Analysts Set CarGurus, Target Price of $22.79, Showing Confidence in the Company’s Future.

February 2, 2023

Trending News ☀️

CARGURUS ($NASDAQ:CARG): Analysts have set a target price of $22.79 for CarGurus, Inc., a leading online automotive marketplace. CarGurus, Inc. is a consumer-focused automotive marketplace and resource for drivers to research and shop for cars. In addition to helping car buyers find their ideal car, CarGurus also provides helpful resources to help them understand the process of buying a car. This includes reviews from other shoppers, estimated market value calculations, and payment calculators to help buyers determine what they can afford. CarGurus also offers car financing options and trade-in values to make the car buying experience as easy and stress-free as possible.

Analysts have set CarGurus, Inc.’s target price of $22.79 due to its impressive growth over the past few years and its potential for continued success. These strong performance numbers have attracted the attention of investors and analysts alike, who recognize the potential for long-term success. With its strong growth and industry-leading platform, it is well-positioned for continued success in the automotive marketplace.

Share Price

On Wednesday, CarGurus, Inc. (CARG) stock opened at $17.6 and closed at $17.7, up by 0.1% from the prior closing price of $17.6. They have taken into account the company’s current financial position, as well as factors such as industry trends and competitive dynamics. The analysts have also considered CARG’s long-term outlook, including its plans for new product launches and expansion plans. They have evaluated the company’s existing product portfolio and its ability to develop new products or services that will be attractive to customers. The company has made significant progress in recent years, with its stock price increasing steadily over the past few years.

The analysts believe that this trend is likely to continue in the future, and they are confident that CarGurus will be able to grow and continue to deliver strong returns for investors. The target price they have set is an indication of their belief that the company will continue to be a strong performer in the stock market. This positive outlook is likely to be welcomed by investors, who are looking for companies with a bright future and strong potential for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cargurus. More…

| Total Revenues | Net Income | Net Margin |

| 1.71k | -45.23 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cargurus. More…

| Operations | Investing | Financing |

| 124.03 | 72.76 | -14.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cargurus. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 982.86 | 232.31 | 4.86 |

Key Ratios Snapshot

Some of the financial key ratios for Cargurus are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.3% | 64.5% | 7.2% |

