Asbury Automotive Stock Fair Value Calculation – HighTower Advisors LLC Invests $769000 in Asbury Automotive Group,

June 2, 2023

🌥️Trending News

HighTower Advisors LLC has recently announced its investment of $769000 in Asbury Automotive ($NYSE:ABG) Group, Inc. According to Defense World, this is the latest move for the investment firm as they have been gradually increasing their stock position in the company. They specialize in new and pre-owned vehicles, parts, service, and body shop services. The company’s portfolio includes luxury and commercial vehicle brands such as Audi, Acura, Mercedes-Benz, Nissan, Land Rover, and more. With HighTower Advisors LLC investing in Asbury Automotive Group, Inc., the company is in a better position to expand their reach and grow their business.

Share Price

On Wednesday, HighTower Advisors LLC made a notable investment in Asbury Automotive Group, Inc. The company opened its stock at $212.2 and closed the day at $209.1, down by 3.4% from its previous closing price of $216.5. The investment is expected to strengthen the company’s financial position and bolster its overall performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Asbury Automotive. More…

| Total Revenues | Net Income | Net Margin |

| 15.1k | 941 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Asbury Automotive. More…

| Operations | Investing | Financing |

| 696 | 464.7 | -1.1k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Asbury Automotive. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.02k | 5.12k | 133.8 |

Key Ratios Snapshot

Some of the financial key ratios for Asbury Automotive are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.3% | 57.8% | 9.3% |

