ADIENT PLC Reports Strong First Quarter Earnings for FY2023

February 12, 2023

Earnings report

ADIENT PLC ($NYSE:ADNT), a global leader in automotive seating and interiors, reported strong first quarter earnings for FY2023 on February 7, 2023. The company achieved a total revenue of USD 12.0 million for the period ending December 31, 2022, representing a 122.2% increase over the same period a year prior.

Additionally, net income was up 6.3% year over year at USD 3699.0 million. The company operates through four segments: Seating, Interior Systems, Seating & Interior Systems, and Other Businesses. Its product portfolio includes automotive seating systems, upholstery, seating components, and other interior products for the aftermarket, OEMs, and specialty vehicle markets. This impressive performance was driven by the successful launch of its new product line, Global SeatSelection, as well as cost-cutting efforts across the organization. The company also had success in increasing its market share in Europe and Asia-Pacific regions. The strong year-over-year revenue growth of 122.2%, along with the 6.3% increase in net income, reflects ADIENT PLC’s momentum in the market. As the demand for automotive seating and interior products continues to rise, the company is well-positioned to capitalize on this growth opportunity. With its robust product portfolio and global presence, ADIENT PLC is poised to remain a leader in the automotive seating and interiors industry for years to come.

Market Price

On Tuesday, ADIENT PLC, the global leader in automotive seating, reported an impressive set of financial results for the first quarter of its fiscal year 2023. The company’s stock opened at $45.0 and closed at $45.5, down by 0.4% from its prior closing price of 45.7. The company’s increased revenue, EPS, net income, operating cash flow and margin are all signs of a healthy business model that is well placed to continue delivering impressive results into the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adient Plc. More…

| Total Revenues | Net Income | Net Margin |

| 14.15k | -45.99 | -0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adient Plc. More…

| Operations | Investing | Financing |

| 337.04 | -307.83 | -1.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adient Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.94k | 7.21k | 24.64 |

Key Ratios Snapshot

Some of the financial key ratios for Adient Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | 9.4% | 2.3% |

