Tesla Intrinsic Value Calculation – Elon Musk’s Tesla Price Cuts Proven to be Unsuccessful Business Strategy

November 17, 2023

🌧️Trending News

Following the global financial crisis, Musk decided to implement a business strategy that would include price cutting of Tesla ($NASDAQ:TSLA) vehicles. Unfortunately, this has proven to be an unsuccessful business strategy. Tesla’s price cuts are not producing the desired results for the company. Although it may seem that such a strategy would be able to increase sales, it has not been successful in doing so.

Additionally, the strategy has had a negative impact on Tesla’s profits. Price cutting has led to lower margins and increased competition from other automakers. This has caused Tesla’s stock to decline significantly over the past year. Furthermore, Elon Musk’s decision to cut costs and lower prices has had an effect on Tesla’s customer base. Many customers have opted for cheaper alternatives to Tesla’s cars and have left the company to purchase cars from other automakers. This has led to a decrease in customer loyalty for Tesla and further decreased the company’s overall profits. The strategy has not produced an increase in profits or sales for Tesla, and has instead caused a decrease in customer loyalty and decreased stock prices. As such, it appears that this strategy was not a sound business decision for Tesla.

Stock Price

This indicates that the price cut strategy has had little impact on Tesla’s share prices. The increase in price could mean that investors have confidence in the company and are willing to pay a higher price for the stock. It could also indicate that they have faith in Elon Musk’s ability to lead the company to success.

However, in the long term, it is still uncertain if the price cut strategy will be effective. While the increase in share price is a positive sign, it could be a short-term reaction and not necessarily an indication of long-term success. Only time will tell how successful this strategy will be for Tesla. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tesla. More…

| Total Revenues | Net Income | Net Margin |

| 95.92k | 10.79k | 11.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tesla. More…

| Operations | Investing | Financing |

| 12.16k | -16.91k | 1.21k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tesla. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 93.94k | 39.45k | 16.82 |

Key Ratios Snapshot

Some of the financial key ratios for Tesla are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 50.4% | 82.7% | 12.4% |

