Stellantis Nv Stock Intrinsic Value – Ossiam Decreases Position in Stellantis NV by 71.5% in 4th Quarter

June 6, 2023

🌥️Trending News

Its shares are listed on the Euronext Amsterdam stock exchange. According to the company’s most recent statement, Ossiam’s position in shares of Stellantis ($NYSE:STLA) decreased by 71.5% in the 4th quarter. This was largely due to a decrease in trading activity and market sentiment towards the stock, as investors become increasingly cautious with their investments in the wake of the pandemic. The decrease in Ossiam’s position indicates that they are now less exposed to the risk associated with Stellantis’ stock. This news has had a dampening effect on Stellantis’ share price, as investors have become more risk-averse.

However, the company’s fundamentals remain strong and its future prospects remain positive. Despite this, investors should still exercise caution when investing in Stellantis’ stock, as market conditions have been highly volatile over the past year.

Analysis – Stellantis Nv Stock Intrinsic Value

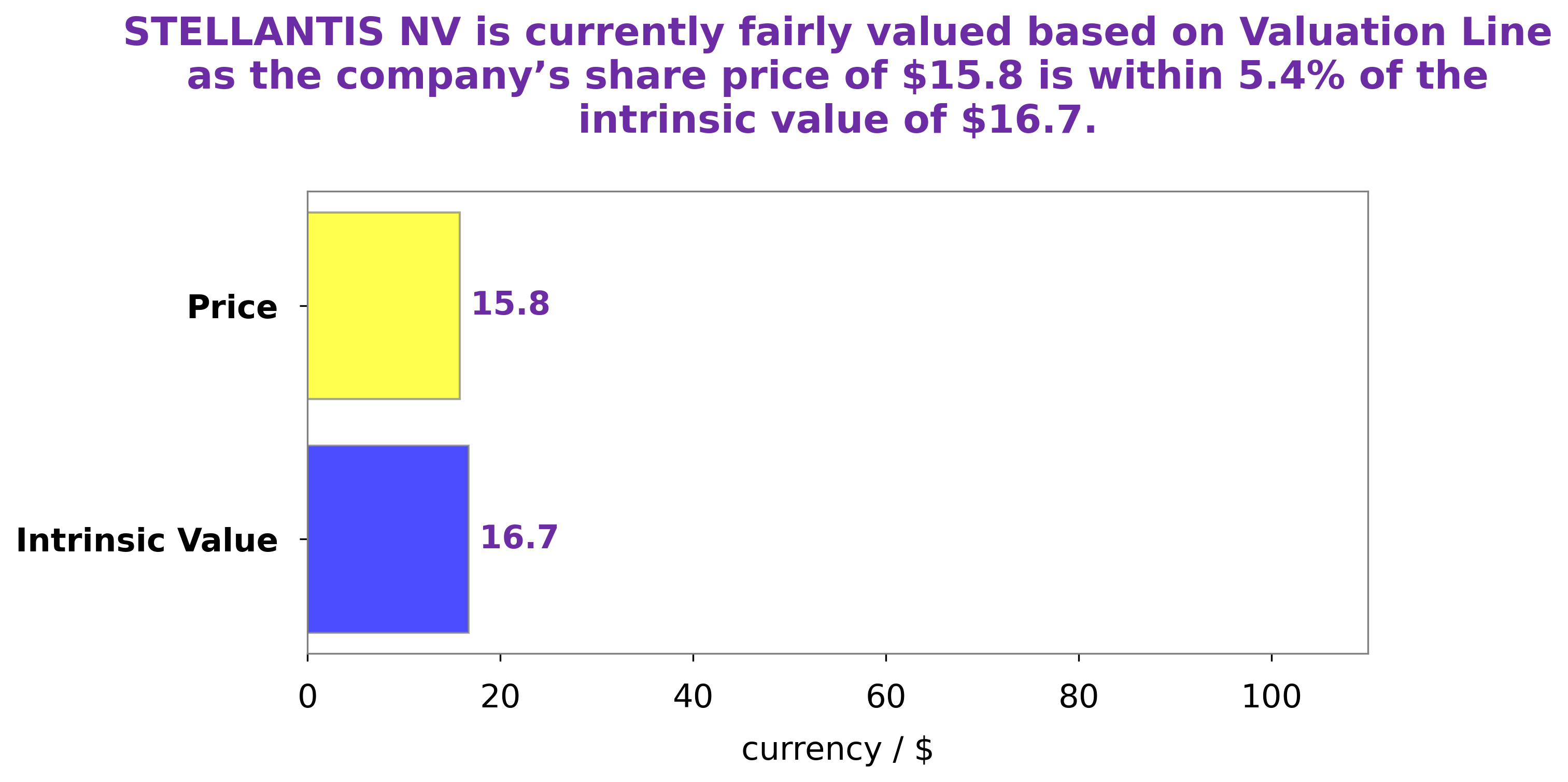

At GoodWhale, we conducted an analysis of STELLANTIS NV‘s financials. Our proprietary Valuation Line shows that the fair value of STELLANTIS NV share is around $16.7. However, at the moment, STELLANTIS NV stock is traded at $15.8, making it a fair price undervalued by 5.7%. Thus, investors may want to consider buying into this stock and reap the benefits of a potential return on their investments. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stellantis Nv. More…

| Total Revenues | Net Income | Net Margin |

| 179.59k | 16.8k | 10.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stellantis Nv. More…

| Operations | Investing | Financing |

| 19.96k | -10.53k | -13.17k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stellantis Nv. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 186.16k | 113.77k | 22.98 |

Key Ratios Snapshot

Some of the financial key ratios for Stellantis Nv are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.4% | 62.0% | 11.4% |

| FCF Margin | ROE | ROA |

| 6.1% | 18.6% | 6.9% |

Peers

The competition between Stellantis NV and its competitors is fierce. Ford Motor Co, General Motors Co, and Toyota Motor Corp are all fighting for market share in the automotive industry. Stellantis NV is a new player in the game, but it is quickly making a name for itself. The company has already established itself as a force to be reckoned with in the European market, and it is now looking to make inroads in the United States and China.

– Ford Motor Co ($NYSE:F)

