Nikki dividend yield – NIKKI Co Ltd Announces 70.0 Cash Dividend

March 19, 2023

Dividends Yield

On March 2 2023, NIKKI ($TSE:6042) Co Ltd announced that it would be paying out a cash dividend of 70.0 JPY per share. This is an attractive dividend stock for investors looking to add dividend-paying stocks to their portfolios. Over the last 3 years, NIKKI has issued an annual dividend per share of 70.0 JPY, 70.0 JPY and 50.0 JPY, with respective dividend yields of 3.77%, 3.77% and 2.49% for 2021-2023, resulting in an average dividend yield of 3.34%. The ex-dividend date for this dividend is March 30 2023. Investors who are looking to maximize their returns through dividend-paying stocks may want to consider investing in NIKKI Co Ltd. With its consistent dividend yield of 3.34%, the company is poised to continue to deliver returns to its shareholders.

Additionally, with its low ex-dividend date of March 30 2023, NIKKI is an attractive choice for investors looking to enjoy the benefits of a high dividend yield sooner rather than later.

Share Price

This news caused the stock to open at JP¥1910.0 and close at JP¥1910.0, a 0.2% increase from its previous closing price of JP¥1906.0. With this dividend, NIKKI Co Ltd is hoping to reward the loyalty of its shareholders and strengthen its financial position. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nikki. More…

| Total Revenues | Net Income | Net Margin |

| 9.11k | 1.03k | 12.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nikki. More…

| Operations | Investing | Financing |

| 1.32k | -2.47k | 1.32k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nikki. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.72k | 10.94k | 5.1k |

Key Ratios Snapshot

Some of the financial key ratios for Nikki are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 14.0% | 15.9% |

| FCF Margin | ROE | ROA |

| -29.1% | 9.4% | 4.4% |

Analysis

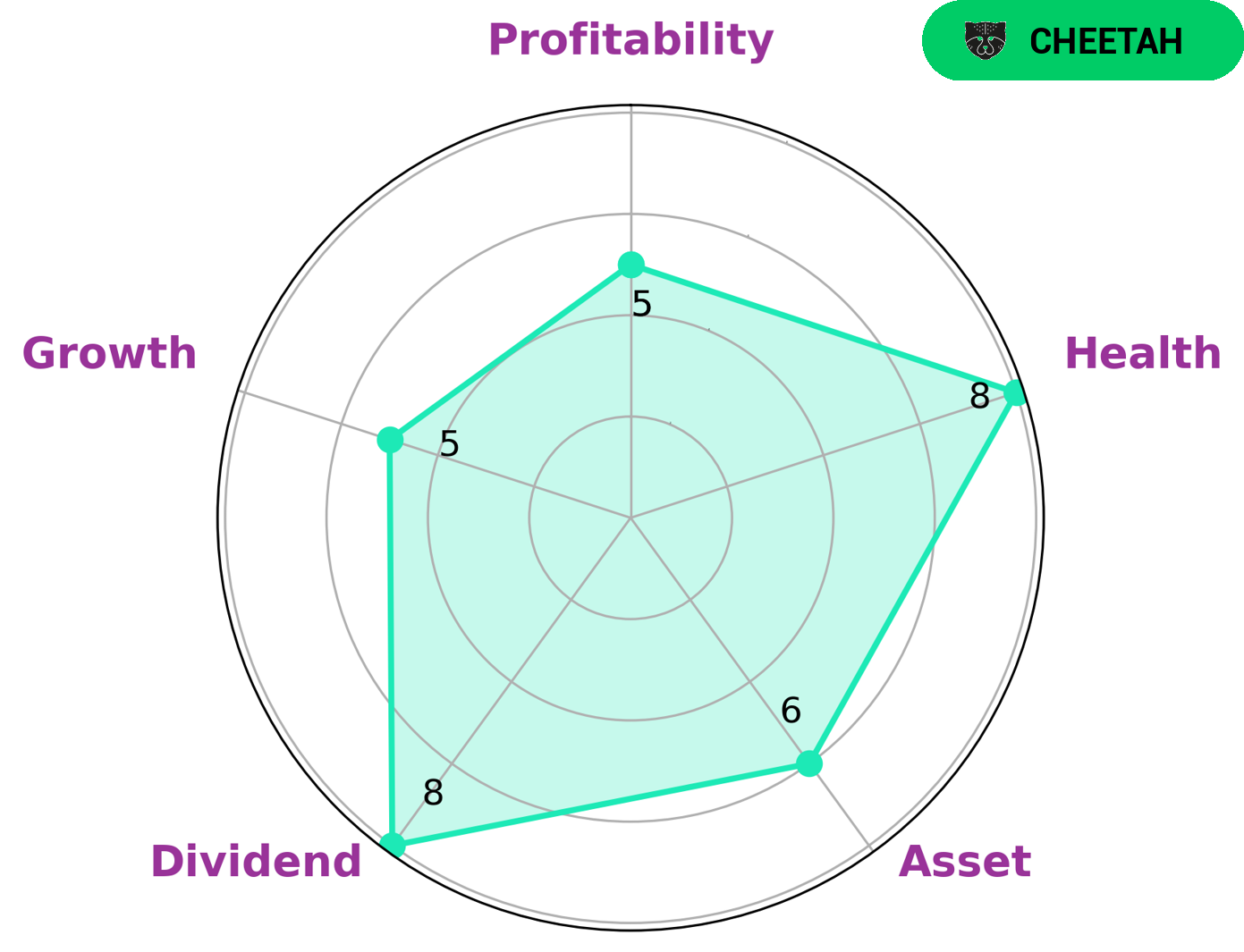

At GoodWhale, we recently conducted an analysis of NIKKI‘s well-being and found that they are classified as ‘cheetah’ type of company according to the Star Chart. This means that NIKKI has achieved high revenue or earnings growth but is considered less stable due to lower profitability. In terms of their dividend, NIKKI is strong, while they are medium in asset, growth, and profitability. The health score of NIKKI is 8/10, which is quite high considering their cashflows and debt. This suggests that the company is capable to safely ride out any crisis without the risk of bankruptcy. This may be attractive to investors who are looking for a potentially high-growth company with a certain degree of stability. More…

Summary

NIKKI is a dividend stock worth considering for investors looking for yield. Over the last three years, it has paid an annual dividend per share of 70.0 JPY, 70.0 JPY and 50.0 JPY, corresponding to dividend yields of 3.77%, 3.77% and 2.49%, respectively. The average dividend yield stands at 3.34%.

When making investing decisions, other factors such as the company’s financials, growth potential and competitive position must be taken into account. It is important to do thorough research and analysis before deciding to invest in any stock.

Recent Posts