TESLA Leads the Way as Electric Vehicles Leave Internal Combustion Engines in the Dust

June 15, 2023

🌧️Trending News

TESLA ($NASDAQ:TSLA) is leading the way as electric vehicles rise to prominence and dominate the automotive industry. This is a remarkable feat, considering internal combustion engines have been the norm for over a century. Thanks to the development of electric vehicles, they are becoming increasingly popular as people realize the environmental and economic benefits they offer. TESLA has been a major driving force behind this revolution, producing some of the most advanced electric vehicles available. Since then, the company has soared in popularity and is now one of the most successful companies in the world.

The company has seen remarkable growth in both its stock price and its market share. This success has made TESLA the leader of the electric vehicle revolution, as their cars consistently outperform their competitors. With their high-end electric vehicles and innovation, TESLA is sure to continue leading the way for a greener future.

Price History

On Wednesday, TESLA stock opened at $260.2 and closed slightly lower at $256.8, down 0.7% from its previous closing price of $258.7. Despite this minor dip, the electric vehicle manufacturer still leads the way when it comes to the transition from traditional internal combustion engine cars to electric vehicles. As the world moves towards a greener, more sustainable future, TESLA is at the forefront of this revolution. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tesla. More…

| Total Revenues | Net Income | Net Margin |

| 86.03k | 11.78k | 13.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tesla. More…

| Operations | Investing | Financing |

| 13.24k | -12.29k | -1.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tesla. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 86.83k | 37.6k | 15.16 |

Key Ratios Snapshot

Some of the financial key ratios for Tesla are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 49.0% | 148.4% | 15.2% |

