Rayhoo Motor Dies to Invest 397 Million Yuan in 2023 for Second Phase of NEV Lightweight Parts Factory.

March 18, 2023

Trending News 🌥️

Rayhoo ($SZSE:002997) MOTOR DIES Co., Ltd. This investment will be undertaken in 2023 and is expected to greatly benefit the company’s manufacturing capabilities. The planned investment will be used for upgraded equipment, research and development, and construction of a new manufacturing line.

In addition, the company will be able to improve the quality of their parts and reduce their production costs. With the second phase now underway, the company will be able to not only increase their production capacity but also produce higher quality parts at a lower cost. The company’s investment into their second phase of their NEV lightweight parts factory is expected to have a positive impact on their business and the industry as a whole.

Market Price

This news saw the company’s stock open at CNY25.0 and close at CNY25.3, an increase of 1.9% from the last closing price of 24.9. The second phase will expand on production capacity, utilizing the latest technologies and designs to produce energy-saving and lightweight NEV parts. The move is seen as a strategic step towards helping RAYHOO MOTOR DIES meet the increasing demand for NEV parts, as the global electric vehicle market is expected to exhibit sustained growth over the next decade and beyond. In addition, with the support of China’s “New Infrastructure” initiative, the market for NEV parts is expected to see strong growth as well. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rayhoo Motor Dies. More…

| Total Revenues | Net Income | Net Margin |

| 1.21k | 134.06 | 13.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rayhoo Motor Dies. More…

| Operations | Investing | Financing |

| 169.44 | -200.05 | 404.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rayhoo Motor Dies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.85k | 2.42k | 6.77 |

Key Ratios Snapshot

Some of the financial key ratios for Rayhoo Motor Dies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.2% | 8.9% | 13.0% |

