Morgan Stanley Confirms Positive Outlook for Rivian Automotive Despite Near-Term Challenges

April 19, 2023

Trending News ☀️

Rivian Automotive ($NASDAQ:RIVN) is an American automotive company that designs and manufactures electric adventure vehicles. Despite near-term challenges, Morgan Stanley recently confirmed a positive outlook for Rivian Automotive. In an investor note, the firm acknowledged that Rivian’s near-term challenges are likely to persist due to the pandemic but that Rivian has the “right ingredients” for success in the long run. The firm believes Rivian will be able to capitalize on its strong brand and technology to become a “true disruptor in the EV landscape.” Morgan Stanley also noted that Rivian’s current production capacity is limited, which will likely cause difficulties in meeting customer demand.

But the firm believes that Rivian is well-positioned to scale up its production capacity, which could lead to significant sales growth. Overall, Morgan Stanley is confident that Rivian Automotive has the potential to become a major player in the electric vehicle space. The firm’s positive outlook for Rivian Automotive is a strong endorsement that the company is on the right track to success.

Price History

The electric vehicle company’s stock opened at $13.7 and closed at $13.4, down by 2.2% from its last closing price of 13.7. This slight decrease in the stock price followed a report by the firm that stated that Rivian faces near-term challenges such as a more competitive market, higher costs and an uncertain demand for EVs. However, Morgan Stanley’s report also pointed out that the company’s long-term competitiveness was not in doubt and that the growth potential of the electric vehicle industry was still significant. Despite these near-term headwinds, Morgan Stanley is still confident in Rivian Automotive‘s long-term growth prospects and is convinced that the company’s approach to electric vehicles can prove successful in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rivian Automotive. More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | -6.75k | -407.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rivian Automotive. More…

| Operations | Investing | Financing |

| -5.05k | -1.37k | 99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rivian Automotive. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.88k | 4.08k | 14.9 |

Key Ratios Snapshot

Some of the financial key ratios for Rivian Automotive are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -400.8% |

