Income | Net Margin |

| 31.65k | 575.59 | 1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carmax. CARMAX_Reports_Surprising_Earnings_Beat_Despite_Lower-Than-Expected_Revenue”>More…

| Operations | Investing | Financing |

| 1.2k | -409.72 | -230.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carmax. CARMAX_Reports_Surprising_Earnings_Beat_Despite_Lower-Than-Expected_Revenue”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.94k | 20.45k | 34.73 |

Key Ratios Snapshot

Some of the financial key ratios for Carmax are shown below. CARMAX_Reports_Surprising_Earnings_Beat_Despite_Lower-Than-Expected_Revenue”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | -9.7% | 3.5% |

| FCF Margin | ROE | ROA |

| 2.5% | 12.9% | 2.7% |

Analysis

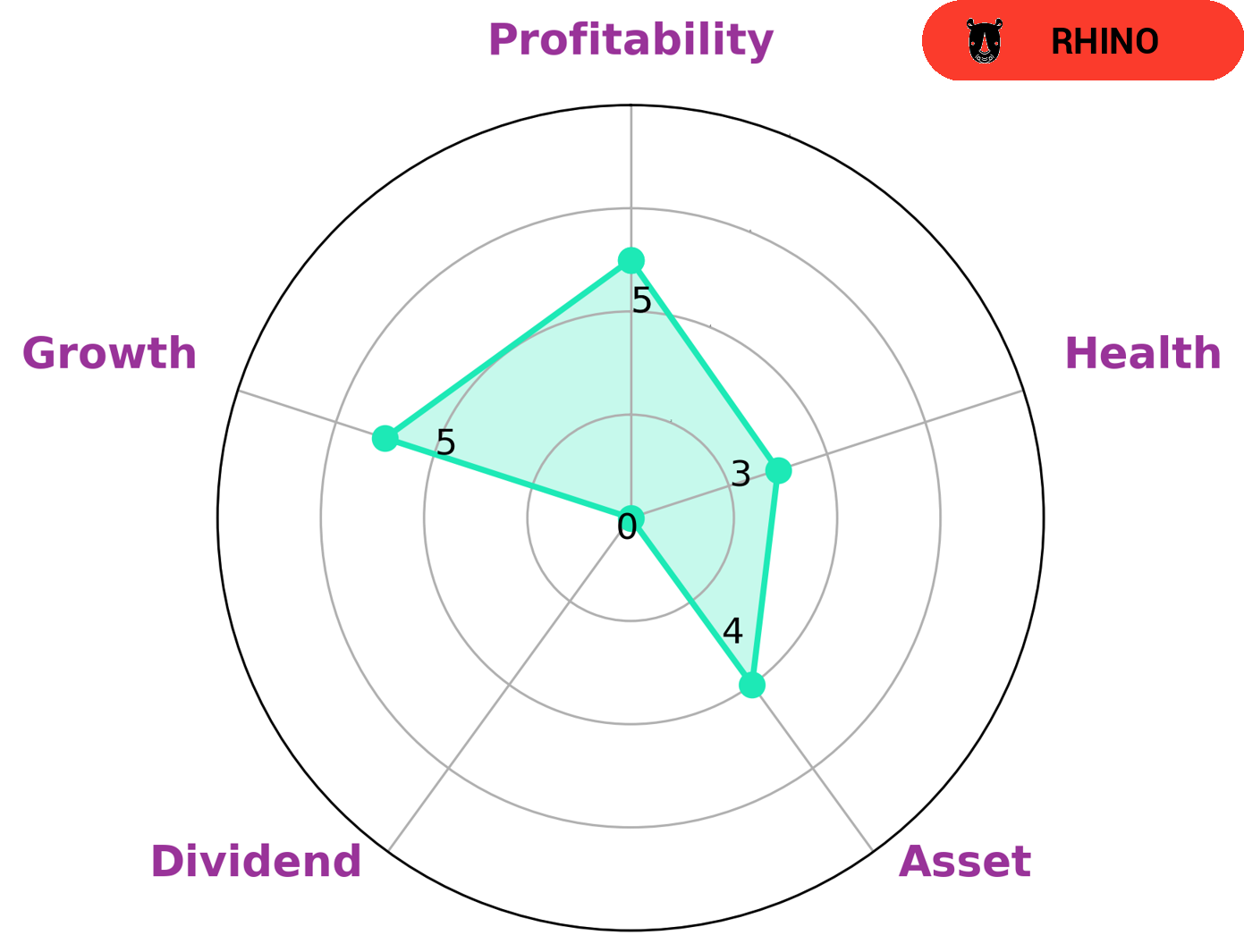

GoodWhale conducted an analysis of CARMAX‘s wellbeing and based on the Star Chart, CARMAX has a low health score of 3/10 with regard to its cashflows and debt. This indicates that CARMAX is less likely to sustain future operations in times of crisis. CARMAX is strong in asset, medium in growth, profitability and weak in dividend. Given these findings, investors who are looking for a moderately successful company that has already achieved some success may be interested in investing in CARMAX. However, potential investors should be aware of the low health score when it comes to cashflows and debt and take this into consideration when making their investment decisions. More…

Peers

CarMax Inc is one of the largest used car dealers in the United States. Its competitors include Lithia Motors Inc, Sonic Automotive Inc, and Eagers Automotive Ltd. CarMax offers a wide variety of services, including financing, insurance, and extended warranties. It has a nationwide network of stores and a strong online presence.

– Lithia Motors Inc ($NYSE:LAD)

As of 2022, Lithia Motors Inc had a market cap of 5.04B and a Return on Equity of 25.15%. Lithia Motors Inc is a publicly traded automotive retailer that sells new and used vehicles, and provides financing, vehicle service contracts, and other aftermarket products. The company operates through three segments: Retail Operations, Vehicle Financing, and Other. Lithia Motors Inc has over 200 dealerships across the United States.

– Sonic Automotive Inc ($NYSE:SAH)

Sonic Automotive Inc is a public company that owns and operates automotive dealerships across the United States. As of 2022, the company had a market cap of 1.61B and a return on equity of 31.11%. Sonic Automotive Inc is a Fortune 500 company and is headquartered in Charlotte, North Carolina. The company operates in over 100 locations and employs over 10,000 people. Sonic Automotive Inc is a publicly traded company on the New York Stock Exchange under the ticker symbol SAH.

– Eagers Automotive Ltd ($ASX:APE)

Eagers Automotive Ltd is a publicly traded company with a market capitalization of $2.81 billion as of 2022. The company has a return on equity of 26.52%. Eagers Automotive is a leading provider of automotive products and services in Australia. The company operates a network of over 60 dealerships across Australia, New Zealand, and the United Kingdom. Eagers Automotive offers a wide range of vehicles, including passenger cars, SUVs, and light commercial vehicles. The company also provides finance, insurance, and aftermarket products and services.

Summary

Despite this, the stock price of CARMAX increased the same day. Investors may be encouraged by the strong EPS results, although some caution should be heeded given the weaker than expected revenue. In the long term, investors should closely monitor the company’s performance on both metrics and any potential shifts in the macroeconomic environment that could affect revenue figures.

Recent Posts