FOXF Intrinsic Value – Fox Factory Holding Corp. Sees Significant Share Price Increase Despite Smaller Size

June 9, 2023

☀️Trending News

Fox Factory Holding ($NASDAQ:FOXF) Corp. (FOX) has seen a significant increase in its share price despite being a smaller company. FOX is a leading manufacturer of high-performance ride dynamics products for mountain bikes, side-by-sides, on-road vehicles, off-road trucks, and all-terrain vehicles. Their suspension components and accessories are designed to provide riders with superior control, performance, and comfort. Despite its relatively small size compared to other companies in the industry, FOX has seen its share price increase significantly over the past few years. This is largely due to FOX’s ability to quickly and efficiently produce quality products that cater to a variety of markets.

Additionally, FOX has implemented an aggressive marketing strategy that has been effective in increasing customer awareness and improving brand recognition. Overall, Fox Factory Holding Corp. may not be the largest company, but it has still seen remarkable success due to its innovative products and successful marketing strategies. With its share price continuing to increase, investors are optimistic about the future of FOX and the potential return on their investments.

Market Price

On Thursday, FOX opened at $96.1 and closed at $95.2, down by 0.9% from last closing price of 96.0. This trend appears to be driven by strong investor confidence in the company’s continued success, with its top and bottom lines showing continuous growth over the past few years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FOXF. More…

| Total Revenues | Net Income | Net Margin |

| 1.62k | 199 | 12.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FOXF. More…

| Operations | Investing | Financing |

| 263.38 | -180.88 | -59.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FOXF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.82k | 660.18 | 27.52 |

Key Ratios Snapshot

Some of the financial key ratios for FOXF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.0% | 34.1% | 15.1% |