| FCF Margin | ROE | ROA |

| 6.7% | 17.6% | 9.4% |

Analysis

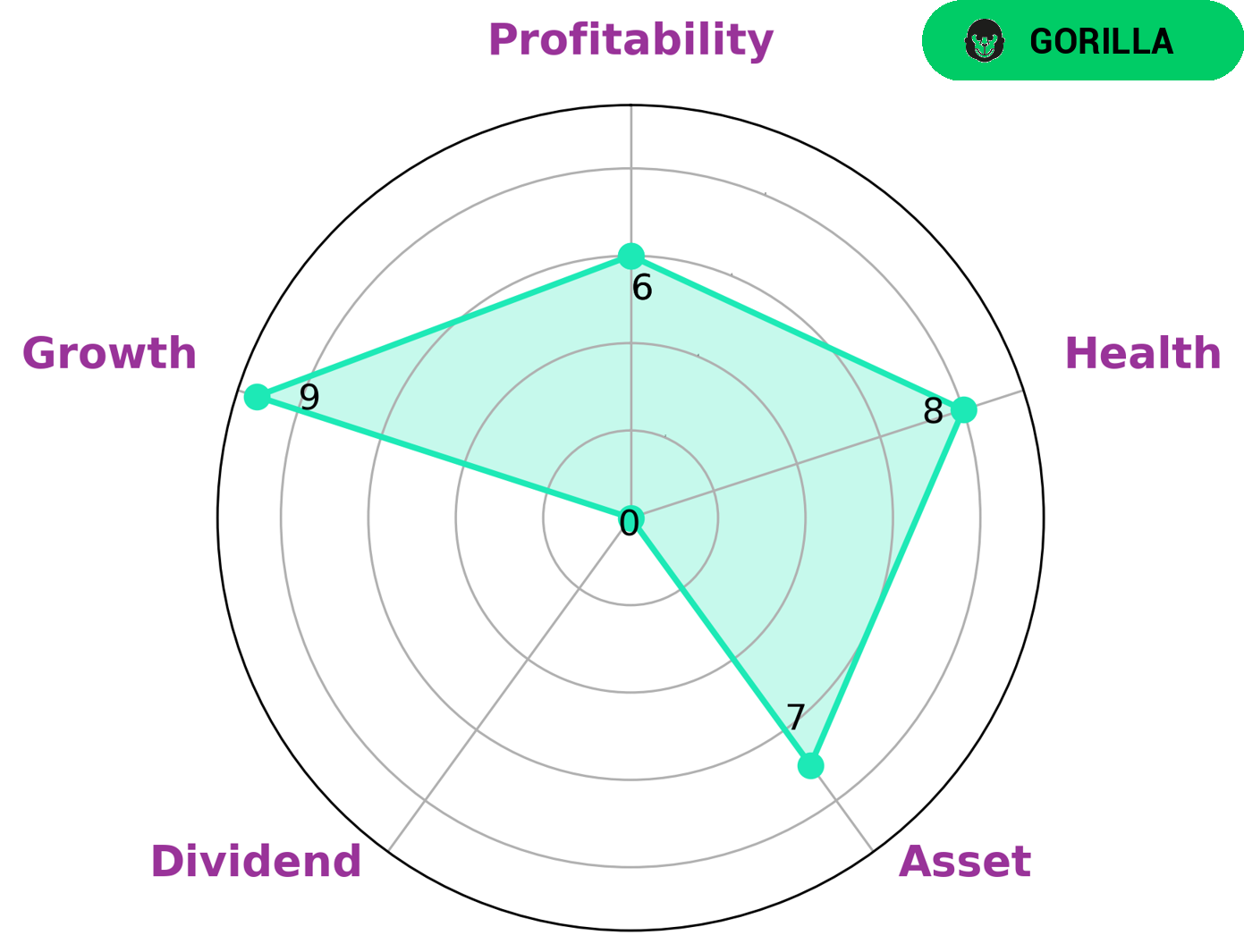

As a GoodWhale analyst, I have conducted an analysis of TESLA‘s fundamentals. According to Star Chart, TESLA is strong in asset, growth, and medium in profitability and weak in dividend. This leads us to classify TESLA as a ‘gorilla’ company, which we have concluded to be one that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Considering TESLA’s health score of 8/10, considering its cashflows and debt, it is definitely an attractive company for investors. With such a high score, TESLA is capable to sustain future operations in times of crisis. Therefore, those who are looking for a safe investment with potential for growth should consider investing in TESLA. More…

Peers

Tesla Inc is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla’s current products include electric cars, battery energy storage from home to grid scale, solar panels and solar roof tiles, and related products and services. Some of Tesla’s notable competitors in the electric vehicle space include NIO Inc, XPeng Inc, and Li Auto Inc.

– NIO Inc ($SEHK:09866)

NIO Inc. is a Chinese electric vehicle manufacturer headquartered in Shanghai. The company was founded in 2014 and has since become one of the leading EV manufacturers in China. NIO produces a range of electric vehicles, including the ES8 SUV, the ES6 SUV, and the EC6 sedan. The company also offers a range of services, including the NIO Power battery-swapping service and the NIO Pilot autonomous driving system. NIO Inc. has a market cap of 154.77B as of 2022 and a Return on Equity of -13.53%. The company is one of the leading EV manufacturers in China and offers a range of electric vehicles and services.

– XPeng Inc ($SEHK:09868)

As of 2022, YPeng Inc has a market capitalization of 54.52 billion dollars and a return on equity of -11.13%. YPeng Inc is a Chinese multinational conglomerate holding company headquartered in Beijing. The company was founded in 1988 and has since grown to become one of the largest companies in China. YPeng Inc is involved in a wide variety of businesses, including but not limited to: e-commerce, retail, transportation, logistics, and financial services.

– Li Auto Inc ($SEHK:02015)

NIO Inc is a Chinese electric vehicle company headquartered in Shanghai. The company was founded in 2014 and is listed on the New York Stock Exchange. NIO Inc designs, manufactures, and sells electric vehicles in China, the United States, and Europe. The company has a market cap of 140.12B as of 2022 and a return on equity of -0.27%.

Summary

Despite significant economic uncertainty, Tesla has achieved remarkable success, with investors drawn to its innovative products and strategic partnerships. The company has seen a huge growth in its presence and market share, driven by increased demand for electric vehicles. Tesla is also taking advantage of the growing acceptance of renewable energy sources and its sustainable approach to energy production.

This has enabled the company to enter new markets and expand its product range, which has further boosted investor confidence. With further developments in the works, it appears that the company’s stock price will continue to remain buoyant.

Recent Posts