Porsche Outshines Ferrari in HSBC’s European Auto Stock Breakdown

December 17, 2023

🌥️Trending News

Porsche has recently outshined Ferrari in a European auto stock breakdown conducted by HSBC. According to the study, Porsche was rated higher than Ferrari in terms of stock profitability and performance. FERRARI N.V ($NYSE:RACE) is a luxury sportscar manufacturer based in Maranello, Italy. It is an Italian automobile brand widely considered to be synonymous with high performance, style, and quality.

Ferrari designs, engineers, manufactures, and sells sports cars, as well as offers both parts and servicing for those vehicles. It also produces and sells merchandise related to the Ferrari brand.

Price History

On Wednesday, FERRARI N.V stock opened at $367.0 and closed at $369.9, down by 0.4% from previous closing price of 371.4. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ferrari N.v. More…

| Total Revenues | Net Income | Net Margin |

| 5.81k | 1.18k | 20.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ferrari N.v. More…

| Operations | Investing | Financing |

| 1.62k | -859.84 | -1.1k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ferrari N.v. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.89k | 5.05k | 15.69 |

Key Ratios Snapshot

Some of the financial key ratios for Ferrari N.v are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.6% | 30.7% | 27.2% |

| FCF Margin | ROE | ROA |

| 13.0% | 35.5% | 12.5% |

Analysis

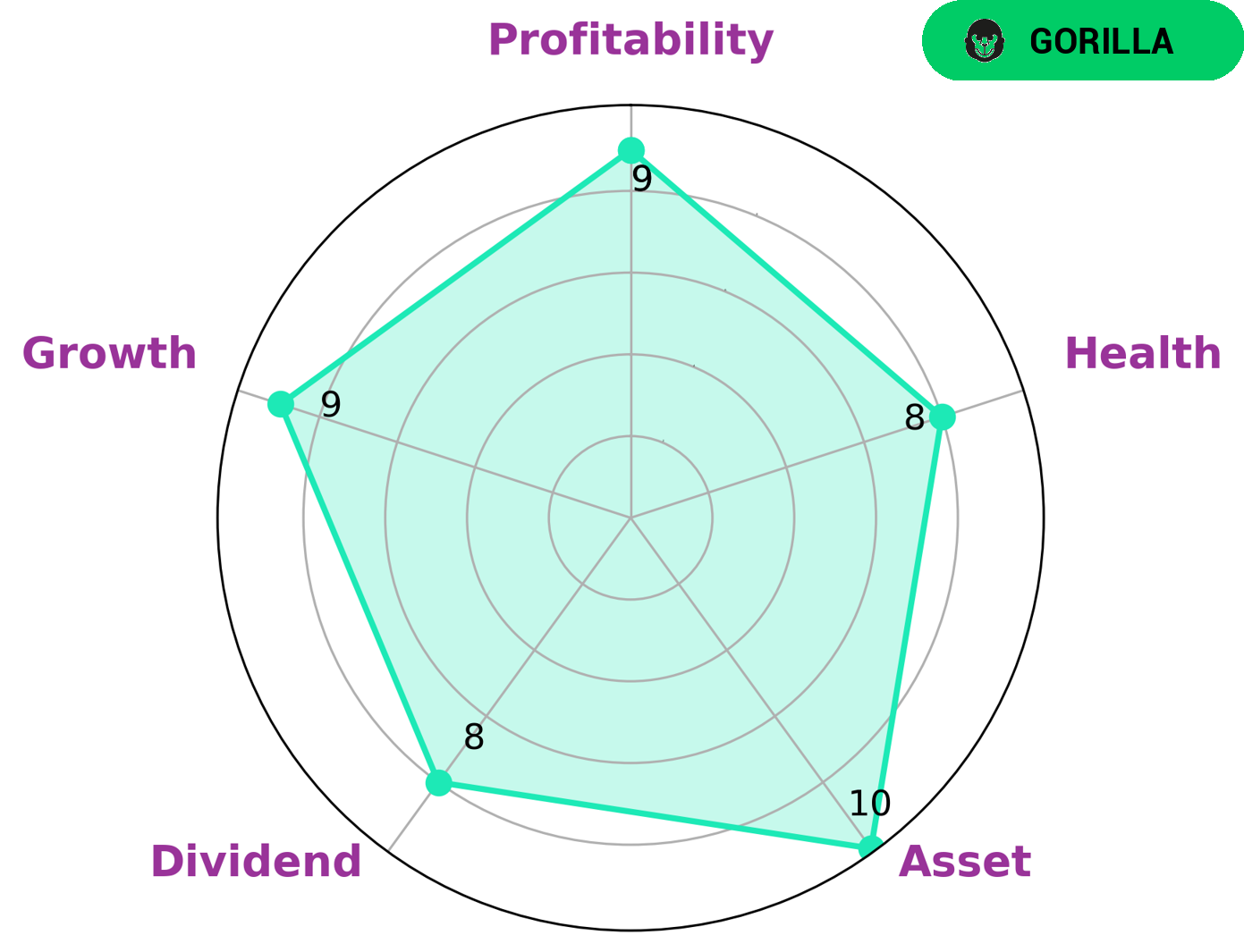

GoodWhale’s analysis of FERRARI N.V.’s financials revealed that the company is strong in asset, dividend, growth, and profitability. Our star chart showed a high health score of 8/10, indicating that FERRARI N.V. is capable of paying off its debt and funding future operations. Furthermore, we classified FERRARI N.V. as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This company may be attractive to value investors who are looking for a reliable and consistent return on their investment. Dividend investors may also be interested in FERRARI N.V. due to its healthy dividend yield, which provides a steady stream of income. Finally, long-term investors who are looking for capital appreciation may also be drawn to FERRARI N.V.’s robust growth potential. More…

Peers

In the automotive industry, there is intense competition between Ferrari NV and its competitors General Motors Co, Ford Motor Co, and Fisker Inc. These companies are constantly striving to outdo each other in terms of innovation, design, and performance. As a result, the customer benefits from this competition in the form of better products and services.

– General Motors Co ($NYSE:GM)

General Motors Company, commonly referred to as GM, is an American multinational corporation headquartered in Detroit that designs, manufactures, markets, and distributes vehicles and vehicle parts, and sells financial services. With global headquarters in Detroit’s Renaissance Center, GM employs approximately 166,000 people in every major region of the world. As of 2018, General Motors is ranked #10 on the Fortune 500 rankings of the largest United States corporations by total revenue.

