Aisan Industry stock dividend – Aisan Industry Co Ltd Announces 18.0 Cash Dividend

March 18, 2023

Dividends Yield

On March 1 2023, Aisan Industry ($TSE:7283) Co Ltd Announces 18.0 Cash Dividend. AISAN INDUSTRY has been issuing a steady stream of dividends per share over the last 3 years – 29.0, 27.0, and 16.0 JPY respectively – giving dividend yields of 4.35%, 3.96%, and 2.95% respectively, with an average dividend yield of 3.75%. AISAN INDUSTRY is an attractive stock option for those looking for stocks that offer dividend yields, with an ex-dividend date of March 30 2023. Investors should take note and consider adding AISAN INDUSTRY to their portfolio as a reliable source of dividend income.

Stock Price

The announcement came as the company’s stock opened at JP¥901.0 and closed at JP¥926.0, down by 0.2% from its prior closing price of 928.0. This marks the third dividend payment for the company this year, after previous announcements of 16.0 and 18.0 in February and April respectively. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aisan Industry. More…

| Total Revenues | Net Income | Net Margin |

| 223.51k | 8.54k | 4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aisan Industry. More…

| Operations | Investing | Financing |

| 7.08k | -6.96k | -4.13k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aisan Industry. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 241.57k | 127.39k | 1.7k |

Key Ratios Snapshot

Some of the financial key ratios for Aisan Industry are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.3% | 22.4% | 5.6% |