| FCF Margin | ROE | ROA |

| 6.3% | 14.8% | 7.8% |

Analysis

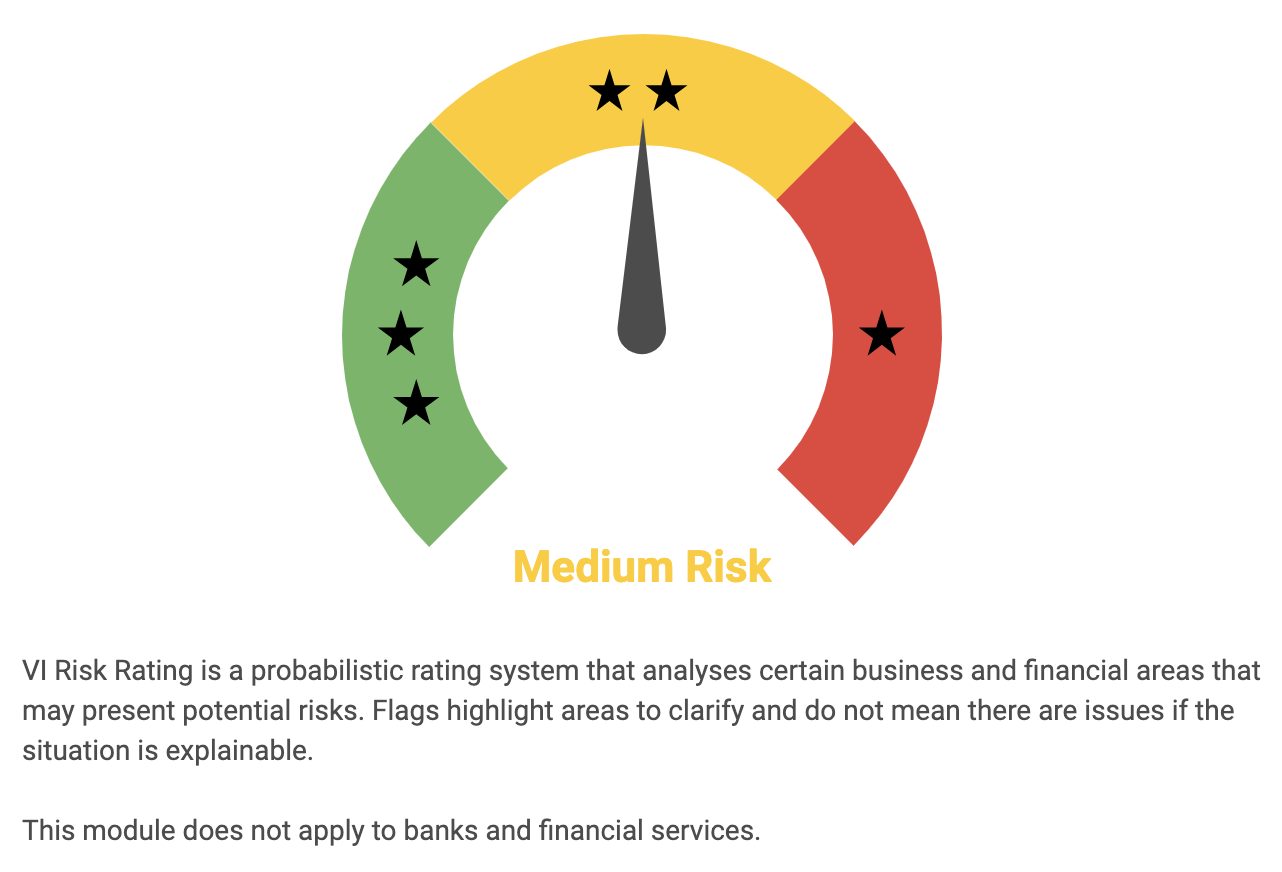

GoodWhale conducted an analysis of CARGURUS’s wellbeing and determined that it is a medium risk investment. CARGURUS’s Risk Rating was evaluated from a financial and business perspective, taking into account various factors such as liquidity, leverage, profitability, and solvency. GoodWhale also detected two risk warnings in the balance sheet and financial journal; however, further information on these risks is only available to registered users. GoodWhale’s analysis found that CARGURUS’s liquidity is balanced, meaning they have sufficient assets to cover their liabilities. The company’s leverage ratio is lower than industry standards but still healthy. Profitability and solvency are also in line with expectations. However, the two risk warnings remain a cause for concern. Overall, GoodWhale has concluded that CARGURUS is a medium risk investment. Although the liquidity and leverage ratios are healthy, the two warnings of risk warrant further investigation for any potential investors. Becoming a registered user at GoodWhale will provide access to more detailed information about these warnings. This data can then be used to accurately assess the potential risks associated with investing in CARGURUS. More…

Peers

In the online automotive marketplace, CarGurus Inc competes with Liberty TripAdvisor Holdings Inc, Points.com Inc, and Camplify Holdings Ltd. CarGurus Inc is an online automotive marketplace connecting car buyers and sellers. Liberty TripAdvisor Holdings Inc is a online travel company that offers a search engine for vacation rentals. Points.com Inc is a provider of loyalty programs. Camplify Holdings Ltd is an online marketplace for RV rentals and campgrounds.

– Liberty TripAdvisor Holdings Inc ($NASDAQ:LTRPA)

Liberty TripAdvisor Holdings Inc is a online travel company. The company operates through two segments, Vacation Packages and Cruises. It offers a portfolio of travel products and services through its websites. The company was founded in 2008 and is headquartered in Denver, Colorado.

Summary

Financial analysts have recently set a target price of $22.79 for CarGurus, Inc., indicating their confidence in the company’s future. The analysis takes into account factors such as the company’s competitive position in the market, its financial stability, and its ability to create value for shareholders. CarGurus is a leading online automotive marketplace, connecting millions of shoppers with thousands of dealers.

With a strong brand presence and a broad suite of products, CarGurus is well positioned to continue its growth in the coming years. Investors looking for exposure to the automotive industry may want to consider investing in CarGurus shares.

Recent Posts