Allison Transmission Stock Fair Value Calculator – ALLISON TRANSMISSION Delivers Strong Q1 Performance With Gaap Eps Beating Estimates By $0.32

April 28, 2023

Trending News ☀️

Revenue totaled $741 million, a beat of $19.58 million. This impressive performance further cements Allison Transmission ($NYSE:ALSN) Holdings’ position as a leader in the design and manufacture of commercial-duty automatic transmissions and hybrid propulsion systems. Allison Transmission is a publicly-traded company headquartered in Indianapolis, Indiana. It is the largest global provider of commercial-duty automatic transmissions and a leader in electric hybrid-propulsion systems.

Allison provides advanced fuel-efficient transmission solutions to a variety of customers, including OEMs, governments and defense organizations, vehicle manufacturers, energy companies and operators. The company’s order book also grew year over year, driven by strong customer demand for new and existing products. Looking ahead, the company remains confident that it will continue to deliver superior financial performance and is well-positioned for long-term growth.

Price History

This is especially noteworthy as the stock closed higher than the previous closing price of $45.4, despite the fact that analysts had estimated Gaap EPS to be $0.32 lower than the actual figure. This performance is a testament to the company’s success, and a sign of continued positive growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Allison Transmission. More…

| Total Revenues | Net Income | Net Margin |

| 2.77k | 531 | 20.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Allison Transmission. More…

| Operations | Investing | Financing |

| 657 | -183 | -367 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Allison Transmission. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.67k | 3.8k | 9.52 |

Key Ratios Snapshot

Some of the financial key ratios for Allison Transmission are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.9% | -4.3% | 27.6% |

