MACHINA CAPITAL S.a.s. Invests In Lear Corporation

July 11, 2023

🌥️Trending News

S.A.S. Machina Capital has recently taken on a new investment in Lear Corporation ($NYSE:LEA), a global automotive technology leader in seating and electrical and electronic systems. With a long history of innovation, Lear Corporation has developed a strong presence in the automotive industry, supplying products for some of the world’s leading automakers. Lear Corporation’s products are used in autos ranging from luxury to economy models for nearly every major automaker.

The investment from Machina Capital will help Lear Corporation to further expand their operations and develop new technologies that will be used in the automotive industry. As a leader in automotive innovation, Lear Corporation is well positioned to benefit from this investment and continue to be a key player in the global automotive market.

Stock Price

On Monday, LEAR CORPORATION shares opened at $148.3 and closed at $147.0, resulting in a 1.1% decrease from its closing price of $148.6 on the previous day. This dip in the stock value did not deter Machina Capital S.a.s. (MCS) from investing in the LEAR CORPORATION, as they announced their investment in the company.

MCS is an Italian-based venture capital fund that focuses its investments on high-growth potential businesses. With a commitment to sustainability and a focus on developing technologies that improve the lives of people, MCS’s investment in LEAR CORPORATION is a step forward in strengthening the global automotive sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lear Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 21.53k | 421.9 | 2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lear Corporation. More…

| Operations | Investing | Financing |

| 765.1 | -637.2 | -398.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lear Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.4k | 9.37k | 82.25 |

Key Ratios Snapshot

Some of the financial key ratios for Lear Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.1% | -6.4% | 3.4% |

