Bike O dividend calculator – Bike O and Co Ltd Declares 15.0 Cash Dividend

May 29, 2023

Dividends Yield

On May 26th, 2023, Bike O ($TSE:3377) and Co Ltd declared a 15.0 cash dividend. This is the third consecutive year that the company has declared a dividend, with the last three years’ dividends per share totaling 20.0, 20.0, and 15.5 JPY, respectively. Over this period, the yield on the dividend has been strong, with yields of 1.77%, 2.6%, and 2.49% in 2021, 2022, and 2023 respectively. The average yield over these three years is 2.29%.

This makes BIKE O an attractive investment opportunity for those actively looking to buy dividend stocks. The ex-dividend date for this dividend is May 30th, 2023.

Stock Price

This announcement came as the company’s stock opened at JP¥850.0 and subsequently closed at JP¥849.0, representing a 0.2% decrease from the previous closing price of JP¥851.0. This is the third dividend declared by the company this year, and shareholders are expected to benefit from the reward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bike O. More…

| Total Revenues | Net Income | Net Margin |

| 34.35k | 1.14k | 3.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bike O. More…

| Operations | Investing | Financing |

| 2.1k | -647.54 | 369.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bike O. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.25k | 4.46k | 484.98 |

Key Ratios Snapshot

Some of the financial key ratios for Bike O are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.6% | 63.2% | 5.1% |

| FCF Margin | ROE | ROA |

| 5.1% | 16.1% | 9.8% |

Analysis

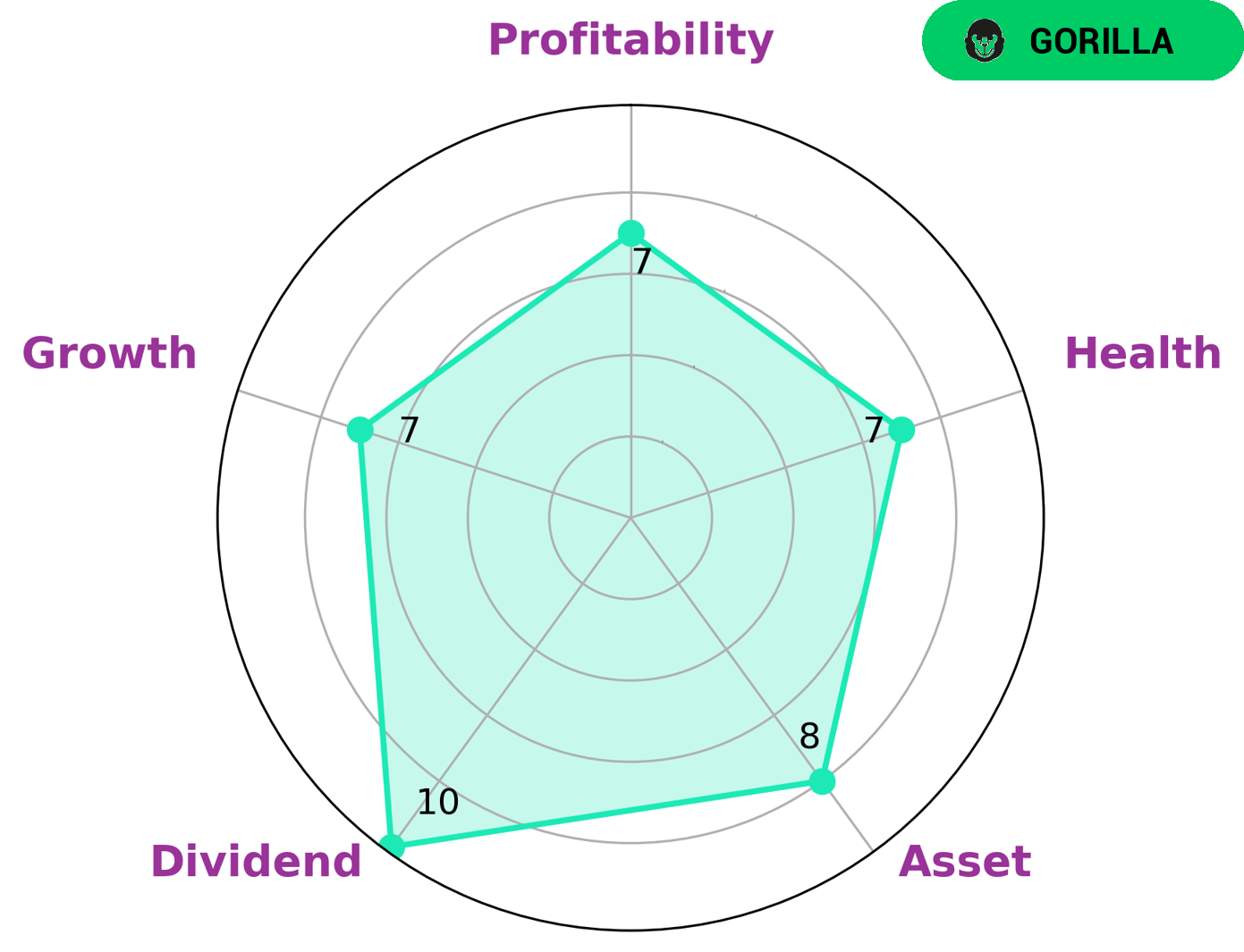

GoodWhale has conducted an analysis of BIKE O‘s wellbeing, and the results show that it is a strong and stable company. According to Star Chart, BIKE O scored a 7/10 in health, which indicates that it has healthy cashflows and debt, and is capable to safely ride out any crisis without the risk of bankruptcy. We classified BIKE O as a ‘gorilla’, a type of company that has achieved stable and high revenue growth due to its strong competitive advantage. Given its strength in asset, dividend, growth, and profitability, BIKE O is likely to attract interest from many types of investors. Those who are seeking long-term investments will be drawn to the company’s stability and growth potential. For investors looking for a more short-term approach, they may be attracted to BIKE O’s high dividend yield and strong asset base. Whatever the investment strategy, BIKE O is likely to be an attractive option for investors. More…

Peers

The competition between Bike O & Co Ltd and its competitors, Klepper Faltbootwerft AG, TFF Group, and Kolon Mobility Group, is intense. These companies have been battling it out in the transportation industry for years, each striving to be the top performing business in the sector. All four of these companies have their own unique strengths and weaknesses, and each has been working hard to get an edge over the competition.

– Klepper Faltbootwerft AG ($BER:KFW1)

TFF Group is a publicly-traded company that provides a range of integrated technology-based solutions for the global agriculture and food industry. Its market cap of 932.75M as of 2023 reflects the company’s standing among peers in the agricultural and food industry, with its solutions being well-regarded for their efficiency and cost-effectiveness. The company’s Return on Equity (ROE) was also impressive at 9.82%, demonstrating the company’s ability to generate profits from shareholders’ investments. This is an indication that the company is well-managed, with management focusing on delivering returns for shareholders.

Summary

Investing in BIKE O has been a profitable choice for dividend investors in the past three years. With an average yield of 2.29%, it has offered an annual dividend per share of 20.0, 20.0, and 15.5 JPY over the past three years, respectively. Its dividend yield has steadily increased from 1.77% in 2021 to 2.6% in 2022 and 2.49% in 2023. With consistent returns, BIKE O is a good dividend stock option for investors actively looking for high-yielding investments.

Recent Posts