| FCF Margin | ROE | ROA |

| 17.7% | 58.3% | 10.2% |

Analysis – Allison Transmission Stock Fair Value Calculator

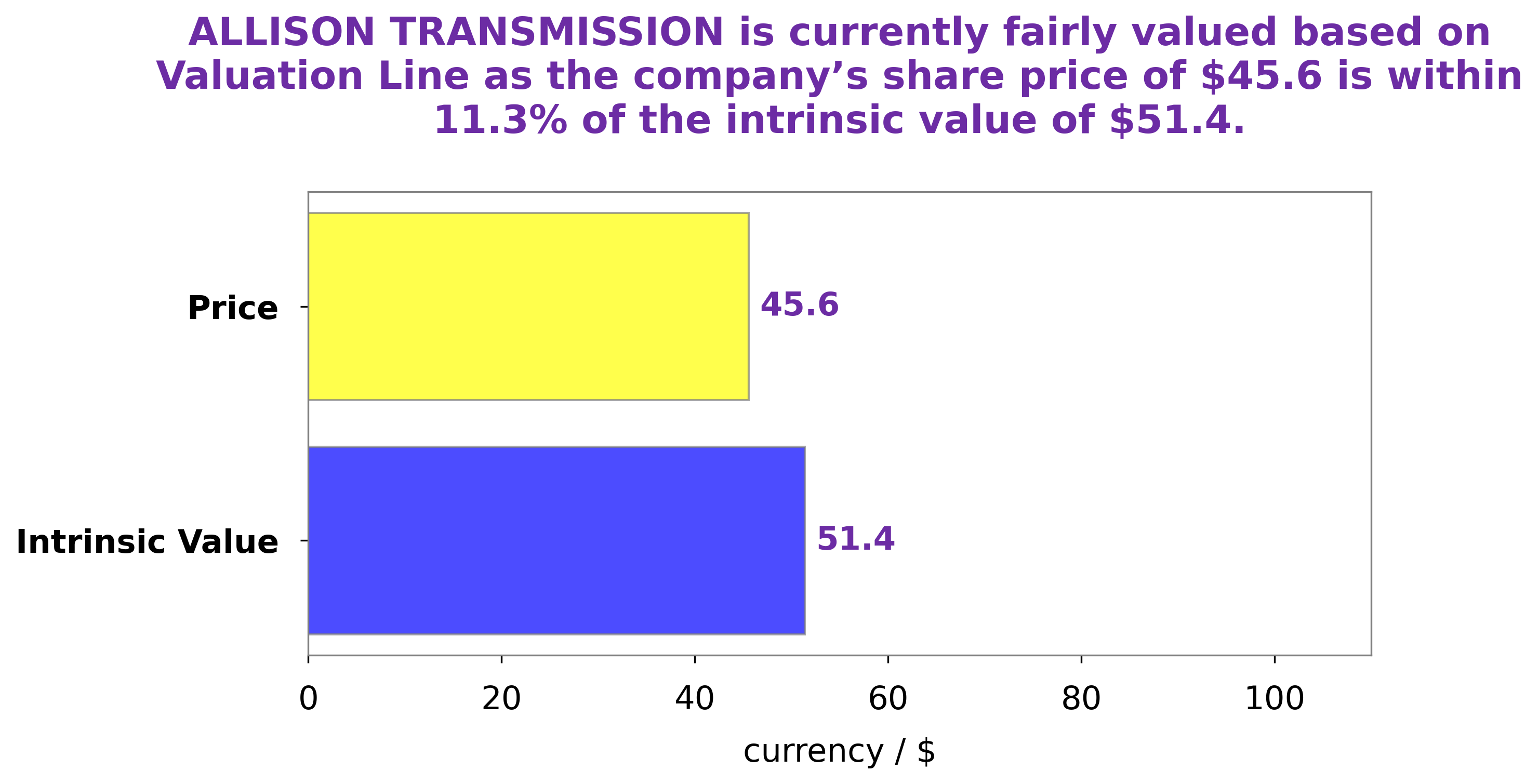

At GoodWhale, we recently performed an analysis of ALLISON TRANSMISSION‘s wellbeing. According to our proprietary Valuation Line, the fair value of ALLISON TRANSMISSION’s share is around $51.4. However, currently ALLISON TRANSISSION’s stock is trading at $45.6, making it a fair price that is undervalued by 11.3%. This discrepancy creates a potential buying opportunity for investors who keep their eye on the stock market. We at GoodWhale recommend ALLISON TRANSMISSION as a worthwhile investment option, as the fair price is likely to rise in the near future. More…

Peers

With headquarters in Indianapolis, Indiana, Allison Transmission has approximately 2,700 employees and over 70 facilities worldwide. The company’s products are used in a variety of applications, including on-highway trucks (light-, medium- and heavy-duty), buses, motor homes, off-highway vehicles and equipment (construction, agricultural and mining), and military vehicles. Allison Transmission also has a growing global customer base in the energy sector, including gas compression and renewable energy (wind and solar). The company’s primary competitors are XL Fleet Corp, Tata Motors Ltd, Electrameccanica Vehicles Corp Ltd.

– XL Fleet Corp ($NYSE:XL)

Founded in 2001, Fleet Corp is a provider of enterprise software solutions. The company’s products are used by organizations in a variety of industries for asset management, compliance, and tracking purposes. Fleet Corp has a market cap of 111.42M as of 2022 and a return on equity of -9.42%. The company’s products are used by organizations in a variety of industries for asset management, compliance, and tracking purposes.

– Tata Motors Ltd ($NYSE:TTM)

Tata Motors Ltd. is an Indian multinational automotive manufacturing company headquartered in Mumbai, Maharashtra, India. Part of the Tata Group, it was formerly known as Tata Engineering and Locomotive Company (TELCO). Its products include passenger cars, trucks, vans, coaches, buses, construction equipment and military vehicles. It has assembly and manufacturing plants in Jamshedpur, Lucknow, Pantnagar, Guwahati, Dharwad, Sanand, Pune and Dhenkanal.

– Electrameccanica Vehicles Corp Ltd ($NASDAQ:SOLO)

Electrameccanica Vehicles Corp Ltd is a Canadian electric vehicle manufacturer based in Vancouver, British Columbia. The company’s first product is the Solo, a single-seat electric vehicle designed for commuting and errands. The Solo uses a 20 kWh lithium-ion battery and has a range of 160 km (100 mi). It is capable of reaching speeds of up to 130 km/h (81 mph).

Summary

Allison Transmission Holdings, a global leader in commercial and military duty automatic transmissions, reported strong third quarter financial results, beating analysts’ expectations. The company reported GAAP earnings per share of $1.85, beating analysts’ expectations by $0.32. Revenue was also impressive, totaling $741 million, which beat estimates by $19.58 million.

These new product lines are increasingly being adopted by commercial and military customers all over the world. On the back of the strong results, investors should consider investing in Allison Transmission as it is likely to continue to outperform in both the short and long term.

Recent Posts