| FCF Margin | ROE | ROA |

| 2.8% | 7.8% | 2.6% |

Analysis

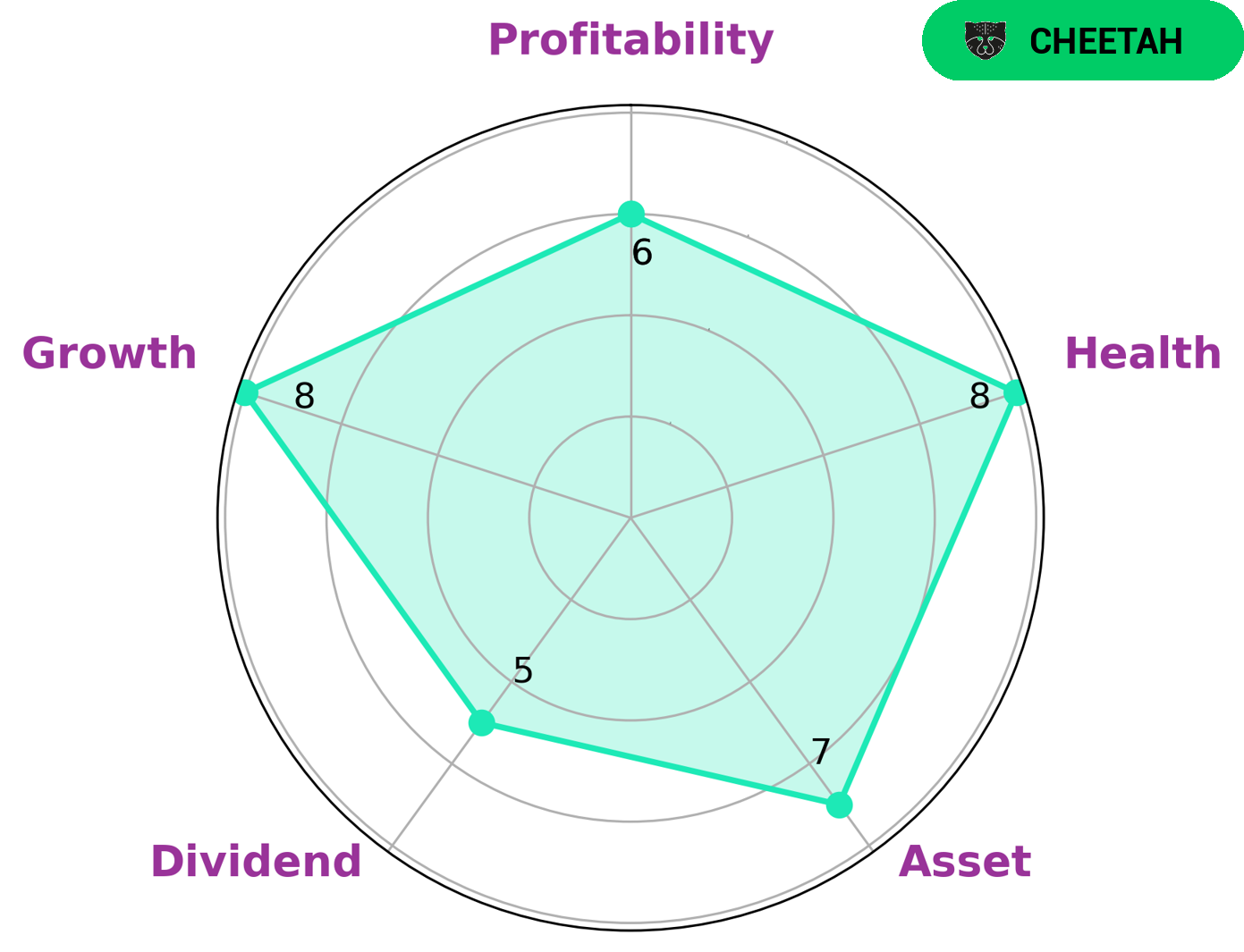

At GoodWhale, we have performed an analysis of RAYHOO MOTOR DIES’s wellbeing. Our Star Chart shows that RAYHOO MOTOR DIES is strong in asset and growth, and medium in dividend and profitability. Based on these analysis, we classify RAYHOO MOTOR DIES as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors looking for high growth opportunities may find that RAYHOO MOTOR DIES is an attractive investment. We have also assessed RAYHOO MOTOR DIES’s health score, which currently stands at 8/10. This score was determined by taking into account the company’s cashflows and debt, and suggests that RAYHOO MOTOR DIES is capable of paying off debt and funding future operations. More…

Peers

With a long and rich history in the automotive sector, Rayhoo has established itself as a reliable supplier of high-quality dies for various purposes. Its competitors also boast a reputation for manufacturing excellence, providing customers with an array of options when it comes to selecting dies that are tailored to their precise requirements.

– Tein Inc ($TSE:7217)

Tein Inc is a global automotive parts supplier. It specializes in suspension components, such as shocks and springs, as well as many other chassis parts including control arms, hub kits, and struts. As of 2023, Tein Inc has a market capitalization of 4.61 billion dollars and an impressive Return on Equity of 8.13%. This shows that the company is well-managed and is performing well financially.

– Unipres Corp ($TSE:5949)

Unipres Corp is a Japanese automotive components manufacturer, specializing in press products and assembling parts. As of 2023, it has a market capitalization of 37.04 billion dollars, a large value compared to its peers. Its return on equity for the same year was 2.14%, indicating a moderate level of profitability. Unipres Corp is well-positioned in its industry, as it has been able to generate a healthy return from its investments.

– Nihon Plast Co Ltd ($TSE:7291)

Nihon Plast Co Ltd is a global plastic manufacturing company based in Japan. The company has a market cap of 7.63B as of 2023, which reflects its strong reputation in the industry and its considerable growth prospects. The company’s return on equity (ROE) of -12.6% indicates a lack of profitability in the near future, suggesting that there may be room for improvement in terms of efficiency and cost management. Despite this, Nihon Plast Co Ltd is well positioned to compete in the international plastics market with its strong presence in the market.

Summary

Rayhoo Motor Dies Co., Ltd. has announced plans to invest 397 million Yuan in 2023 to expand its production of new energy vehicle (NEV) lightweight parts. This is the second phase of their NEV factory development, and it is expected to significantly improve the company’s production capabilities. This investment follows previous investments in the factory’s first phase, which includes the building of new workshops and the introduction of advanced equipment. The move is expected to further solidify Rayhoo’s position as one of the leading producers of NEV parts in China.

The additional capacity is expected to generate increased revenue for the company, allowing for further growth and expansion opportunities. This investment is a positive sign for shareholders and should create long-term value for them.

Recent Posts