| FCF Margin | ROE | ROA |

| 0.7% | 9.6% | 3.2% |

Analysis

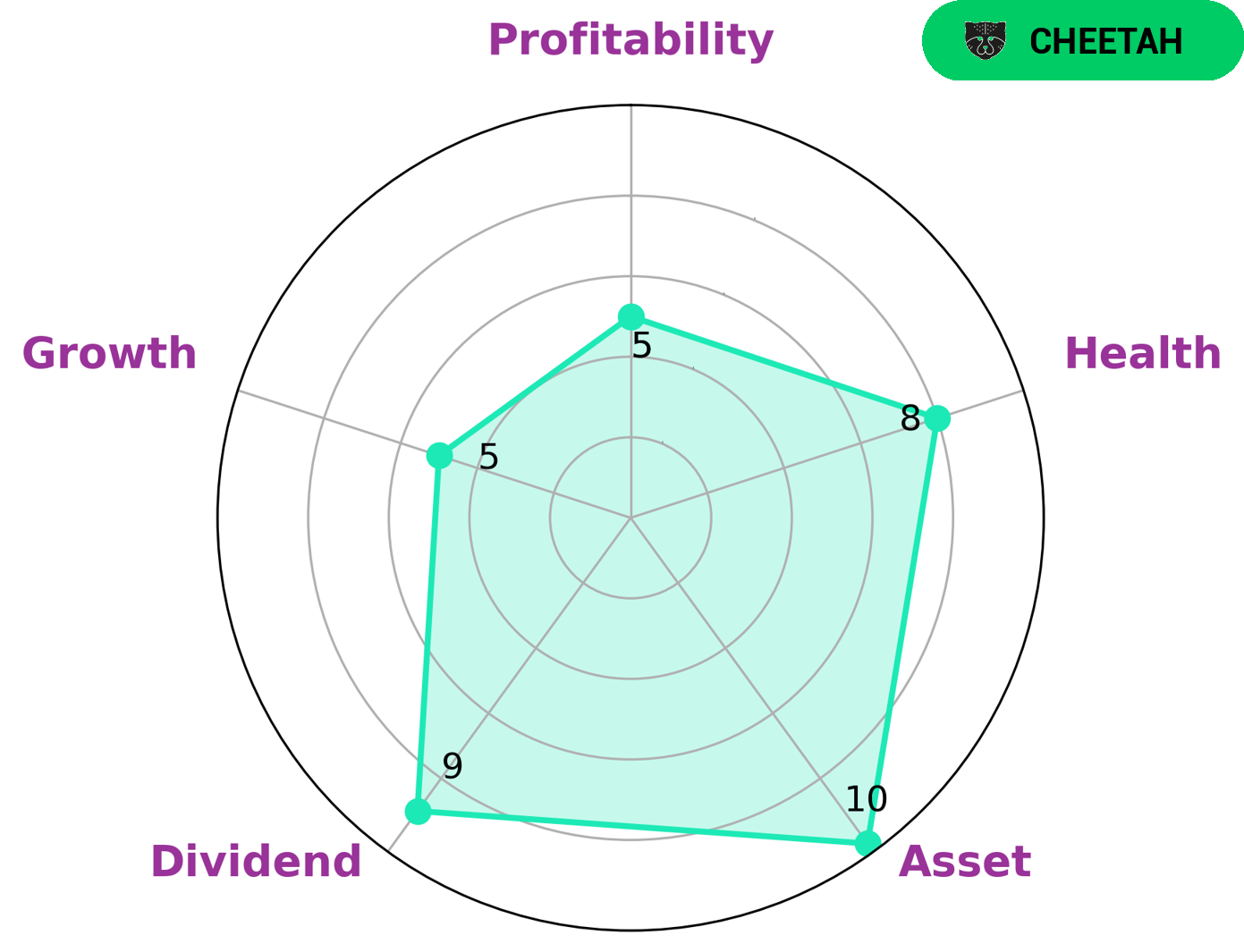

At GoodWhale, we conducted an analysis of LEAR CORPORATION‘s fundamentals. Our Star Chart revealed that LEAR CORPORATION was strong in asset and dividend, and medium in profitability. It was weak in growth. Despite this, our analysis of LEAR CORPORATION’s cashflows and debt revealed a high health score of 9/10, meaning that the company is capable of paying off debt and funding future operations. We classified LEAR CORPORATION as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. This type of company may be of interest to investors looking for a safe, steady return on their investment. Such investors may be drawn to LEAR CORPORATION’s strong asset and dividend performance, as well as its relatively low growth rate – meaning that there is less risk associated with investing in the company. Additionally, the fact that it has a healthy balance sheet and can pay off its debts and fund future operations gives investors added assurance that their investment is secure. More…

Peers

In the automotive industry, suppliers of parts and systems are constantly vying for business from the major carmakers. Two of the biggest players in this space are Lear Corporation and Ningbo Joyson Electronic Corporation. Both companies are based in China and have a long history of supplying carmakers with everything from seats and electrical systems to instrument panels and body control modules. While Lear is the bigger company, with annual sales of around $19 billion, Ningbo Joyson is no slouch, with sales of $7.4 billion. The two companies are constantly jockeying for position in the market, with each trying to undercut the other on price while also offering better quality and more innovative products. The competition between these two companies is fierce, but it is also healthy, as it helps to keep both companies on their toes and provides carmakers with a choice of two very competent suppliers.

– Ningbo Joyson Electronic Corp ($SHSE:600699)

Ningbo Joyson Electronic Corp is a Chinese multinational automotive electronic components company headquartered in Ningbo, Zhejiang. The company has a market cap of 21.55B as of 2022 and a Return on Equity of -18.07%. The company manufactures and supplies automotive electronic components and systems for vehicles worldwide. Its products include airbags, seatbelts, steering wheels, instrument panels, door modules, and other safety-related products.

– Denso Corp ($TSE:6902)

Denso Corp is a Japanese company that manufactures automotive components and systems. It has a market cap of 5.37 trillion as of 2022 and a return on equity of 5.0%. The company produces a wide range of products including engine components, electrical components, and air conditioning systems. It also provides services such as engineering, design, and testing. Denso is a leading supplier of components to the automotive industry.

– Aptiv PLC ($NYSE:APTV)

Aptiv PLC is a global technology company that develops safer, greener and more connected solutions that enable the future of mobility. The company has a market cap of 22.94B as of 2022 and a Return on Equity of 4.8%. Aptiv’s products are used in a variety of vehicles, including cars, trucks, buses and trains. The company’s products are designed to make vehicles safer, more efficient and more connected.

Summary

Lear Corporation is a global leader in automotive seating and electrical distribution systems. It offers a variety of products and services designed to meet the needs of automotive manufacturers and suppliers worldwide. Investing in Lear Corporation can be a great opportunity for investors who are looking for an established company with strong fundamentals. The company has a diversified portfolio of products and services, a strong balance sheet, and has increased revenues for the past several years.

Additionally, Lear has a record of consistent dividend payments, returning cash to shareholders. It also has an efficient operational structure, allowing it to compete effectively in global markets while maintaining profitable margins. With its experience and expertise, Lear is well positioned to capitalize on the growing demand for automotive seating and electrical systems worldwide.

Recent Posts