Adient Plc Stock Fair Value Calculation – ADIENT PLC Reports Q4 Earnings of USD 3729.0 Million, a 2.2% Increase Year Over Year

November 24, 2023

☀️Earnings Overview

On November 8, 2023, Adient ($NYSE:ADNT) PLC reported their 4th quarter earnings for Fiscal Year 2023, ending on September 30, 2023. Total revenue was reported at 3729.0 million USD, representing an increase of 2.2% from the same period the previous year. Net income increased by 200.0%, amounting to 135.0 million USD.

Analysis – Adient Plc Stock Fair Value Calculation

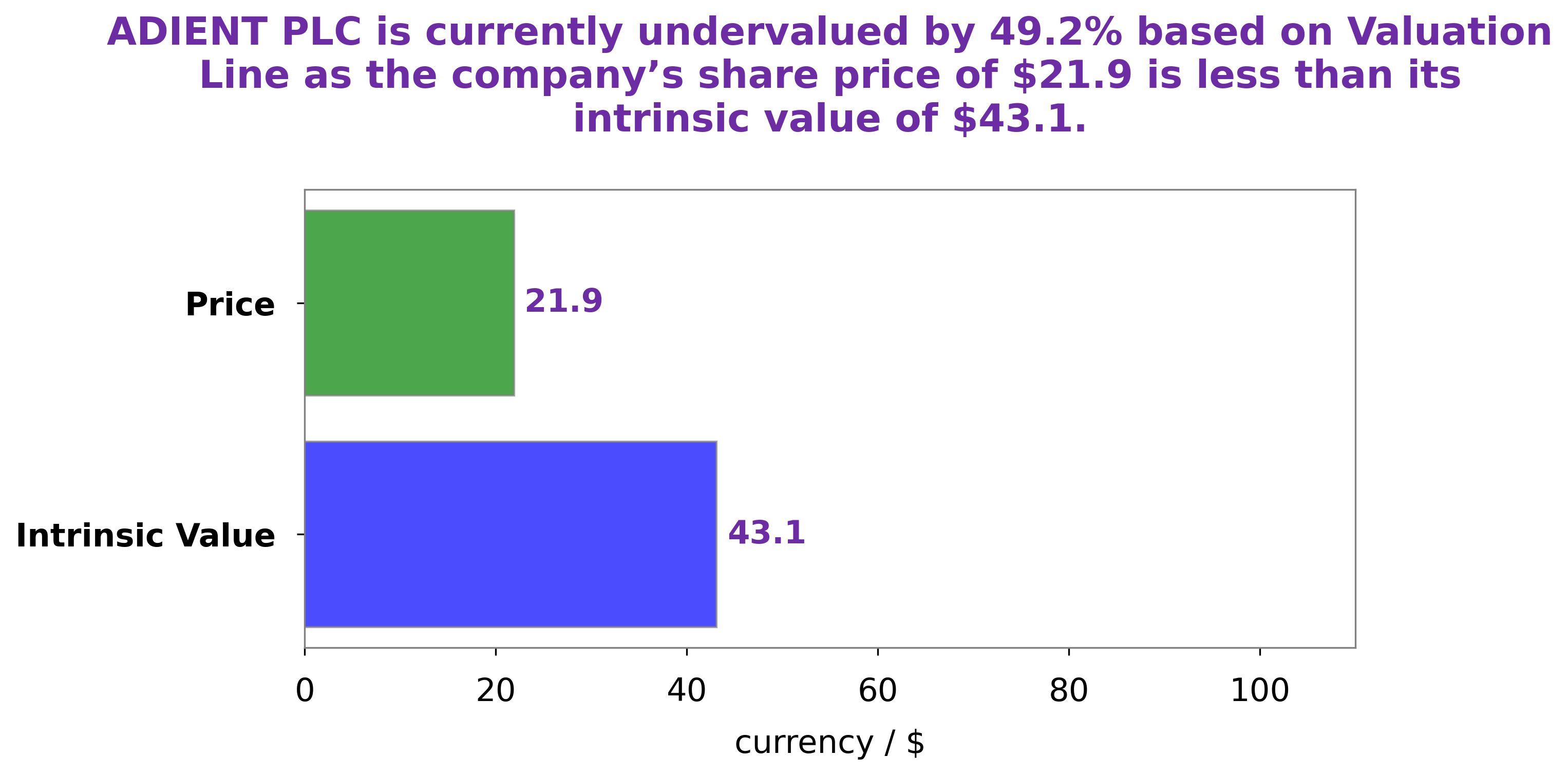

GoodWhale has conducted an analysis of ADIENT PLC‘s financials, and determined that the intrinsic value of their share is around $43.1. This value was calculated through our proprietary Valuation Line. Currently, ADIENT PLC stock is being traded at $32.5, which represents a 24.5% discount to its intrinsic value. This makes it a great opportunity for investors looking for undervalued stocks in the market. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adient Plc. More…

| Total Revenues | Net Income | Net Margin |

| 15.39k | 205 | 1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adient Plc. More…

| Operations | Investing | Financing |

| 667 | -229 | -271 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adient Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.42k | 6.82k | 23.79 |

Key Ratios Snapshot

Some of the financial key ratios for Adient Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | 181.5% | 3.2% |

| FCF Margin | ROE | ROA |

| 2.7% | 13.9% | 3.2% |

Peers

Adient PLC is one of the world’s leading suppliers of automotive seating. The company’s products are used by major automakers around the globe. Adient PLC is headquartered in Dublin, Ireland. The company’s primary competitors are Great Wall Motor Co Ltd, Yutong Bus Co Ltd, and China Grand Automotive Services Group Co Ltd.

– Great Wall Motor Co Ltd ($SEHK:02333)

Great Wall Motor Co Ltd is a Chinese automotive manufacturing company headquartered in Baoding, Hebei, China. The company is China’s largest SUV and pickup truck producer. Great Wall Motors sells vehicles under the Great Wall, Haval, and WEY brand names.

– Yutong Bus Co Ltd ($SHSE:600066)

Yutong Bus Co Ltd is a leading bus manufacturer in China with a market cap of 15.63B as of 2022. The company has a Return on Equity of 1.38%. Yutong Bus Co Ltd manufactures buses and coaches for urban and inter-city transportation. The company’s products are sold in over 80 countries and regions around the world.

– China Grand Automotive Services Group Co Ltd ($SHSE:600297)

Grand Automotive Services Group Co Ltd is a publicly traded company with a market cap of 17.6 billion as of 2022. The company has a return on equity of 7.5%. Grand Automotive Services Group Co Ltd is engaged in the business of providing automotive services and products in China. The company offers a wide range of services including vehicle maintenance, repair, and inspection services; and sells a variety of automotive products, such as tires, batteries, and lubricants.

Summary

ADIENT PLC‘s fourth quarter earnings for FY2023 showed strong growth across the board, surpassing analysts’ estimates. Total revenue was up 2.2% year-on-year to USD 3729 million, while net income increased 200% to USD 135 million. Despite this encouraging news, the stock price dropped on the same day. Investors may be concerned about the slowing growth prospects for ADIENT PLC or potential market saturation. It is important for investors to examine the company’s fundamentals and overall outlook before making any decisions about investing in this firm.

Additionally, it may be beneficial to compare and contrast ADIENT PLC with its peers in the same industry to get a better understanding of the company’s long-term performance.

Recent Posts