Zhejiang Double Arrow stock dividend – Zhejiang Double Arrow Rubber Co Ltd Announces 0.2 Cash Dividend

June 1, 2023

🌥️Dividends Yield

On May 26, 2023 Zhejiang Double Arrow ($SZSE:002381) Rubber Co Ltd Announces 0.2 Cash Dividend. This brings the company’s total dividend yield over the past three years to 4.06%, with dividends of 0.2, 0.2, and 0.5 CNY per share respectively over the last three years. This makes them an attractive option for investors looking for dividends stocks, with a yield of 3.33%, 3.33%, and 5.51% over the past three years.

The ex-dividend date for this dividend is May 23, 2023 which should be kept in mind by investors looking to take advantage of this dividend. This could be an excellent opportunity for investors looking to maximize their returns through dividends while investing in a reliable company with a long history of dividend yield increases.

Share Price

The stock opened at CNY7.4 and closed at CNY7.3, down by 0.7% from the last closing price of 7.4. This dividend is seen as a sign of confidence from the company and a positive indication that the company is committed to rewarding its shareholders for their loyalty. It is also a sign of the company’s commitment to continuous growth and development. The dividend payout is expected to help boost investor confidence in the company and provide a further incentive for shareholders to invest in the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zhejiang Double Arrow. More…

| Total Revenues | Net Income | Net Margin |

| 2.37k | 135.51 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zhejiang Double Arrow. More…

| Operations | Investing | Financing |

| 104.03 | -235.72 | -122.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zhejiang Double Arrow. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.57k | 1.54k | 4.9 |

Key Ratios Snapshot

Some of the financial key ratios for Zhejiang Double Arrow are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.6% | -11.9% | 8.2% |

