CarGurus, Stock Drops 4.4%, Shareholders Lose 51% in a Week

February 12, 2023

Trending News 🌧️

CARGURUS ($NASDAQ:CARG): CarGurus, Inc. is a leading online automotive marketplace that connects car buyers and sellers all across the United States. This past week, CarGurus, Inc. experienced a 4.4% stock drop, which is much lower than the 51% loss that other shareholders have had to deal with. The fact that CarGurus, Inc. stock has only dropped 4.4% is good news for shareholders, as it shows that the company is still in a good position moving forward. It is clear that the company has been able to weather the recent market downturn and remain relatively stable over the past week. This bodes well for future investors, as it illustrates that this company is resilient and well-managed. The company’s success is largely attributed to its innovative online car buying platform and its commitment to providing customers with an easy and efficient car buying experience. CarGurus, Inc.’s platform allows customers to search for cars based on their preferences, compare prices from different dealerships, and get the best deals from dealerships located near them.

This has enabled the company to acquire more customers and grow its presence in the market. In addition to its strong customer base, CarGurus, Inc. has also been able to make strategic investments in technology and marketing initiatives which have allowed the company to remain competitive in an ever-evolving market. These investments have resulted in increased brand awareness and have helped solidify CarGurus, Inc.’s position as a leader in the automotive marketplace. Overall, CarGurus, Inc. shareholders can be thankful that the company’s stock has only dropped 4.4% this past week rather than the 51% loss that other investors have had to endure. This illustrates that the company is well managed and continuing to make very strategic investments in order to remain competitive in the marketplace. This bodes well for future investors and proves that CarGurus, Inc. is an excellent investment opportunity moving forward.

Stock Price

On Thursday, the stock of CarGurus, Inc. (CARG) opened at $17.4 and closed at $16.8, a 4.4% decrease from its previous closing price of $17.3. This brings the stock’s price down by a staggering 51% in just one week and is a cause for concern for shareholders of the company. The sharp decline in the stock price of CarGurus Inc. is mainly due to recent news coverage surrounding the company which has been largely negative. This news coverage has highlighted the company’s struggles with keeping up with its competitors and not having a competitive edge in the industry. The company’s stock performance has been under pressure over the past few months, and this latest drop has further put pressure on the stock and investors. This had led investors to be wary about investing in the company, with many choosing to stay away from investing in the stock due to the uncertainties surrounding the company’s future prospects.

However, some investors are still optimistic about CarGurus’ long-term prospects and are confident that the company can turn its fortunes around with better management and a renewed focus on innovation and growth. It remains to be seen whether the company can recover from this latest setback and if the stock will eventually rise back up again. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cargurus. More…

| Total Revenues | Net Income | Net Margin |

| 1.71k | -45.23 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cargurus. More…

| Operations | Investing | Financing |

| 124.03 | 72.76 | -14.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cargurus. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 982.86 | 232.31 | 4.86 |

Key Ratios Snapshot

Some of the financial key ratios for Cargurus are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.3% | 64.5% | 7.2% |

