Lucid Group Misses Earnings and Revenue Estimates by Wider Margins

May 9, 2023

Trending News 🌧️

Lucid Group ($NASDAQ:LCID), a public company traded on the London Stock Exchange, has recently released earnings results that have come in substantially lower than expected. The company posted a GAAP EPS of -$0.43, which was $0.07 short of the expected figure. Likewise, the revenue came in at $149.43M, which was $62.1M lower than forecast. As a pharmaceutical shareholders’ agency, Lucid Group provides services to a wide array of healthcare companies throughout the life cycle of a drug.

Their clients range from major pharmaceutical companies to smaller organizations looking for a strategic partner to help them grow. Through their portfolio of services and products, Lucid Group is able to provide a comprehensive suite of support to its customers.

Earnings

In its latest earnings report of fiscal year 2022 Q4, as of December 31 2022, Lucid Group reported total revenues of 257.71M USD, missing estimates by a wide margin. This is a massive 876.5% increase from the same period of the previous year, with total revenue rising from 3.63M USD to 257.71M USD in the last 3 years. Unfortunately, Lucid Group also reported a net income loss of 472.65M USD, again missing estimates by a wider margin. These numbers paint a worrying picture for the future of the company, and investors are likely to be concerned by the wide earnings miss.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lucid Group. More…

| Total Revenues | Net Income | Net Margin |

| 608.18 | -1.3k | -420.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lucid Group. More…

| Operations | Investing | Financing |

| -2.23k | -3.68k | 1.35k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lucid Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.88k | 3.53k | 2.38 |

Key Ratios Snapshot

Some of the financial key ratios for Lucid Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 409.8% | – | -209.4% |

| FCF Margin | ROE | ROA |

| -542.8% | -21.0% | -10.1% |

Price History

On Monday, Lucid Group reported their quarterly earnings and revenue, both of which missed estimates by wider margins than expected. Lucid Group’s stock opened at $7.8 and closed at $7.7, down by 0.3% from the previous closing price of 7.7. The company attributed the lower-than-expected performance to delays in product launches and lower demand in certain markets, and said that they are working on improving their performance in the upcoming quarters. In response to the earnings report and subsequent stock dip, trading was halted while analysts re-evaluated their outlook on the company. Live Quote…