GM’s market cap is $53.79B as of 2022 and its ROE is 11.79%. The company designs, manufactures, markets, and distributes vehicles and vehicle parts, and sells financial services.

– Ford Motor Co ($NYSE:F)

Return on equity is a measure of profitability that calculates how much profit a company generates with the money shareholders have invested. The higher the return on equity, the more profitable the company is. Ford Motor Company’s return on equity is 23.7%. This means that for every dollar invested by shareholders, the company generates 23.7 cents in profit.

Ford Motor Company is an American multinational automaker that designs, manufactures, markets, and services vehicles worldwide. The company was founded in 1903 by Henry Ford and is headquartered in Dearborn, Michigan. Ford Motor Company sells vehicles under the Ford and Lincoln brands.

– Fisker Inc ($NYSE:FSR)

Fisker Inc is an American electric vehicle manufacturer founded in 2016 by Henrik Fisker, former CEO of Fisker Automotive. The company’s first product is the Ocean SUV, which is scheduled to go into production in late 2021. The Ocean is a battery-electric vehicle with a range of over 250 miles and a starting price of $37,499. Fisker Inc also offers a unique lease-to-own program that allows customers to own their car after 36 monthly payments.

Fisker Inc’s market cap is 2.3B as of 2022. The company’s Return on Equity is -44.42%.

Fisker Inc is an American electric vehicle manufacturer founded in 2016 by Henrik Fisker, former CEO of Fisker Automotive. The company’s first product is the Ocean SUV, which is scheduled to go into production in late 2021. The Ocean is a battery-electric vehicle with a range of over 250 miles and a starting price of $37,499. Fisker Inc also offers a unique lease-to-own program that allows customers to own their car after 36 monthly payments.

Summary

Ferrari N.V. is an Italian luxury sports car manufacturer and a prominent player in the global auto industry. For investors, Ferrari is an attractive stock to consider due to its luxurious brand appeal, as well as its strong financial performance. Although it is not rated as highly as other European auto stocks like Porsche by HSBC’s European auto stock breakdown, Ferrari has still seen its stock price increase steadily over the years. Furthermore, Ferrari has a strong presence in the motorsport industry and recently announced the launch of its e-Sports series, which may further contribute to its market share and profitability.

Investors should be aware of the risks associated with investing in Ferrari, such as geopolitical tensions, economic downturns, and increased competition. Nevertheless, Ferrari remains an attractive stock to consider for those who are looking for long-term growth potential.

Recent Posts