Sei Investments Co. Reduces Stake in Gentex Corporation

June 11, 2023

🌥️Trending News

Gentex Corporation ($NASDAQ:GNTX) is an automotive supplier that produces and distributes digital vision, connected car, and dimmable glass products. The company is headquartered in Zeeland, Michigan and works in partnership with the world’s leading automotive manufacturers, such as BMW, Ford, and Toyota. The Main reason for this reduction is said to be Gentex Corporation’s lackluster performance in the past year, as the company has seen a decline in its sales and profits. In addition, investors have been concerned about the potential impacts of the ongoing trade war between the US and China on the company’s production costs and international sales. Given the current market conditions, it is uncertain how long this decrease in shares of Gentex Corporation will last.

However, despite the recent setback, the company remains an attractive investment for many due to its innovative products and strong partnerships with leading automotive manufacturers. With a solid future outlook, investors will likely continue to have faith in Gentex Corporation and its potential for success in the coming years.

Share Price

Tuesday saw a notable increase in the stock of GENTEX CORPORATION, opening at $26.9 and closing at $27.3, an increase of 1.7% from the previous closing price of $26.8. This increase was largely driven by Sei Investments Co., which reduced their stake in the company. No further information has been made available as to why Sei Investments Co. decided to reduce their holdings. Nevertheless, this has had a positive impact on the stock of GENTEX CORPORATION and is likely to continue to shape its performance in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gentex Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2k | 325.29 | 16.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gentex Corporation. More…

| Operations | Investing | Financing |

| 338.2 | -172.74 | -209.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gentex Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.43k | 310.09 | 8.82 |

Key Ratios Snapshot

Some of the financial key ratios for Gentex Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.8% | -7.0% | 19.0% |