| FCF Margin | ROE | ROA |

| 3.9% | 14.2% | 7.9% |

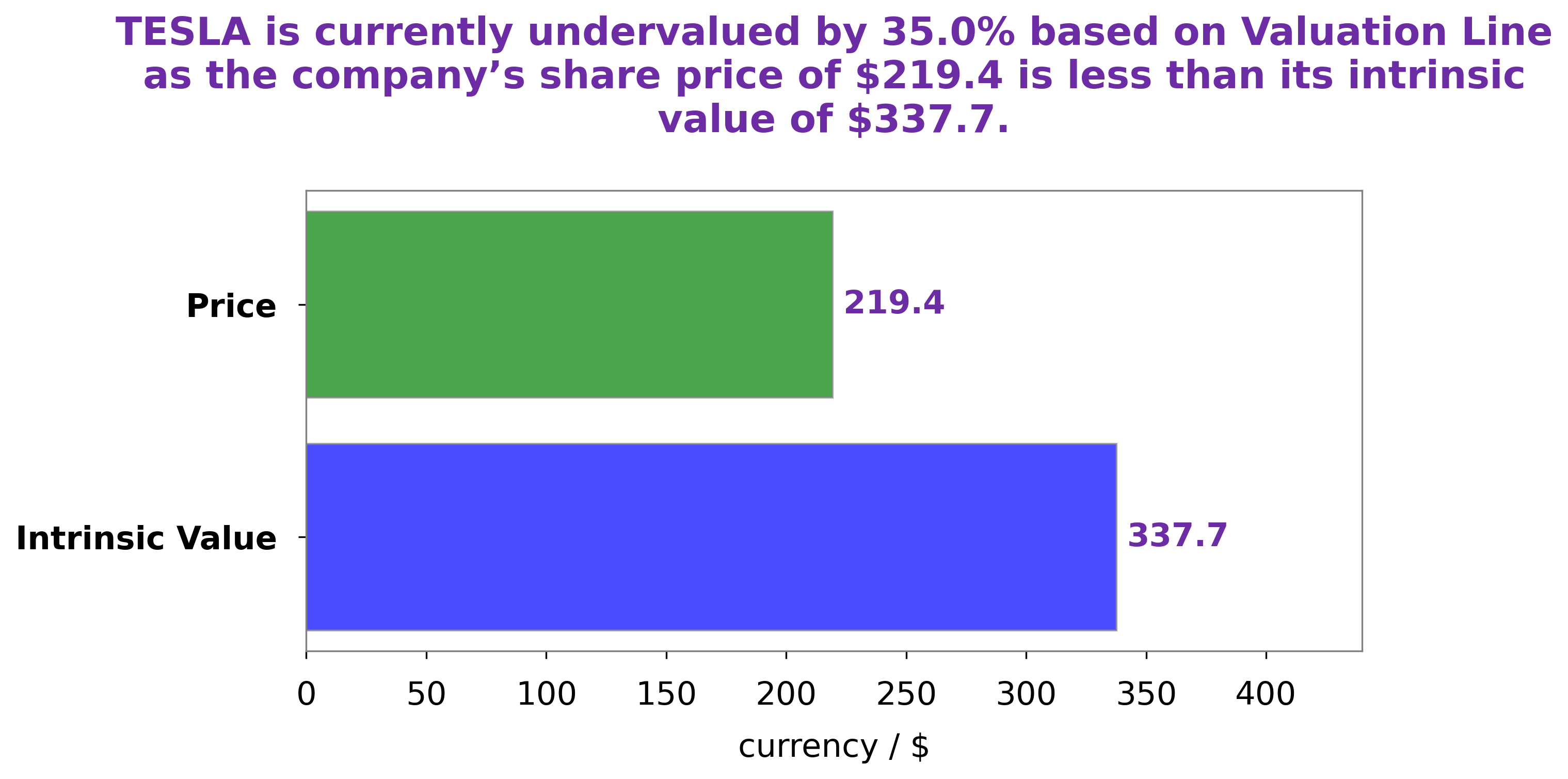

Analysis – Tesla Intrinsic Value Calculation

At GoodWhale, we have done a thorough analysis of TESLA’s financials and have determined the fair value of TESLA shares to be around $374.7. This figure was calculated using our proprietary Valuation Line, which takes into account a range of traditional financial indicators. Currently, the TESLA stock is trading at $223.7, indicating that it is undervalued by 40.3%. This offers an attractive investment opportunity for those looking to invest in a well-established and growing company. Tesla_Price_Cuts_Proven_to_be_Unsuccessful_Business_Strategy”>More…

Peers

Tesla Inc is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla’s current products include electric cars, battery energy storage from home to grid scale, solar panels and solar roof tiles, and related products and services. Some of Tesla’s notable competitors in the electric vehicle space include NIO Inc, XPeng Inc, and Li Auto Inc.

– NIO Inc ($SEHK:09866)

NIO Inc. is a Chinese electric vehicle manufacturer headquartered in Shanghai. The company was founded in 2014 and has since become one of the leading EV manufacturers in China. NIO produces a range of electric vehicles, including the ES8 SUV, the ES6 SUV, and the EC6 sedan. The company also offers a range of services, including the NIO Power battery-swapping service and the NIO Pilot autonomous driving system. NIO Inc. has a market cap of 154.77B as of 2022 and a Return on Equity of -13.53%. The company is one of the leading EV manufacturers in China and offers a range of electric vehicles and services.

– XPeng Inc ($SEHK:09868)

As of 2022, YPeng Inc has a market capitalization of 54.52 billion dollars and a return on equity of -11.13%. YPeng Inc is a Chinese multinational conglomerate holding company headquartered in Beijing. The company was founded in 1988 and has since grown to become one of the largest companies in China. YPeng Inc is involved in a wide variety of businesses, including but not limited to: e-commerce, retail, transportation, logistics, and financial services.

– Li Auto Inc ($SEHK:02015)

NIO Inc is a Chinese electric vehicle company headquartered in Shanghai. The company was founded in 2014 and is listed on the New York Stock Exchange. NIO Inc designs, manufactures, and sells electric vehicles in China, the United States, and Europe. The company has a market cap of 140.12B as of 2022 and a return on equity of -0.27%.

Summary

Investing in Tesla has been a volatile journey, characterized by extreme price swings. Recently, Tesla announced a cut in its prices to better compete in the market and potentially increase sales.

However, while the stock price moved up on the news, the long-term implications remain uncertain. Many analysts argue that this strategy could be a losing battle, as it could create a price war and lead to shrinking margins for Tesla.

Additionally, it may not be enough to offset the costs of expansion or attract new buyers, given the competitive landscape. As a result, investors should proceed with caution when considering Tesla as an investment option.

Recent Posts