| FCF Margin | ROE | ROA |

| 0.8% | 9.1% | 2.0% |

Analysis

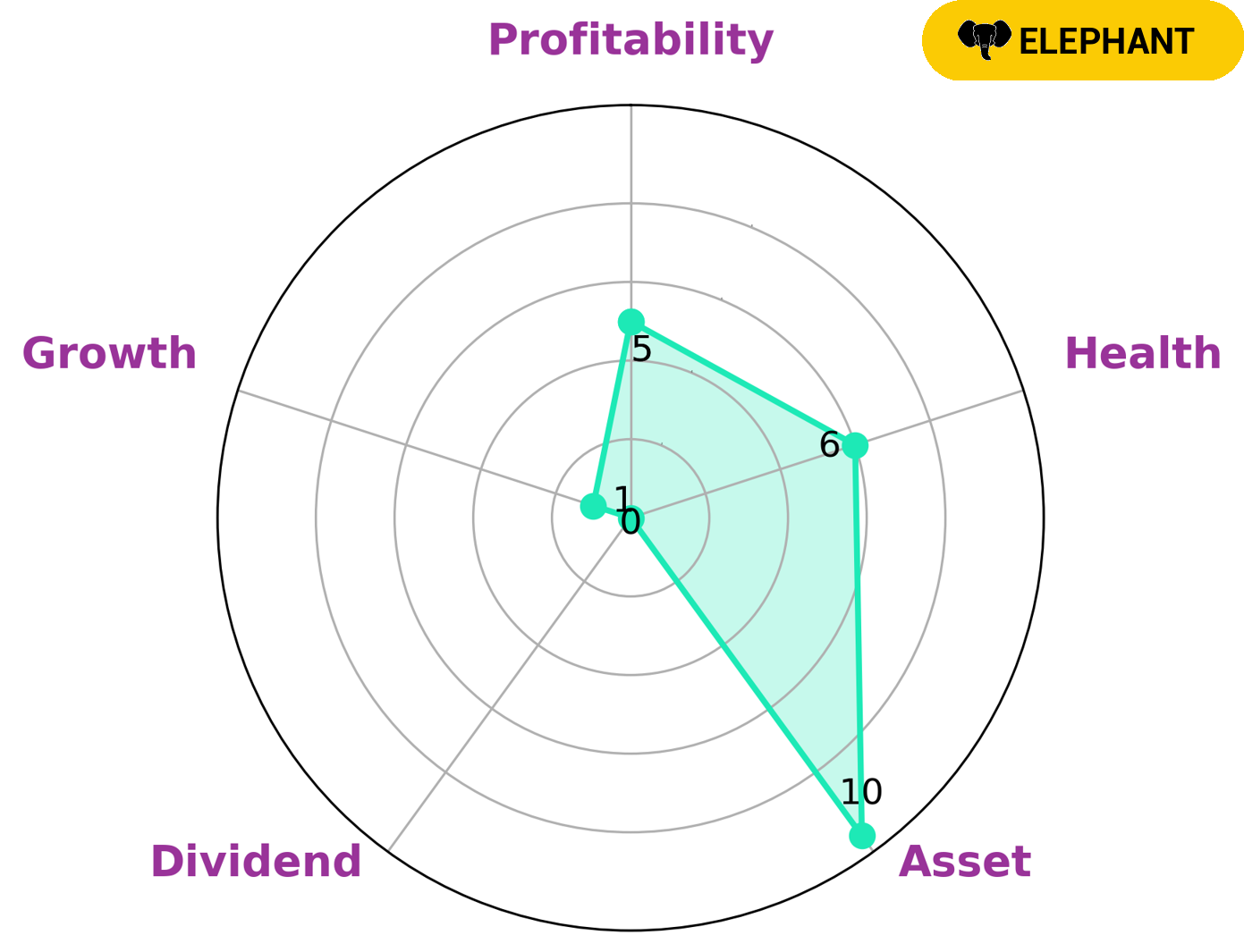

GoodWhale has conducted an analysis of ADIENT PLC‘s fundamentals and based on the Star Chart, the company is classified as an ‘elephant’, meaning it has a large amount of assets after subtracting liabilities. This makes it an attractive investment opportunity for investors with a long-term outlook since it is able to pay off its debts and fund future operations. ADIENT PLC also has an intermediate health score of 6/10, indicating that it has the capability to sustain itself and its operations. The company is strong in terms of its assets, intermediate in profitability and weak in dividend and growth. As such, ADIENT PLC may be a suitable option for investors who are looking for stability and security in the long term, but who are willing to forgo potential for growth. The company’s financials indicate that it is able to pay off its debts and sustain its operations, making it an attractive investment opportunity for those with a long-term outlook. Investors who are not looking for growth and are more interested in stability may be interested in ADIENT PLC as it is able to pay off its debts and fund future operations. Furthermore, with a relatively high asset base, it is able to use its resources efficiently to maximize returns. Ultimately, the type of investor who may be interested in ADIENT PLC depends on their individual goals and risk-appetite. More…

Peers

Adient PLC is one of the world’s leading suppliers of automotive seating. The company’s products are used by major automakers around the globe. Adient PLC is headquartered in Dublin, Ireland. The company’s primary competitors are Great Wall Motor Co Ltd, Yutong Bus Co Ltd, and China Grand Automotive Services Group Co Ltd.

– Great Wall Motor Co Ltd ($SEHK:02333)

Great Wall Motor Co Ltd is a Chinese automotive manufacturing company headquartered in Baoding, Hebei, China. The company is China’s largest SUV and pickup truck producer. Great Wall Motors sells vehicles under the Great Wall, Haval, and WEY brand names.

– Yutong Bus Co Ltd ($SHSE:600066)

Yutong Bus Co Ltd is a leading bus manufacturer in China with a market cap of 15.63B as of 2022. The company has a Return on Equity of 1.38%. Yutong Bus Co Ltd manufactures buses and coaches for urban and inter-city transportation. The company’s products are sold in over 80 countries and regions around the world.

– China Grand Automotive Services Group Co Ltd ($SHSE:600297)

Grand Automotive Services Group Co Ltd is a publicly traded company with a market cap of 17.6 billion as of 2022. The company has a return on equity of 7.5%. Grand Automotive Services Group Co Ltd is engaged in the business of providing automotive services and products in China. The company offers a wide range of services including vehicle maintenance, repair, and inspection services; and sells a variety of automotive products, such as tires, batteries, and lubricants.

Summary

The financial performance of ADIENT PLC in the first quarter of FY2023 has been impressive. Revenue increased by 122.2% from the same period last year, and net income was up 6.3%. This growth demonstrates the company’s ability to manage costs and capitalize on opportunities. Analysts have generally been optimistic about the stock, citing its strong financials and outlook. The company has a solid balance sheet with low debt levels, giving it the flexibility to make strategic investments when needed. Its strong cash flow and healthy margins further add to investor confidence. The company’s market position is also strong, with significant competitive advantages in a number of areas. ADIENT PLC has a strong presence in the automotive sector, which is expected to experience healthy demand in the coming years.

In addition, the company has an impressive product portfolio and a well-developed global distribution network. The company is well positioned for future growth and is expected to benefit from further gains in the near future.

Recent Posts