| FCF Margin | ROE | ROA |

| 3.2% | 7.2% | 3.2% |

Analysis

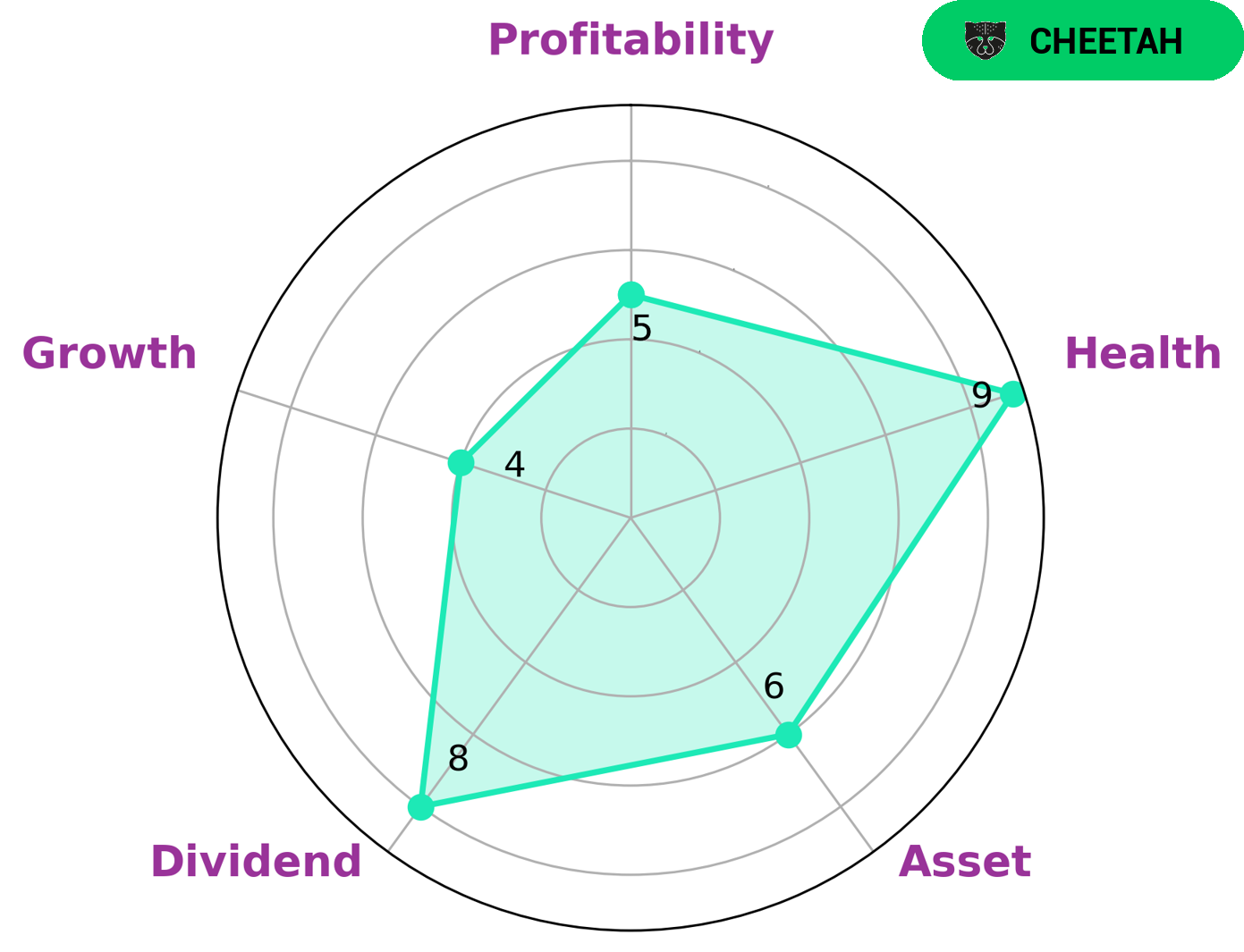

GoodWhale analyzed the financials of AISAN INDUSTRY and classified it as a ‘cheetah’ type company – one that has achieved high revenue and/or earnings growth but is considered less stable due to lower profitability. This type of company could be interesting to investors who are looking for higher growth and higher risk to get higher returns. AISAN INDUSTRY also scored a 9/10 in terms of its cashflows and debt, meaning that it is in good health and is capable of paying off debt and funding future operations. Additionally, AISAN INDUSTRY is strong in dividend and medium in asset, growth, and profitability. More…

Peers

The Asian Industry Co Ltd faces stiff competition from Altur SA, Universal Manufacturing Co, and Tokyo Radiator Mfg Co Ltd in the global market. Each of these companies brings different strengths and capabilities to the table and all are aiming for a piece of the same market share. As a result, there is a constant battle between these companies to remain competitive and stay ahead of the game.

– Altur SA ($LTS:0J0G)

Altur SA is a global engineering and industrial solutions provider specializing in the production of heavy machinery and component parts. Founded in 1910, Altur is one of the oldest and most respected companies in its field, with a strong track record of customer service and innovation. The company has a market capitalization of 15.76M as of 2023, which reflects the value of its assets and its ability to generate profits for shareholders. Additionally, Altur’s Return on Equity (ROE) stands at 0.64%, indicating that it is able to generate a healthy return from its investments. Altur’s success is a testament to its commitment to staying ahead of the curve and providing quality products and services to its customers.

– Universal Manufacturing Co ($OTCPK:UFMG)

Universal Manufacturing Co is a leading global manufacturer of industrial and commercial products. With a market cap of 4.49M as of 2023, the company is valued at a considerable amount, indicating its strong financial position and performance. Additionally, Universal Manufacturing Co’s Return on Equity (ROE) of 16.98% is well above the industry average, indicating it is making efficient use of its resources to generate a high level of profitability. As a company dedicated to producing high-quality products, Universal Manufacturing Co is well-positioned to continue its growth in the coming years.

– Tokyo Radiator Mfg Co Ltd ($TSE:7235)

T o k y o R a d i a t o r M f g C o L t d i s a J a p a n e s e c o m p a n y t h a t s p e c i a l i z e s i n t h e m a n u f a c t u r i n g o f r a d i a t o r s a n d o t h e r r e l a t e d p r o d u c t s . A s o f 2 0 2 3 , t h e c o m p a n y h a s a m a r k e t c a p i t a l i z a t i o n o f 7 . 9 1 b i l l i o n , w h i c h i n d i c a t e s t h e c o m p a n y ‘ s t o t a l v a l u e i n t h e s t o c k m a r k e t . T h e c o m p a n y ‘ s R e t u r n o n E q u i t y ( R O E ) i s – 1 . 2 4 % , w h i c h i s l o w e r t h a n t h a t o f i t s c o m p e t i t o r s . T h i s c o u l d b e d u e t o t h e c o m p a n y ‘ s i n a d e q u a t e p e r f o r m a n c e a n d l a c k o f p r o f i t a b i l i t y . D e s p i t e t h e l o w R O E , T o k y o R a d i a t o r M f g C o L t d h a s m a i n t a i n e d i t s s t r o n g p r e s e n c e i n t h e m a r k e t a n d c o n t i n u e s t o b e a m a j o r p l a y e r i n t h e r a d i a t o r m a n u f a c t u r i n g i n d u s t r y

Summary

AISAN INDUSTRY is an attractive investment option due to its strong dividend yield. Over the last 3 years, the company has consistently paid out dividends per share of 29.0, 27.0, and 16.0 JPY, giving dividend yields of 4.35%, 3.96%, and 2.95% respectively, with an average dividend yield of 3.75%. This indicates that the company is a reliable income generator for investors and provides a steady return on investment.

In addition, AISAN INDUSTRY is likely to experience growth in the future due to its successful business model and competitive positioning in the market. Therefore, it is a wise choice for investors looking for both capital appreciation and reliable dividends.

Recent Posts