| FCF Margin | ROE | ROA |

| -387.3% | -28.5% | -23.2% |

Analysis

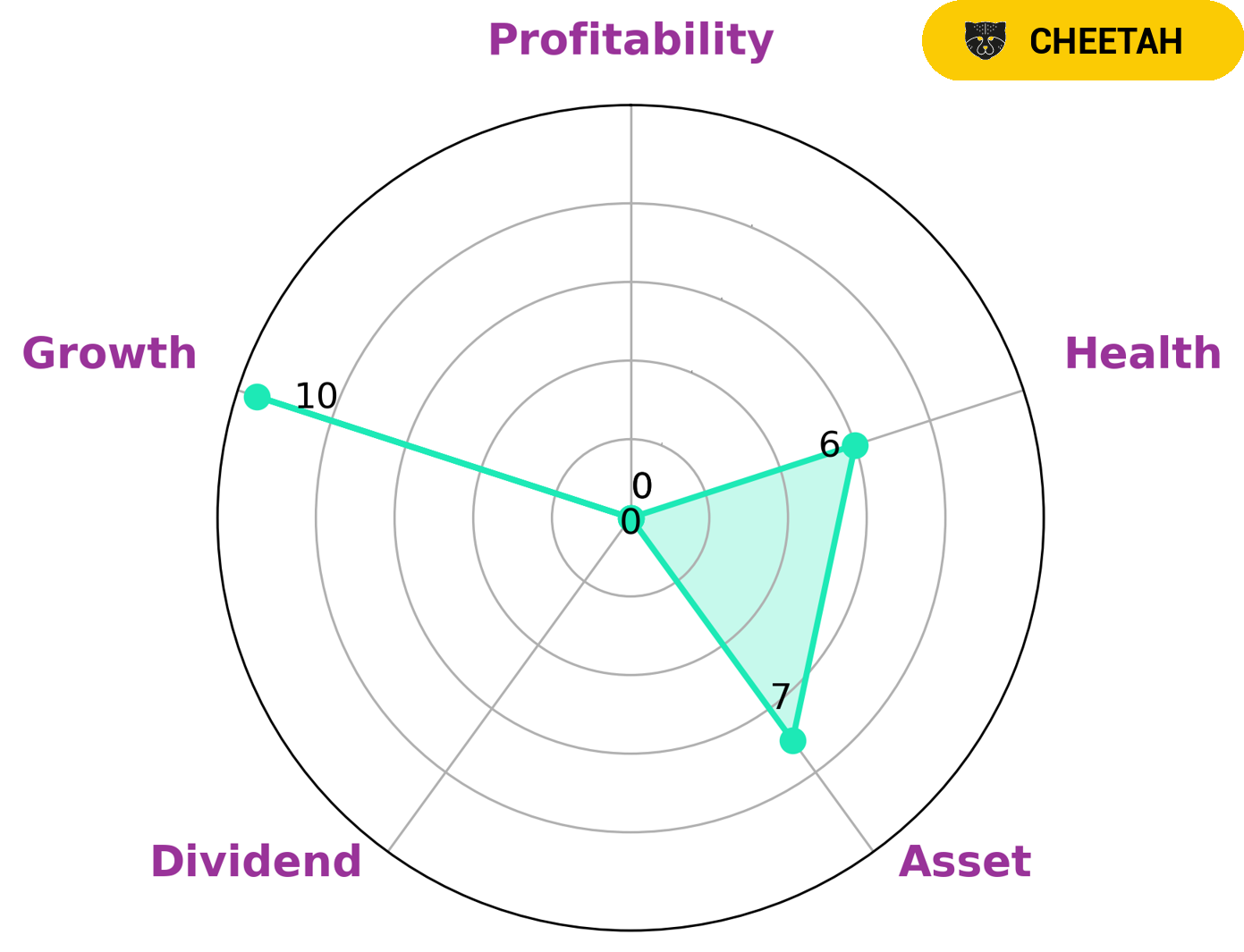

At GoodWhale, we analyze the financials of RIVIAN AUTOMOTIVE to assess their overall financial health. According to our Star Chart, RIVIAN AUTOMOTIVE has an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that they may be able to pay off debt and fund future operations. RIVIAN AUTOMOTIVE is classified as a ‘cheetah’ company, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. As such, this type of company attracts a variety of investors looking for rapid growth and high returns. RIVIAN AUTOMOTIVE is strong in asset growth but weak in dividend and profitability. Investors seeking a higher degree of stability and cash flow may find another company more suitable to their needs. More…

Peers

Rivian Automotive Inc is an American automotive and energy storage company. Founded in 2009, the company focuses on developing electric vehicles. Rivian has raised over $6 billion from investors including Amazon.com and Ford Motor Company. Rivian’s main competitors are Lucid Group Inc, Tesla Inc, and Ford Motor Co.

– Lucid Group Inc ($NASDAQ:LCID)

As of 2022, Lucid Group Inc has a market cap of 21.21B and a Return on Equity of -29.52%. Lucid Group Inc is a leading provider of marketing and advertising services. The company has a strong focus on delivering high-quality, innovative, and effective marketing and advertising solutions to its clients. Lucid Group Inc has a strong reputation for providing excellent service and delivering results that exceed expectations. The company’s focus on quality and customer satisfaction has resulted in a loyal client base and a strong market position. Lucid Group Inc is well-positioned to continue its growth and success in the marketing and advertising industry.

– Tesla Inc ($NASDAQ:TSLA)

Tesla’s market cap as of 2022 is 695.76B. The company has a Return on Equity of 27.88%. Tesla is an American electric vehicle and clean energy company based in Palo Alto, California. The company specializes in electric vehicle manufacturing, batteries, and solar panel manufacturing. Tesla also offers vehicle service centers, superchargers, and home energy systems.

– Ford Motor Co ($NYSE:F)

As of 2022, Ford Motor Company has a market capitalization of 48.77 billion dollars and a return on equity of 23.7%. The company is one of the largest automakers in the world and is known for its production of cars and trucks. The company also has a strong presence in the world of motorsports, with its vehicles competing in a number of different racing series.

Summary

Despite near-term macro-economic challenges, Morgan Stanley continues to recommend investing in Rivian Automotive. According to the investment banking firm, Rivian remains a compelling investment opportunity due to its potential for long-term growth, driven by its commitment to innovate and develop the future of mobility. The company has seen significant investments from key players in the automotive and technology sectors, demonstrating the industry’s confidence in Rivian’s potential. Rivian is at the cusp of disrupting the traditional automotive sector as it develops electric vehicles and autonomous driving technology, as well as other connected services.

Morgan Stanley believes that Rivian will continue to benefit from strong customer demand, technological innovation and a robust supply chain, all of which will contribute to its future success. As such, Morgan Stanley recommends that investors should consider investing in Rivian in the long-term, despite near-term macro-economic challenges.

Recent Posts