| FCF Margin | ROE | ROA |

| 13.3% | 13.4% | 8.4% |

Analysis – FOXF Intrinsic Value

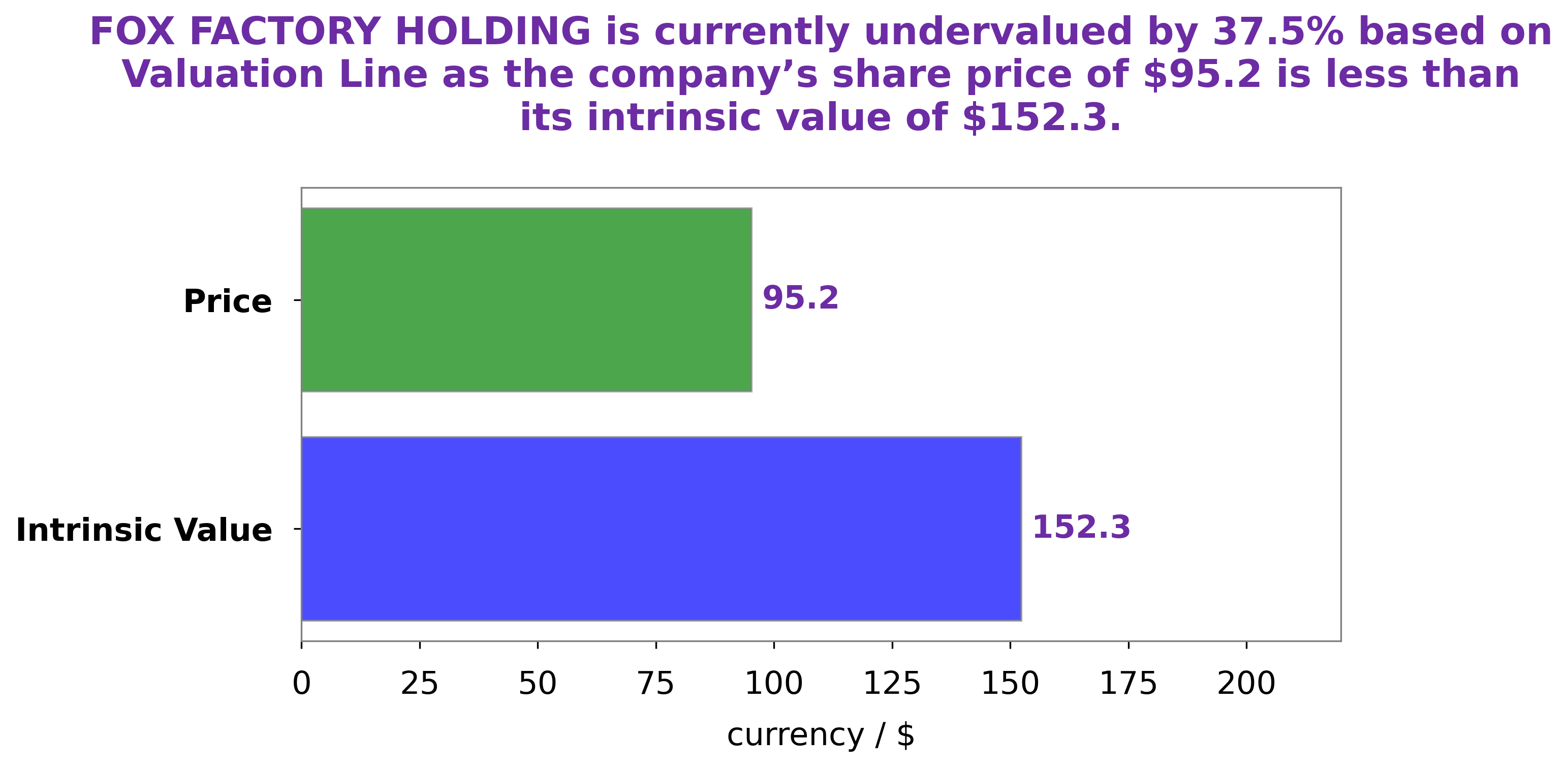

At GoodWhale, we are constantly analyzing the financials of FOX FACTORY HOLDING to provide our readers with the best insights. After our analysis, we have determined that the fair value of FOX FACTORY HOLDING share is around $152.3. This calculation was done with our proprietary Valuation Line. Currently, FOX FACTORY HOLDING stock is trading at $95.2, which is 37.5% below its fair value. This implies that the current stock price is a great opportunity to invest in the company for its long-term potential. More…

Peers

The Company’s products are sold to original equipment manufacturers and aftermarket customers. Fox Factory Holding Corp was founded in 1974 and is headquartered in Scotts Valley, California. Hankook & Co is a South Korean company that manufactures and sells tires. The company was founded in 1941 as the Chosun Tire Company and changed its name to Hankook Tire in 1968. Hankook Tire has manufacturing plants in South Korea, China, Hungary, and Indonesia. The company sells its tires under the Hankook, Kumho, and Nexen brands. Federal Corp is a Taiwanese company that manufactures and sells tires. Federal Corp was founded in 1954 and is headquartered in Taipei, Taiwan. The company has manufacturing plants in Taiwan, China, and Thailand. Federal Corp sells its tires under the Federal, Achilles, and Atturo brands. PT Multistrada Arah Sarana Tbk is an Indonesian company that manufactures and sells tires. PT Multistrada Arah Sarana Tbk was founded in 1976 and is headquartered in Jakarta, Indonesia. The company has manufacturing plants in Indonesia and Vietnam. PT Multistrada Arah Sarana Tbk sells its tires under the Multistrada, Tristar, and Maxxis brands.

– Hankook & Co ($KOSE:000240)

Hankook & Co is a South Korean conglomerate with a market cap of 1.17T as of 2022. The company has a Return on Equity of 5.05%. Hankook & Co is involved in a variety of businesses including tires, chemicals, and auto parts. The company has a strong presence in South Korea and is a major player in the global market.

– Federal Corp ($TWSE:2102)

Federal Corp is a publicly traded company with a market capitalization of 8.5 billion as of 2022. The company has a negative return on equity of 13.91%. Federal Corp is engaged in the business of manufacturing and selling automotive parts and systems.

– PT Multistrada Arah Sarana Tbk ($IDX:MASA)

PT Multistrada Arah Sarana Tbk has a market cap of 18.64T as of 2022, a Return on Equity of 19.35%. The company is engaged in the manufacturing of passenger car radial tyres and motorcycle tyres in Indonesia. It also exports its products to over 60 countries worldwide.

Summary

Fox Factory Holding Corp. is a small, publicly traded company that has seen a notable increase in its share price in recent years. Analysts suggest that the company’s growth potential is based on its strong fundamentals and strategic positioning in the market. Fox Factory Holding has seen success through investments in areas such as advanced engineering, research and development, employee training, and product innovation.

In addition to this, the company also has a strong international presence and experienced management team which have helped it to achieve consistent profit growth. Investors may want to consider Fox Factory Holding Corp. as a potential investment option due to its long-term stability and potential for further growth in a competitive market.

Recent Posts