| FCF Margin | ROE | ROA |

| 9.6% | 11.5% | 9.8% |

Analysis

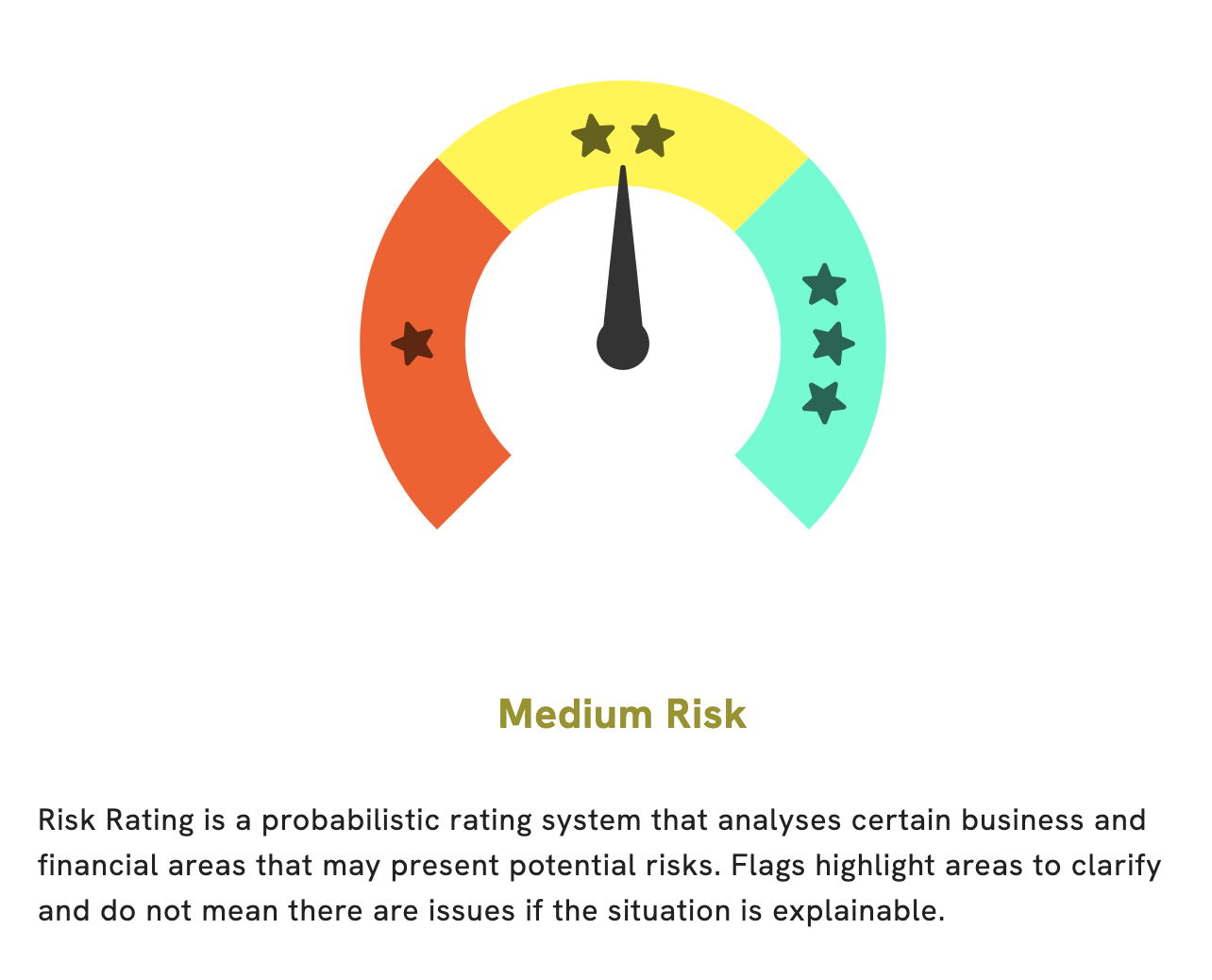

At GoodWhale, we provide you with an in-depth analysis of GENTEX CORPORATION‘s fundamentals. Based on our Risk Rating system, GENTEX CORPORATION is a medium risk investment in terms of financial and business aspects. To help you decide whether or not to invest in the company, we have identified three risk warnings in the income statement, balance sheet, and nonfinancial reports. If you would like to take a closer look, be sure to register with us and get started. More…

Peers

The company’s main competitors are Standard Motor Products Inc, Dorman Products Inc, LCI Industries Inc.

– Standard Motor Products Inc ($NYSE:SMP)

As of 2022, Standard Motor Products Inc has a market cap of 764.51M and a ROE of 12.67%. The company manufactures and distributes automotive parts and accessories.

– Dorman Products Inc ($NASDAQ:DORM)

Dorman Products Inc is a leading supplier of automotive replacement parts, including brake parts, engine parts, and suspension parts. The company has a market cap of 2.73B as of 2022 and a Return on Equity of 14.77%. Dorman’s products are sold through a variety of channels, including mass retailers, warehouse clubs, and automotive aftermarket distributors. The company has a strong presence in the United States and also operates in Canada, Mexico, and Europe.

– LCI Industries Inc ($NYSE:LCII)

LCI Industries, through its subsidiaries, manufactures and sells components and systems to the recreational vehicle, marine, commercial, and industrial markets. It operates through two segments, Original Equipment Manufacturing and Aftermarket. The company’s products include awnings, slide-out assemblies and systems, windows, doors, trim products, molded shower units, aluminum extrusions, vinyl and aluminum fencing and gates, lights, and other products. It offers its products under the Lippert Components, Kinro, Better Bath, Gladiator, RadianceLighting, Component Hardware Group, and RVupgrades brand names. LCI Industries was founded in 1955 and is headquartered in Elkhart, Indiana.

Summary

Gentex Corporation (GNTX) is a U.S.-based company that designs, manufactures, and distributes automotive products and services. Analysts have suggested this move is related to a decrease in optimism toward the stock. Despite this, GNTX continues to be a popular stock for investors, mainly due to its impressive financial performance. In the past two years, GNTX has seen an increase in sales and profits, as well as an increase in its stock price.

Furthermore, GNTX has maintained a favorable dividend payout ratio and its balance sheet remains strong. All of these factors make GNTX an attractive investment opportunity for those looking to gain exposure to the automotive sector.

Recent Posts