Fox Factory Holding Reports Record Fourth Quarter Earnings for FY 2022-2023.

March 13, 2023

Earnings Overview

Fox Factory Holding ($NASDAQ:FOXF) reported total revenue of USD 53.0 million for the fourth quarter of fiscal year 2022, ending February 23, 2023, representing a 40.4% year-over-year increase. Net income for the quarter was USD 408.6 million, a 19.4% year-over-year increase compared to December 31, 2022.

Transcripts Simplified

Fourth quarter sales were $408.6 million, a 19.4% increase year-over-year. The Powered Vehicles Group (PVG) saw a 38.5% increase in sales, while the Specialty Sports Group (SSG) saw a 1.9% decrease. For the full year, sales were $1.602.5 billion, a 23.4% increase year-over-year. Gross margin was 32% in the fourth quarter of 2022 and non-GAAP adjusted gross margin was also 32%.

Total operating expenses were $74.2 million or 18.1% of sales in the fourth quarter of 2022. Non-GAAP operating expenses decreased by 50 basis points to 16.2% in the fourth quarter of 2022 compared to 16.7% in the same period in the prior year. Sales and marketing expenses increased approximately $1.8 million in the fourth quarter of 2022, while research and development costs increased approximately $2.2 million in the fourth quarter of 2022.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FOXF. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 205.28 | 12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FOXF. More…

| Operations | Investing | Financing |

| 187.09 | -44.73 | -179.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FOXF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 496.95 | 26.53 |

Key Ratios Snapshot

Some of the financial key ratios for FOXF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.7% | 29.8% | 15.1% |

| FCF Margin | ROE | ROA |

| 8.9% | 13.9% | 9.4% |

Share Price

FOX FACTORY HOLDING, a manufacturer of performance parts and accessories for the powersports, mountain bike, and marine markets, reported record fourth quarter earnings for its fiscal year 2022-2023. On Thursday, FOX FACTORY HOLDING stock opened at $120.2 and closed at $122.5, up by 1.8% from the prior closing price of 120.3. The company attributed its success to strong demand for its performance parts and accessories, as well as strong cost control measures put in place throughout the year. The company also managed to increase its margins by improving its manufacturing processes and streamlining operations. CEO Mike Fox stated that the company is “pleased to report record earnings this quarter, and is confident in our ability to continue to grow in the coming years.”

Additionally, FOX FACTORY HOLDING has expanded its distribution channels and invested heavily in research and development in order to bring new and innovative products to market. Overall, FOX FACTORY HOLDING’s record fourth quarter earnings demonstrate the company’s commitment to providing customers with high quality and reliable performance parts and accessories. The company is well-positioned for continued growth in the coming years as it continues to invest in research and development and expand its reach. Live Quote…

