Interhides Public dividend calculator – “Interhides PCL Announces 0.1 Cash Dividend”.

April 9, 2023

Dividends Yield

On April 1 2023, Interhides PCL announced that it would be paying a 0.1 THB cash dividend per share. This dividend is consistent with the company’s dividend policy in the past three years, resulting in an average dividend yield of 2.55%. This is an attractive dividend yield in comparison to other stocks in the market that offer lower yields. Investors looking to purchase INTERHIDES PUBLIC ($SET:IHL) stock should be aware of the ex-dividend date, which is April 28 2023. This means that any dividends paid by the company will be paid to shareholders on or after the ex-dividend date.

INTERHIDES PUBLIC is a great choice for those who are interested in investing in dividend stocks. It is a reliable company with a consistent dividend policy and an attractive dividend yield. With the ex-dividend date coming up soon, now is the perfect time to invest in INTERHIDES PUBLIC.

Market Price

On Monday, INTERHIDES PUBLIC announced that it had declared a 0.1 cash dividend to its shareholders. Following the announcement of the dividend, INTERHIDES PUBLIC’s stock opened at THB2.9 and closed at THB2.9, representing a 1.4% increase from its previous closing price of THB2.9. This news has been well-received by investors, who have been encouraged by the company’s commitment to providing returns to their shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Interhides Public. More…

| Total Revenues | Net Income | Net Margin |

| 2.05k | 99.93 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Interhides Public. More…

| Operations | Investing | Financing |

| 257.1 | -133.95 | -151.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Interhides Public. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.69k | 2.04k | 2.8 |

Key Ratios Snapshot

Some of the financial key ratios for Interhides Public are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.7% | -2.7% | 8.8% |