Ford Motor Company is an American multinational automaker that has its main headquarters in Dearborn, Michigan, a suburb of Detroit. The company sells automobiles and commercial vehicles under the Ford brand and most luxury cars under the Lincoln brand. Ford also owns Brazilian SUV manufacturer Troller, an 8% stake in Aston Martin of the United Kingdom, and a 32% stake in Jiangling Motors of China. It also has joint-ventures in China, Taiwan, Thailand, Turkey, and Russia. The company is listed on the New York Stock Exchange and is controlled by the Ford family; they have minority ownership but the majority of the voting power.

As of 2022, Ford Motor Company has a market capitalization of $47.56 billion and a return on equity of 23.7%. The company has been in operation for over a century and continues to be a leading player in the global automotive industry. Ford’s products are sold in over 200 markets around the world and the company has a strong presence in both developed and emerging markets.

– General Motors Co ($NYSE:GM)

General Motors Co., commonly referred to as GM, is an American multinational corporation headquartered in Detroit that designs, manufactures, markets, and distributes vehicles and vehicle parts, and sells financial services.

As of 2020, GM had a market capitalization of $48.95 billion. This is down from $52.6 billion in 2019. GM’s return on equity was 10.52% in 2020. This is down from 11.92% in 2019.

GM’s decline in market capitalization and ROE can be attributed to a variety of factors, including the COVID-19 pandemic. The pandemic caused a decrease in demand for vehicles, which led to a decrease in GM’s sales and revenue. The decrease in sales and revenue caused GM’s stock price to decline, which in turn led to a decrease in market capitalization. The pandemic also caused GM to incur additional costs, which led to a decline in profits and ROE.

– Toyota Motor Corp ($TSE:7203)

Toyota Motor Corp is one of the largest automakers in the world with a market cap of 27.37T as of 2022. It has a Return on Equity of 11.32%. Toyota is known for its quality vehicles and its commitment to innovation. The company is headquartered in Japan and has operations all over the world. Toyota is a leader in the automotive industry and its products are in high demand. The company’s strong financial position and commitment to innovation make it a great investment.

Summary

Stellantis NV is a leading automotive company that has seen significant investment activity recently. Analysts scrutinizing the company have concluded that Stellantis NV has a strong competitive edge compared to its competitors, with attractive profit growth and market share in both Europe and North America. Investment sentiment towards the company has been positive, with the potential for further growth in the future. Investors should take caution and be mindful of any further developments in the company’s stock prices before making any decisions.

Recent Posts