Analysis

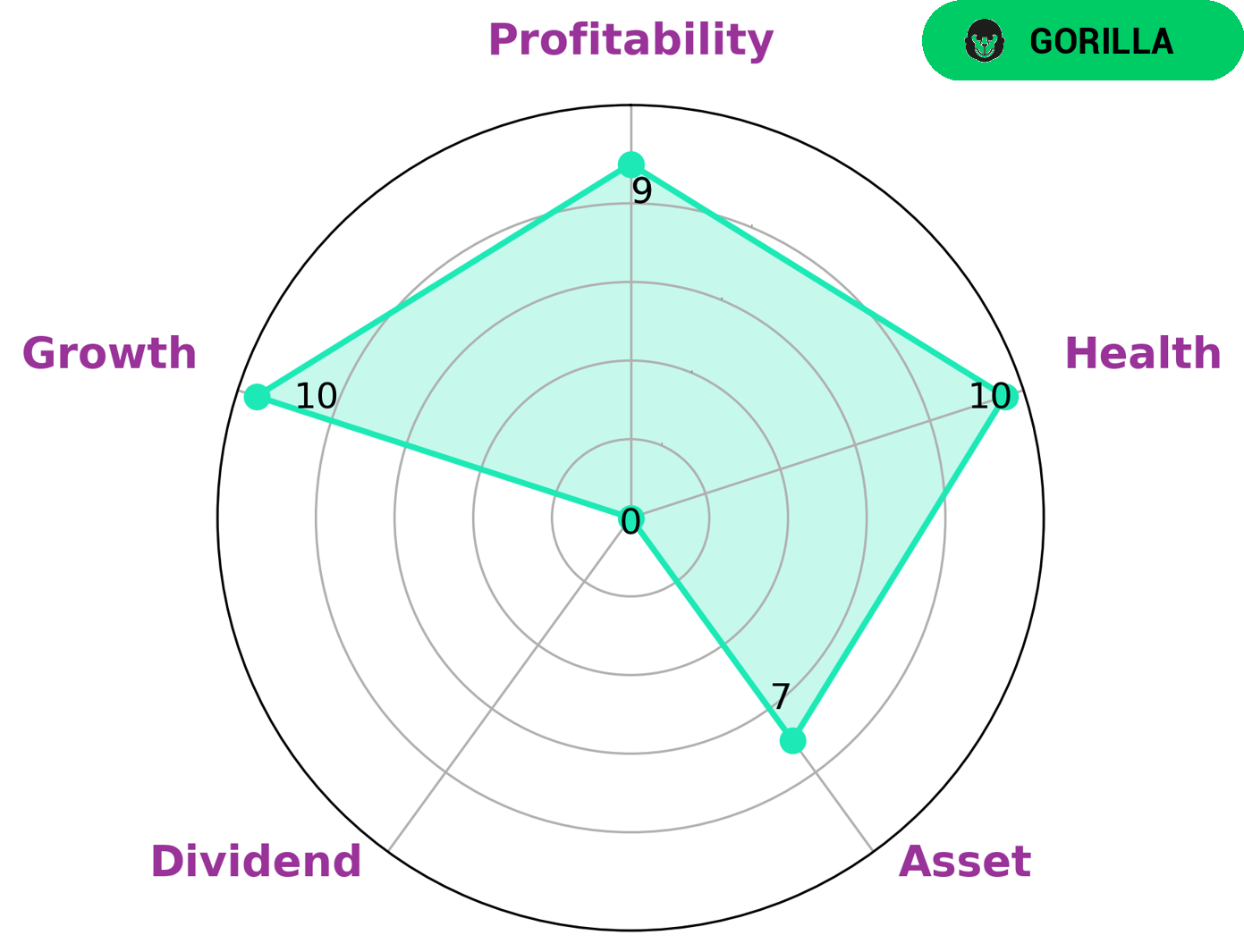

GoodWhale is an ideal platform for analyzing the fundamentals of FOX FACTORY HOLDING. Our Star Chart shows that FOX FACTORY HOLDING is strong in asset, growth, and profitability. However, it is weak in dividend, indicating that investors may not be interested in receiving payments from this company. We also found that FOX FACTORY HOLDING has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable of sustaining its future operations during times of crisis. Furthermore, this company is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given these findings, FOX FACTORY HOLDING may be attractive to long-term investors seeking stable returns over the long-term. Investors interested in capital appreciation and growth may also be interested in FOX FACTORY HOLDING due to its strong asset and profitability fundamentals. More…

Peers

The Company’s products are sold to original equipment manufacturers and aftermarket customers. Fox Factory Holding Corp was founded in 1974 and is headquartered in Scotts Valley, California. Hankook & Co is a South Korean company that manufactures and sells tires. The company was founded in 1941 as the Chosun Tire Company and changed its name to Hankook Tire in 1968. Hankook Tire has manufacturing plants in South Korea, China, Hungary, and Indonesia. The company sells its tires under the Hankook, Kumho, and Nexen brands. Federal Corp is a Taiwanese company that manufactures and sells tires. Federal Corp was founded in 1954 and is headquartered in Taipei, Taiwan. The company has manufacturing plants in Taiwan, China, and Thailand. Federal Corp sells its tires under the Federal, Achilles, and Atturo brands. PT Multistrada Arah Sarana Tbk is an Indonesian company that manufactures and sells tires. PT Multistrada Arah Sarana Tbk was founded in 1976 and is headquartered in Jakarta, Indonesia. The company has manufacturing plants in Indonesia and Vietnam. PT Multistrada Arah Sarana Tbk sells its tires under the Multistrada, Tristar, and Maxxis brands.

– Hankook & Co ($KOSE:000240)

Hankook & Co is a South Korean conglomerate with a market cap of 1.17T as of 2022. The company has a Return on Equity of 5.05%. Hankook & Co is involved in a variety of businesses including tires, chemicals, and auto parts. The company has a strong presence in South Korea and is a major player in the global market.

– Federal Corp ($TWSE:2102)

Federal Corp is a publicly traded company with a market capitalization of 8.5 billion as of 2022. The company has a negative return on equity of 13.91%. Federal Corp is engaged in the business of manufacturing and selling automotive parts and systems.

– PT Multistrada Arah Sarana Tbk ($IDX:MASA)

PT Multistrada Arah Sarana Tbk has a market cap of 18.64T as of 2022, a Return on Equity of 19.35%. The company is engaged in the manufacturing of passenger car radial tyres and motorcycle tyres in Indonesia. It also exports its products to over 60 countries worldwide.

Summary

Fox Factory Holding’s fourth quarter of fiscal 2022 showed impressive results, with revenue increasing by 40.4% year-over-year and net income increasing by 19.4%. This indicates that the company is performing well and has continued to show significant growth over the past several quarters. Investors should take note that Fox Factory Holding appears to be a solid investment opportunity with its strong performance in revenue and net income. Additionally, any future growth potential should also be taken into consideration when making an investing decision in this company.

Recent Posts