Barclays Maintains Positive Outlook on Adient PLC with Overweight Rating

April 21, 2023

Trending News ☀️

Barclays maintained its positive outlook on Adient ($NYSE:ADNT) PLC with an overweight rating on April 17, 2023, according to Fintel. Adient PLC is a leading global provider of automotive seating and automotive interior system components and electronics. The company designs, develops, manufactures, and markets a range of seating and interior systems and components for passenger cars, commercial vehicles, and light trucks. Adient also provides original equipment manufacturers with a range of seating and interior systems and components in a variety of product categories. Barclays’ Overweight rating reflects their view that Adient PLC is well-positioned for long-term growth. The firm believes that the company is well-positioned to benefit from the growing demand for automotive seating and interior systems and components in the global market, particularly in emerging markets.

Additionally, Barclays notes Adient’s strong balance sheet and ability to generate significant cash flow from operations, which further supports the company’s outlook. Finally, Barclays highlights Adient’s ability to invest in research and development to support growth initiatives.

Price History

On Thursday, Barclays maintained its positive outlook on Adient PLC with an Overweight rating, causing the stock to open at $38.2 and close at $39.3, up by 0.3% from the prior closing price of 39.2. The positive outlook on the company is driven by their strong financial performance and their focus on long-term growth initiatives, such as new product launches, market expansion, and strategic acquisitions. Barclays is confident that these initiatives will continue to drive growth for Adient PLC in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adient Plc. More…

| Total Revenues | Net Income | Net Margin |

| 14.15k | -45.99 | -0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adient Plc. More…

| Operations | Investing | Financing |

| 337.04 | -307.83 | -1.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adient Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.94k | 7.21k | 24.64 |

Key Ratios Snapshot

Some of the financial key ratios for Adient Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | 9.4% | 2.3% |