| FCF Margin | ROE | ROA |

| 3.9% | 30.2% | 10.9% |

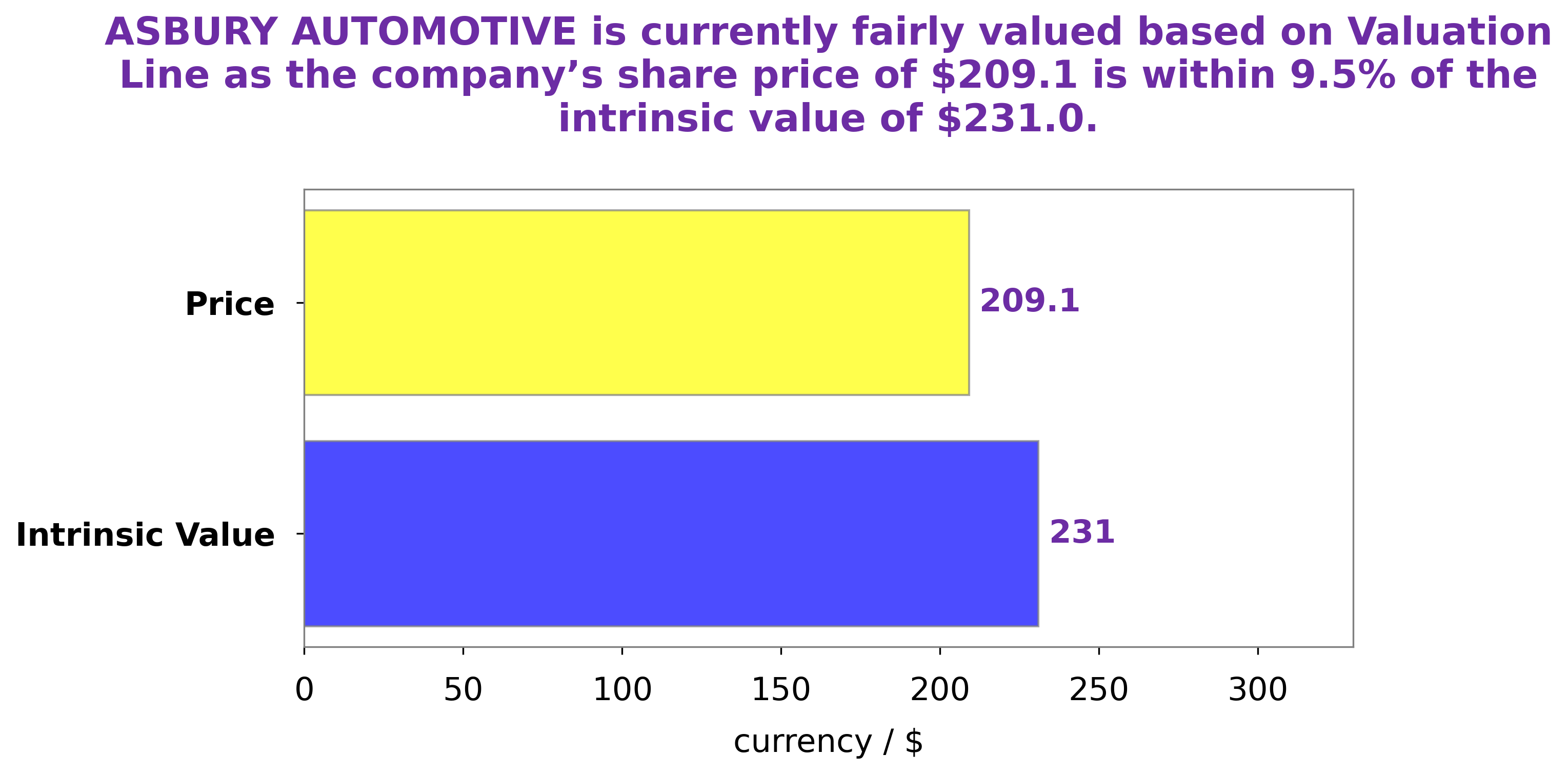

Analysis – Asbury Automotive Stock Fair Value Calculation

GoodWhale has conducted a thorough analysis of ASBURY AUTOMOTIVE‘s wellbeing. Our proprietary Valuation Line indicates that the intrinsic value of ASBURY AUTOMOTIVE share is around $231.0. While this figure is an accurate estimate of the company’s potential, the current stock price of $209.1 is slightly lower than the intrinsic value. This means that ASBURY AUTOMOTIVE’s stocks are currently undervalued by 9.5%. More…

Peers

Asbury Automotive Group Inc, Sonic Automotive Inc, Group 1 Automotive Inc, and Penske Automotive Group Inc are all competing for market share in the automotive retail industry. All four companies have a nationwide footprint and are considered the top-tier automotive retailers in the United States.

– Sonic Automotive Inc ($NYSE:SAH)

Sonic Automotive, Inc. is a leading automotive retailer in the United States. The company operates over 150 dealerships in 14 states. Sonic Automotive is a publicly traded company on the NASDAQ stock exchange under the ticker symbol SAH. The company’s headquarters is in Charlotte, North Carolina.

Sonic Automotive’s market capitalization is $1.67 billion as of 2022. The company’s return on equity is 32.11%. Sonic Automotive is a leading automotive retailer in the United States. The company operates over 150 dealerships in 14 states. Sonic Automotive is a publicly traded company on the NASDAQ stock exchange under the ticker symbol SAH. The company’s headquarters is in Charlotte, North Carolina.

– Group 1 Automotive Inc ($NYSE:GPI)

Group 1 Automotive Inc is a publically traded company that operates in the automotive retail industry. The company operates through three segments: the United States, the United Kingdom, and Brazil. The company operates over 200 automotive dealerships, which sell 30 different brands of automobiles. The company has a market cap of 2.46B as of 2022 and a return on equity of 33.54%.

– Penske Automotive Group Inc ($NYSE:PAG)

Penske Automotive Group Inc is an American multinational transportation services company. It is headquartered in Bloomfield Hills, Michigan and operates in the retail automotive industry. The company operates over 3,300 automobile dealerships and auto service outlets in the United States, Canada, and Europe.

Penske Automotive Group Inc had a market capitalization of 7.85 billion dollars as of 2022. The company had a return on equity of 29.56%. The company operated over 3,300 automobile dealerships and auto service outlets in the United States, Canada, and Europe.

Summary

Asbury Automotive Group, Inc. is an automotive retailer that operates in the United States. Despite the recent investment, the stock price of Asbury Automotive has decreased on the same day. This could be because investors are uncertain of the company’s future prospects or unsure how the investment will affect the company’s performance. Analysts suggest that investors should view Asbury Automotive’s stock as a long-term investment as the automotive industry is expected to experience growth in the near future. Investors should keep in mind factors such as the company’s financial health, competitive landscape, and industry trends when evaluating the stock.

Additionally, investors should monitor news and announcements from the company for any development or changes that may affect their investment decisions.

Recent Posts