| FCF Margin | ROE | ROA |

| 6.0% | 6.8% | 3.1% |

Analysis – Interhides Public Intrinsic Value Calculation

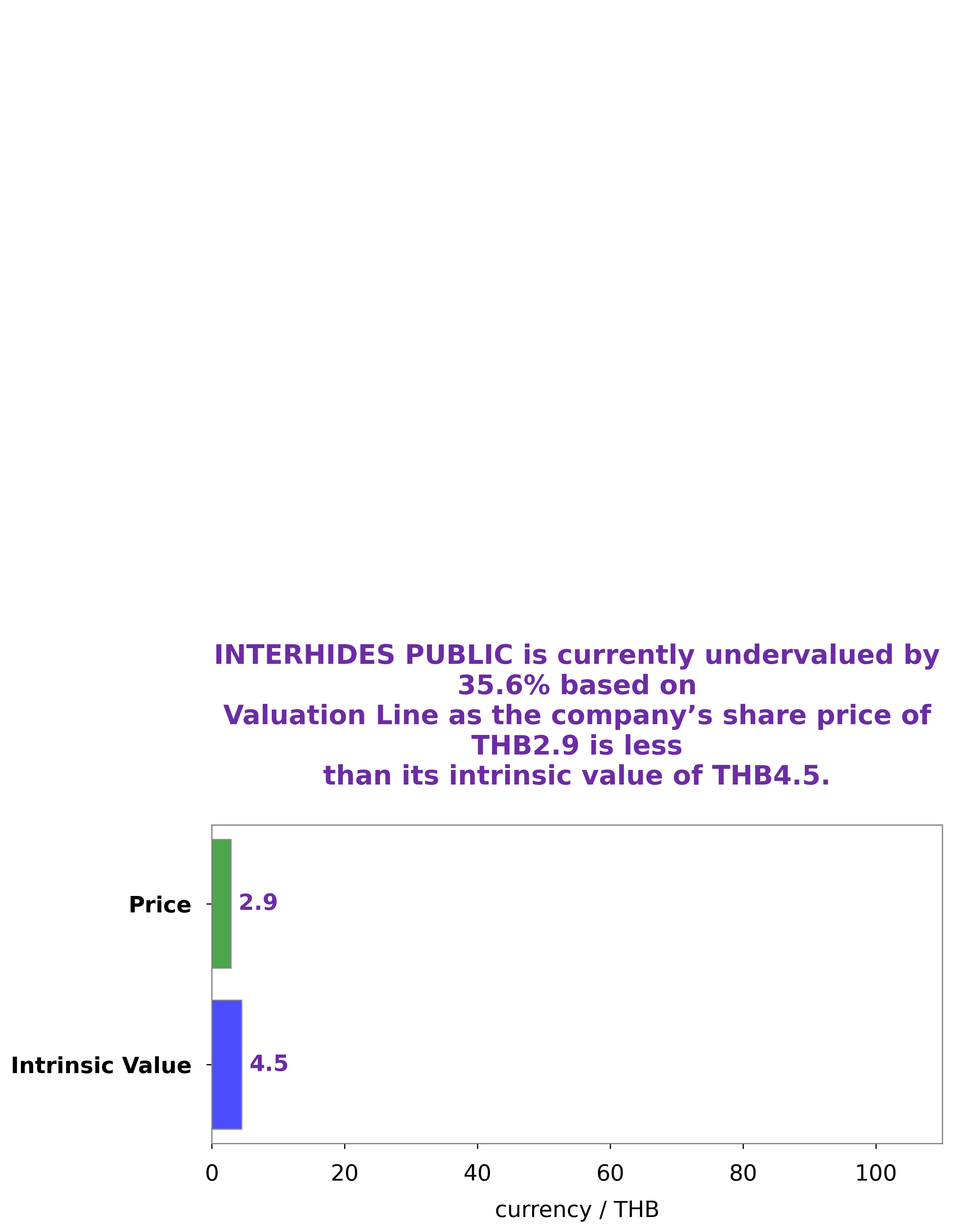

At GoodWhale, we have analyzed the financials of INTERHIDES PUBLIC and calculated the intrinsic value of its share to be around THB4.5. Our proprietary Valuation Line tool was used to make this calculation. After the analysis, it was discovered that the INTERHIDES PUBLIC stock is currently traded at THB2.9, which is a 35.4% undervaluation compared to its intrinsic value. More…

Peers

Interhides PCL is an international company that has been involved in a fierce competition with its competitors, Pirelli & C SpA, Tianneng Power International Ltd, and Yunnan Xiyi Industry Co Ltd. With each of these companies vying to be the top producer of rubber and other related products, the competition has become increasingly intense as they strive to outdo each other and gain market share.

– Pirelli & C SpA ($BER:2PI)

Pirelli & C. SpA is an Italian tire and cable manufacturer based in Milan, Italy. Founded in 1872, Pirelli is the world’s fifth-largest tire manufacturer and the second-largest in Europe, after Michelin. The company has a market cap of 4.51 billion as of 2023, reflecting its strong financial performance over the years and its ability to generate returns for its shareholders. Its Return on Equity (ROE) of 9.74% is also impressive and highlights Pirelli’s efficiency in using its assets to generate income for shareholders. Pirelli is known for its premium tires and has a global footprint with operations in over 160 countries.

– Tianneng Power International Ltd ($SEHK:00819)

Tianneng Power International Ltd is a leading Chinese company that produces and sells batteries and other energy storage solutions. As of 2023, the company had a market cap of 10.8B and a Return on Equity of 13.85%. The company has enjoyed considerable growth in recent years and has been able to increase its market share in the battery power industry. The impressive Return on Equity reflects the success of the company’s strategies and its ability to generate strong earnings from its products and services. The company continues to expand its production capacity and technology, which suggests that it will grow even more in the near future.

– Yunnan Xiyi Industry Co Ltd ($SZSE:002265)

Yunnan Xiyi Industry Co Ltd is a Chinese based industrial company that produces a wide range of products, such as chemicals, electronics, and machinery. As of 2023, the market cap of the company is 12.95B, which reflects the strength of the company’s underlying financial performance. In addition, Yunnan Xiyi Industry Co Ltd has a Return on Equity (ROE) of 0.54%, which measures the company’s ability to generate profits based on its shareholders’ investments. This suggests that the company has been able to make good use of its equity capital to generate profits and increase shareholder value.

Summary

Investing in INTERHIDES PUBLIC is an attractive proposition for income investors, due to its strong track record of consistent dividend payments over the last three years. The stock currently offers a dividend yield of 2.55%, which is higher than the broader market average. This level of income combined with the potential for capital appreciation makes it an appealing option for long-term investors.

Fundamental analysis of the company’s financials and industry trends suggest that INTERHIDES PUBLIC’s dividend yield is sustainable in the medium to long-term. There may also be further upside in the stock as it continues to grow and increase its market share.

Recent Posts