| FCF Margin | ROE | ROA |

| 6.3% | 14.8% | 7.8% |

Analysis

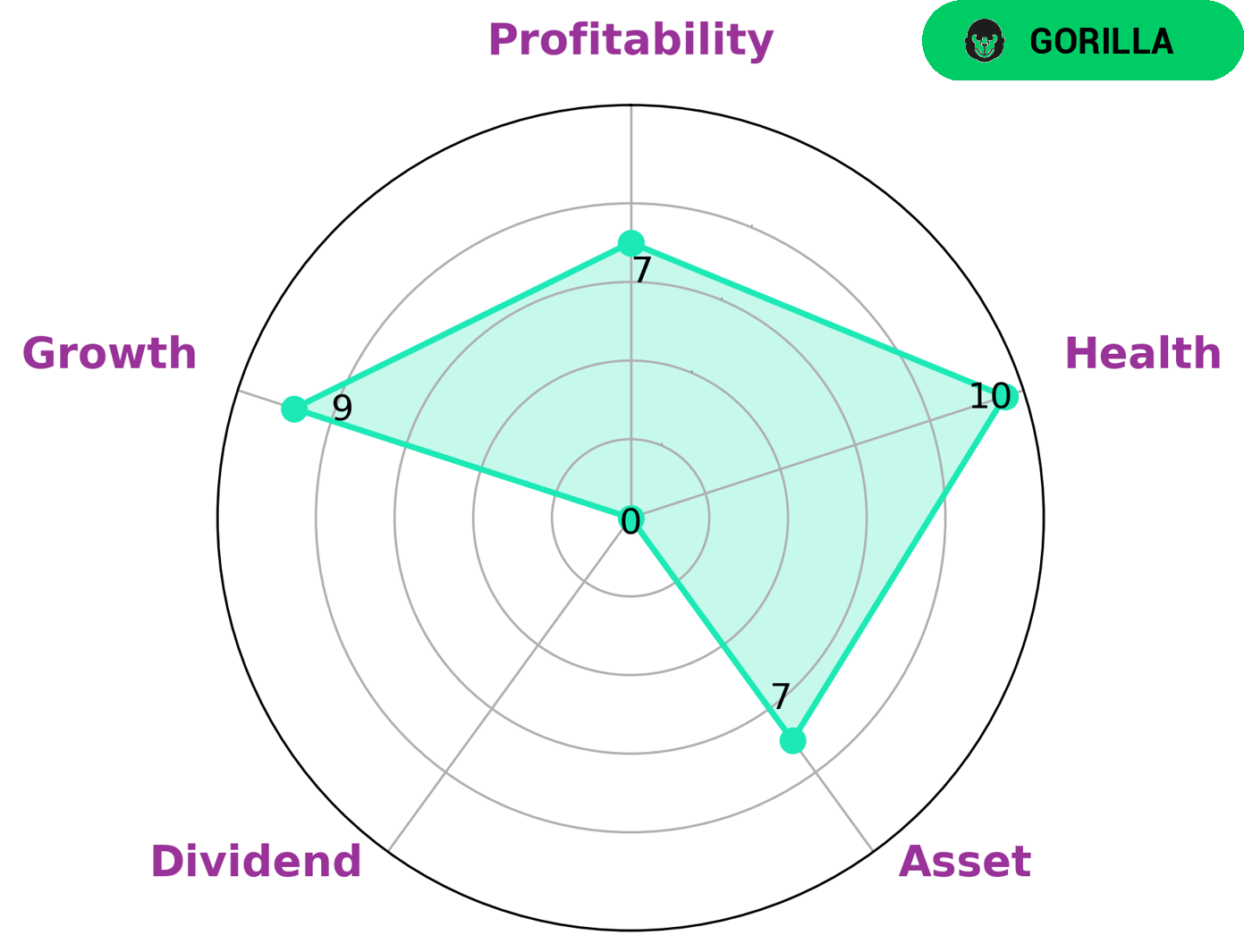

CARGURUS has been evaluated by GoodWhale to have strong financials, and have been classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Such a company is likely to be of interest to investors seeking growth opportunities. CARGURUS has high scores in terms of asset, growth and profitability, but its dividend score is average. It also has a high health score of 10/10 when it comes to cashflows and debt, which indicates that it is capable of riding out any crisis without the risk of bankruptcy. CARGURUS’ financials show that it is well-positioned to meet the needs of investors who are looking for sustainable and reliable growth opportunities. The company has strong asset and profitability metrics, as well as a relatively healthy dividend score. Its health score of 10/10 is an indication that it is resilient to external shocks and market volatility, making it an attractive opportunity for those who are looking for reliable investments with long-term potential. The company’s strong competitive advantage means that it is likely to remain profitable in the years to come. Overall, CARGURUS is an attractive option for investors looking for growth opportunities. Its financials demonstrate its ability to remain profitable despite external shocks and market volatility, while its competitive advantage gives it an edge over its competitors. Its solid asset and profitability metrics make it an attractive long-term investment opportunity. For those looking for reliable investments with potential for growth, CARGURUS is certainly one to watch. More…

Peers

In the online automotive marketplace, CarGurus Inc competes with Liberty TripAdvisor Holdings Inc, Points.com Inc, and Camplify Holdings Ltd. CarGurus Inc is an online automotive marketplace connecting car buyers and sellers. Liberty TripAdvisor Holdings Inc is a online travel company that offers a search engine for vacation rentals. Points.com Inc is a provider of loyalty programs. Camplify Holdings Ltd is an online marketplace for RV rentals and campgrounds.

– Liberty TripAdvisor Holdings Inc ($NASDAQ:LTRPA)

Liberty TripAdvisor Holdings Inc is a online travel company. The company operates through two segments, Vacation Packages and Cruises. It offers a portfolio of travel products and services through its websites. The company was founded in 2008 and is headquartered in Denver, Colorado.

Summary

Investing in CarGurus, Inc. has been a difficult decision for shareholders in the past week, as the stock price has dropped 4.4%. This has resulted in investors losing 51% of their value in just seven days. The news coverage has been largely negative, with investors and analysts weighing in on the potential downside of such a steep decline.

Despite this, investors should continue to monitor the stock and assess its prospects moving forward, as it may yet prove to be a good long-term investment. As always, research and due diligence should be conducted before investing in any stock, and it is also wise to diversify one’s investments across different assets.

Recent Posts