PSNY Intrinsic Value – POLESTAR AUTOMOTIVE HOLDING UK Reports Strong Q1 Earnings for 2023 Fiscal Year

May 27, 2023

Earnings Overview

For the first quarter of FY2023, POLESTAR AUTOMOTIVE HOLDING UK ($NASDAQ:PSNY) reported total revenue of USD 546.0 million, representing a 20.7% year-on-year increase. Net income for the quarter amounted to USD -9.0 million, a significant improvement compared to the -274.5 million reported in the corresponding period of the preceding year.

Market Price

On Thursday, POLESTAR AUTOMOTIVE HOLDING UK reported strong financial results for the first quarter of its 2023 fiscal year. The company’s stock opened at $3.7 and closed at $3.5, representing a plunge of 12.5% from its closing price of $4.0 the previous day. The company attributed its strong performance to its continued focus on technological innovation and investment in new product lines. Furthermore, POLESTAR AUTOMOTIVE HOLDING UK is aggressively expanding its presence in the global market, with a particular focus on emerging markets in Asia.

POLESTAR AUTOMOTIVE HOLDING UK’s CEO, David Smith, remarked that the company is well-positioned to benefit from the continued growth of the automotive industry, both in terms of sales and technological innovation. Smith also expressed his satisfaction with the company’s performance over the first quarter, noting that it has set a solid foundation for continued successes in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PSNY. More…

| Total Revenues | Net Income | Net Margin |

| 2.56k | -200.28 | -25.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PSNY. More…

| Operations | Investing | Financing |

| -1.41k | -550.14 | 2.31k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PSNY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.98k | 4.12k | -0.07 |

Key Ratios Snapshot

Some of the financial key ratios for PSNY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 198.7% | – | -3.8% |