| FCF Margin | ROE | ROA |

| -3.9% | 6.1% | 3.4% |

Analysis – Zhejiang Double Arrow Intrinsic Value

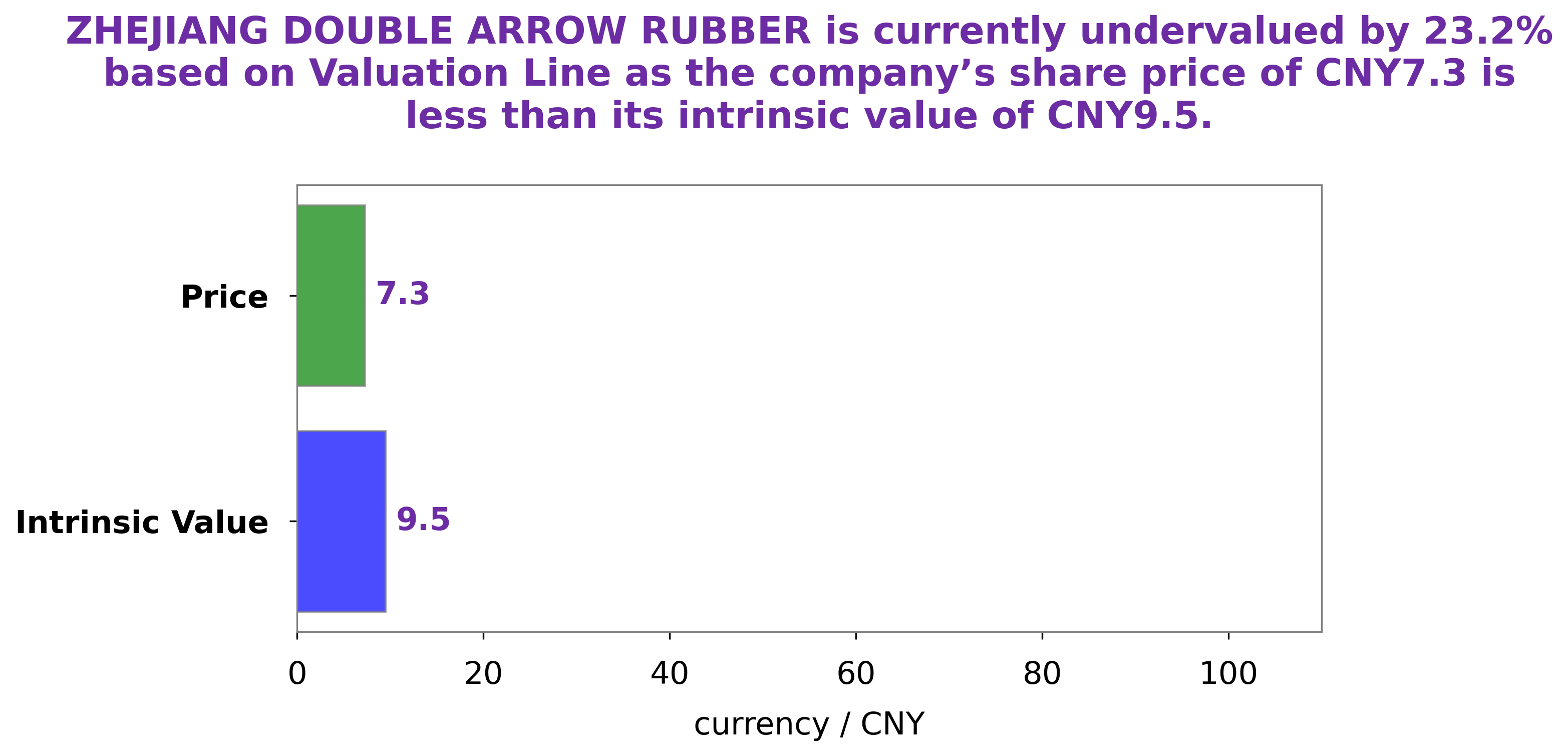

At GoodWhale, we have performed an analysis of ZHEJIANG DOUBLE ARROW RUBBER’s fundamentals, and our proprietary Valuation Line has given an estimated fair value of CNY9.5 for a share of the company. Currently, ZHEJIANG DOUBLE ARROW RUBBER stock is traded at CNY7.3, indicating that it is undervalued by 23.2%. We believe this might be a good opportunity for investors to consider the stock as part of their portfolio. More…

Peers

The competition between Zhejiang Double Arrow Rubber Co Ltd and its competitors Shandong Meichen Ecology & Environment Co Ltd, Unitel High Technology Corp and Artego SA has been intense and tight. All four companies are striving to provide the best products and services in order to remain competitive in the market.

– Shandong Meichen Ecology & Environment Co Ltd ($SZSE:300237)

Shandong Meichen Ecology & Environment Co Ltd is a Chinese environmental technology company that focuses on technology for waste management, pollution control, and energy conservation. The company has a market capitalization of 2.75 billion dollars as of 2023 and has a Return on Equity of -88.04%, indicating poor profitability. This indicates that investors have lower confidence in the company’s abilities to generate profits. To increase confidence and profitability, Shandong Meichen Ecology & Environment Co Ltd must improve efficiency and focus on value-creating processes.

– Unitel High Technology Corp ($TPEX:3642)

Unitel High Technology Corp is a leading provider of information and communication technology solutions, services, and products. Founded in 2015, the company has grown from a small-scale business to a global entity offering innovative solutions to customers in the fields of artificial intelligence, robotics, cloud computing, and more. As of 2023, Unitel High Technology Corp has a market capitalization of 165.74M and a Return on Equity of -130.4%. This suggests that the company has negative stockholder equity and is not generating sufficient profits to cover its debt obligations. Despite its concerning ROE, Unitel High Technology Corp is still able to provide a wide range of services to its customers and continues to be a leader in the industry.

– Artego SA ($LTS:0Q50)

Artego SA is a Polish chemical company that specializes in the production of paints and varnishes, as well as other chemical products. As of 2023, the company has a market cap of 20.32M and a Return on Equity (ROE) of 9.44%. The market cap is a measure of Artego SA’s size and market value, which provides insight into the company’s financial health. The ROE, in turn, is a measure of the company’s profitability, which provides additional evidence that Artego SA is a financially sound firm.

Summary

ZHEJIANG DOUBLE ARROW RUBBER has been paying out generous dividends to shareholders over the past three years, with an average dividend yield of 4.06%. This makes it an attractive option for dividend investors looking for higher returns. The company has paid out 0.2, 0.2, and 0.5 CNY per share over the last three years, resulting in respective dividend yields of 3.33%, 3.33%, and 5.51%. With a consistent dividend history and a relatively high dividend yield, ZHEJIANG DOUBLE ARROW RUBBER looks to be an attractive dividend stock for investors.

Recent Posts