| FCF Margin | ROE | ROA |

| 0.8% | 9.1% | 2.0% |

Analysis

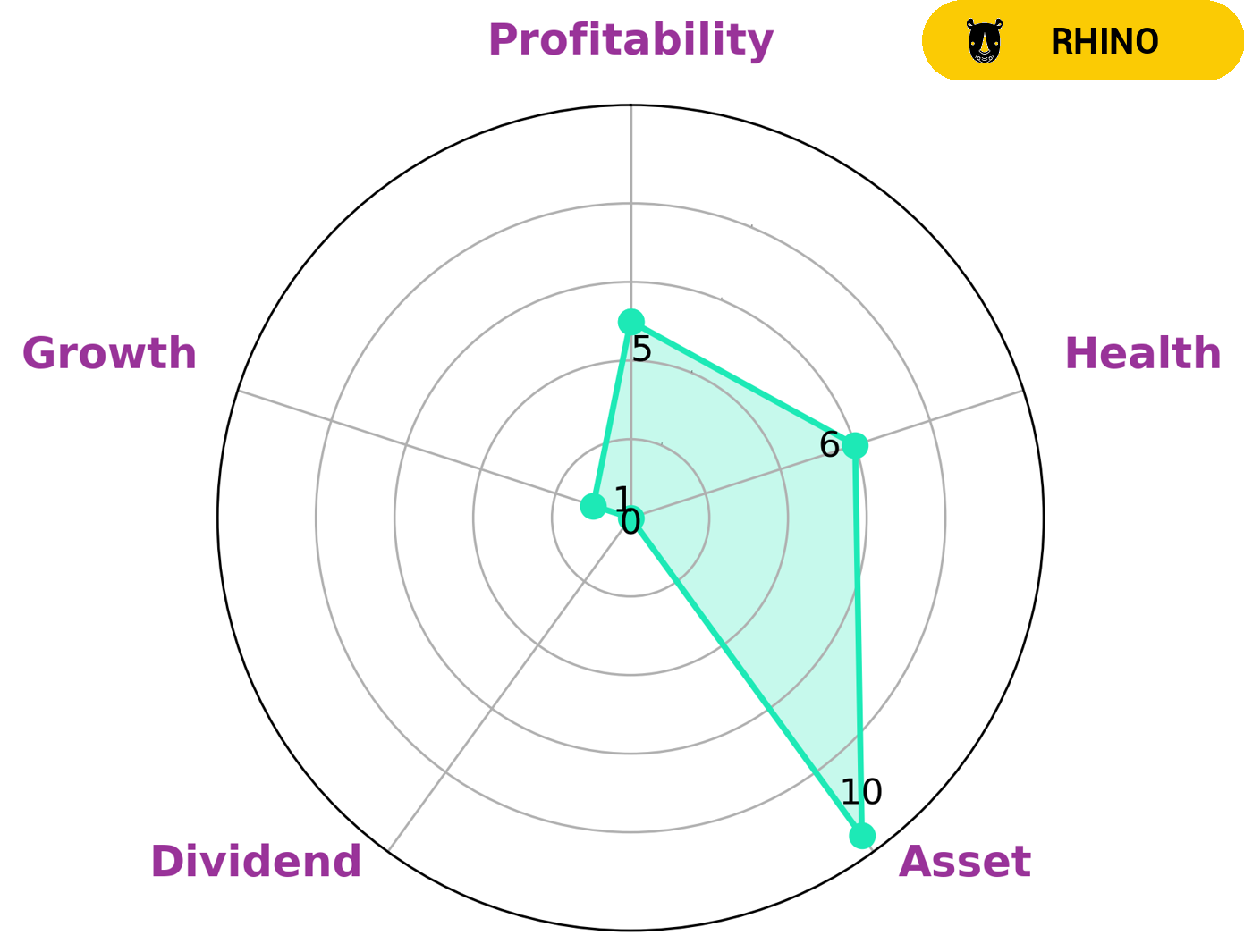

GoodWhale conducted a financial analysis of ADIENT PLC and the results are as follows. Our Star Chart suggests that ADIENT PLC is performing well in terms of assets, but is only medium with regard to profitability and weak in dividend and growth. The company’s intermediate health score of 6/10 with regard to its cashflows and debt indicates that it should be able to safely ride out any crisis without the risk of bankruptcy. Based on this analysis, we have classified ADIENT PLC as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Therefore, we believe that ADIENT PLC would be an attractive investment opportunity for investors looking for companies with a solid asset base and moderate growth prospects. The company’s intermediate health score indicates that it is unlikely to experience bankruptcy and its moderate growth means that investors can enjoy steady and consistent returns. More…

Peers

Adient PLC is one of the world’s leading suppliers of automotive seating. The company’s products are used by major automakers around the globe. Adient PLC is headquartered in Dublin, Ireland. The company’s primary competitors are Great Wall Motor Co Ltd, Yutong Bus Co Ltd, and China Grand Automotive Services Group Co Ltd.

– Great Wall Motor Co Ltd ($SEHK:02333)

Great Wall Motor Co Ltd is a Chinese automotive manufacturing company headquartered in Baoding, Hebei, China. The company is China’s largest SUV and pickup truck producer. Great Wall Motors sells vehicles under the Great Wall, Haval, and WEY brand names.

– Yutong Bus Co Ltd ($SHSE:600066)

Yutong Bus Co Ltd is a leading bus manufacturer in China with a market cap of 15.63B as of 2022. The company has a Return on Equity of 1.38%. Yutong Bus Co Ltd manufactures buses and coaches for urban and inter-city transportation. The company’s products are sold in over 80 countries and regions around the world.

– China Grand Automotive Services Group Co Ltd ($SHSE:600297)

Grand Automotive Services Group Co Ltd is a publicly traded company with a market cap of 17.6 billion as of 2022. The company has a return on equity of 7.5%. Grand Automotive Services Group Co Ltd is engaged in the business of providing automotive services and products in China. The company offers a wide range of services including vehicle maintenance, repair, and inspection services; and sells a variety of automotive products, such as tires, batteries, and lubricants.

Summary

Adient PLC is currently being analyzed by Barclays, who maintained an Overweight recommendation on April 17th, 2023. As a global leader in the design and manufacture of automotive seating, investors may find potential benefits to investing in Adient. The company has a strong track record of innovation and quality products, which has allowed them to achieve strong financial performance in the past. Adient has also seen an increase in share prices over the last year, making it an attractive option for investors who are looking for a reliable stock. Adient’s dividend yield is above industry average, further increasing its value to investors.

In addition, the company has a strong balance sheet and cash flow, further improving its appeal to potential investors. With a strong outlook and solid fundamentals, Adient remains an attractive option for investors.

Recent Posts