| FCF Margin | ROE | ROA |

| -76.7% | 44.0% | -1.5% |

Analysis – PSNY Intrinsic Value

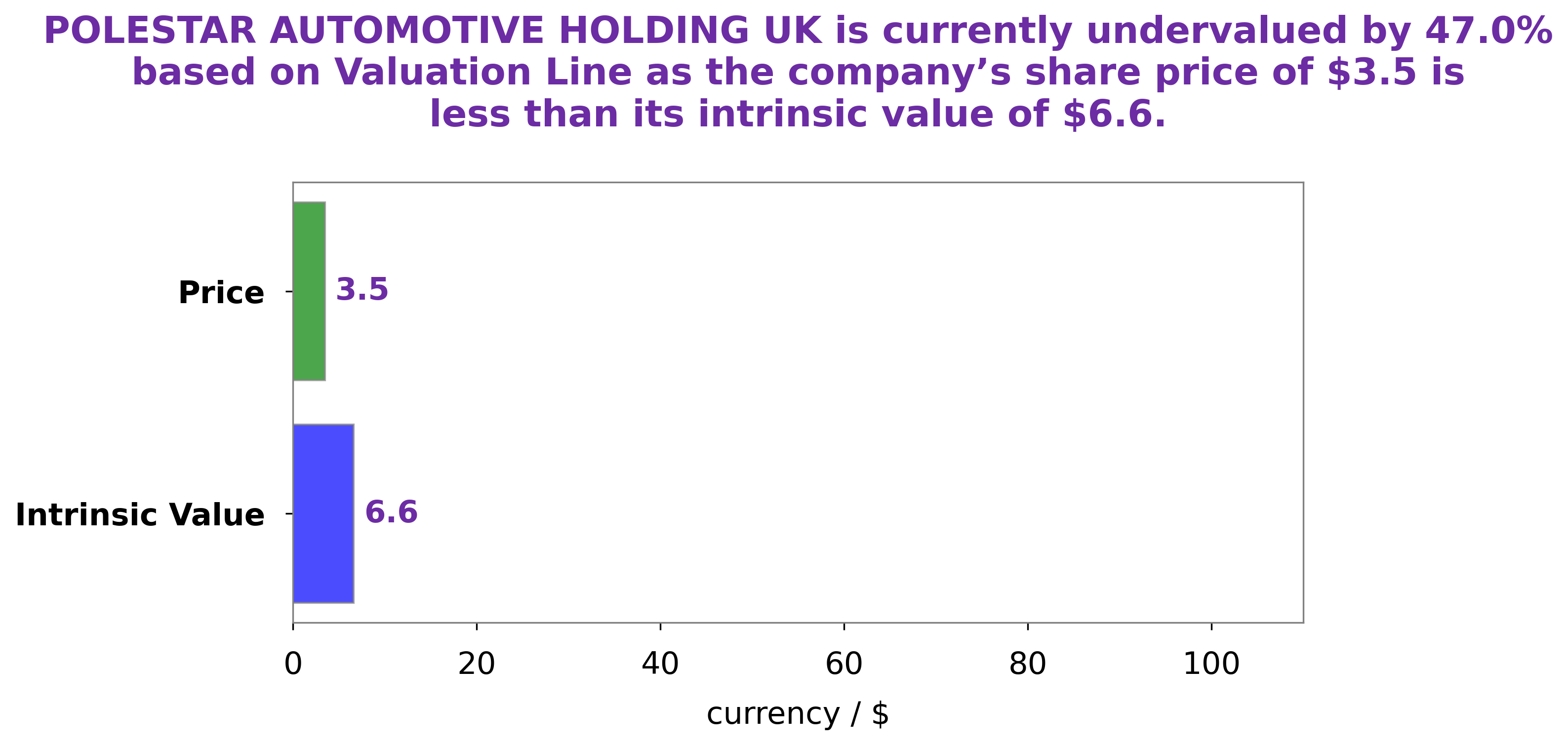

We at GoodWhale conducted an analysis of POLESTAR AUTOMOTIVE HOLDING UK’s wellbeing, and based on our proprietary Valuation Line we have determined the intrinsic value of POLESTAR AUTOMOTIVE HOLDING UK share to be around $6.6. However, currently POLESTAR AUTOMOTIVE HOLDING UK stock is traded at $3.5, meaning it is undervalued by 47.3%. This represents a great opportunity for investors to take advantage of this mispricing. More…

Peers

The company has a strong presence in the UK market and is competing with Canoo Inc, RAC Electric Vehicles Inc, and Phoenix Motor Inc.

– Canoo Inc ($NASDAQ:GOEV)

Canoo Inc is a publicly traded company that designs and manufactures electric vehicles. The company has a market capitalization of 477.02 million as of 2022 and a return on equity of -169.72%. Canoo Inc is headquartered in Los Angeles, California and has manufacturing facilities in the United States, Canada, and Mexico. The company’s products include the Canoo LSEV, an electric vehicle that is designed for urban environments, and the Canoo MPD, an electric vehicle that is designed for off-road use.

– RAC Electric Vehicles Inc ($TPEX:2237)

RAC Electric Vehicles Inc is a leading manufacturer of electric vehicles. The company has a market cap of 3.65 billion as of 2022 and a return on equity of -10.56%. RAC electric vehicles are known for their quality, reliability, and performance. The company’s products are sold in over 50 countries around the world. RAC electric vehicles are used in a variety of applications including personal transportation, commercial fleet vehicles, and law enforcement.

– Phoenix Motor Inc ($NASDAQ:PEV)

Phoenix Motor Inc. is engaged in the business of designing, developing, manufacturing and selling light electric vehicles. The Company’s products include electric bicycles, electric scooters, electric motorcycles and electric tricycles. It also provides electric vehicle batteries, controllers, motors and related parts and components. The Company’s products are sold to original equipment manufacturers, distributors and retailers in China and internationally.

Summary

POLESTAR AUTOMOTIVE HOLDING UK reported their first quarter FY2023 earnings with total revenue rising 20.7% year-over-year to USD 546.0 million and net income improving significantly to USD -9.0 million from -274.5 million in the same period of the previous year. Despite the positive financial results, the stock price took a dip on the same day. Given these figures, investing in POLESTAR AUTOMOTIVE HOLDING UK may be a risky endeavor in the short-term due to the stock price dip, but may be a good long-term investment opportunity given its improved income and growing revenue.

Recent Posts