Analysis

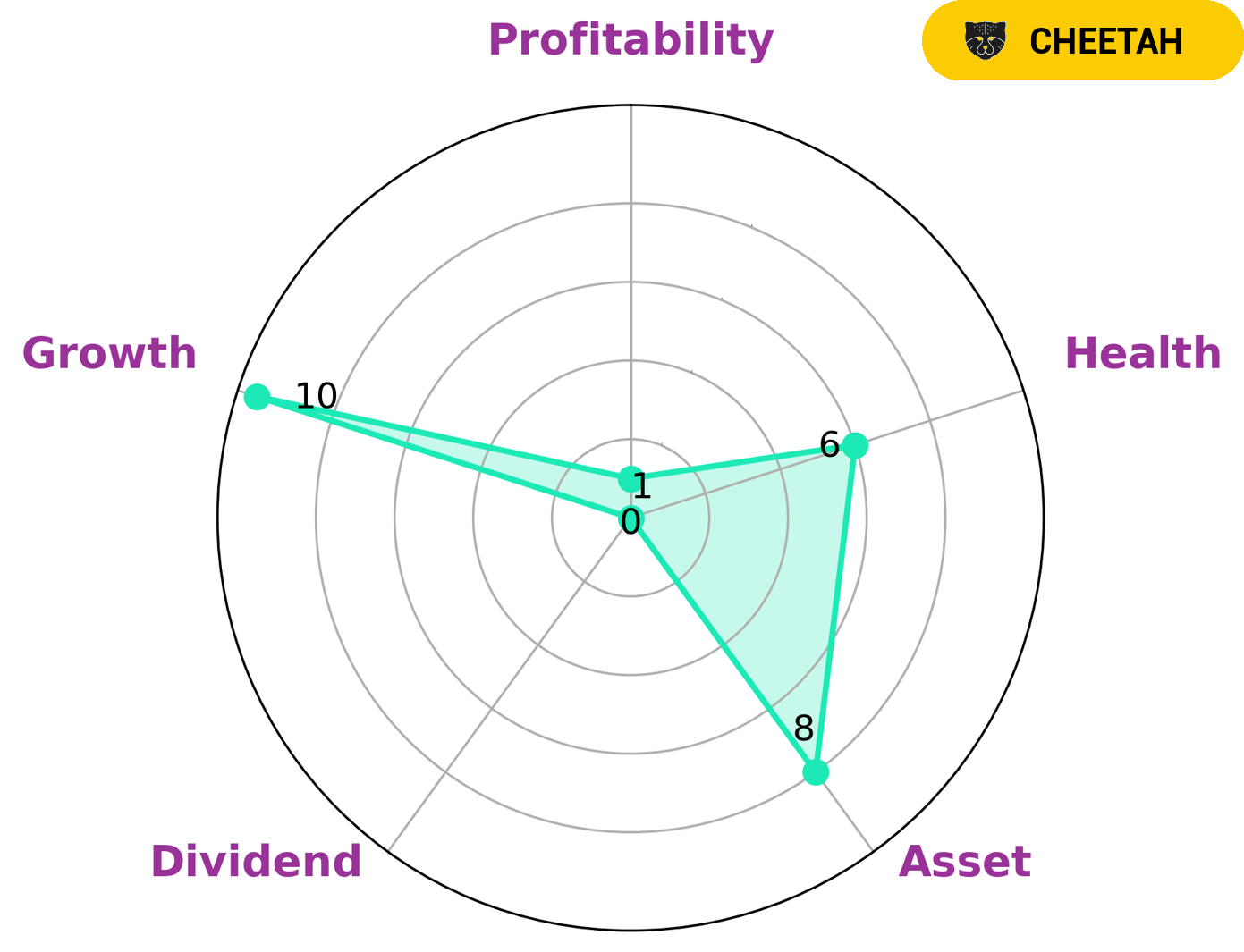

At GoodWhale, we conducted an analysis of the wellbeing of LUCID GROUP. Our Star Chart shows that LUCID GROUP is strong in assets and growth, but weak in dividend and profitability. The LUCID GROUP has an intermediate health score of 6/10, indicating that it may be able to safely ride out any crisis without the risk of bankruptcy. We have classified LUCID GROUP as a ‘cheetah’ type of company, which has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who enjoy higher risk and higher reward may find this type of company attractive, as they may benefit from the potential of higher returns in exchange for taking on more risk. More…

Peers

Lucid Group Inc is an American automotive company founded in 2007 by Bernard Tse and Sam Weng. The company’s first car, the Lucid Air, was unveiled in December 2016. Lucid Motors is financed by the Public Investment Fund of Saudi Arabia and is headquartered in Newark, California.

Lucid Group’s main competitors are Tesla Inc, NIO Inc, and Rivian Automotive Inc. Tesla Inc is an American electric vehicle and clean energy company based in Palo Alto, California. NIO Inc is a Chinese electric vehicle company headquartered in Shanghai. Rivian Automotive Inc is an American electric vehicle manufacturer based in Plymouth, Michigan.

– Tesla Inc ($NASDAQ:TSLA)

Tesla, Inc. is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla’s market cap as of 2022 is 689.96B with a ROE of 27.88%. The company specializes in electric vehicle manufacturing, battery energy storage from home to grid scale, solar panel manufacturing, solar roof tiles, and related products and services.

– NIO Inc ($SEHK:09866)

NIO Inc is a Chinese electric vehicle and technology company headquartered in Shanghai. The company was founded in 2014 by William Li. NIO designs, develops, manufactures, and sells electric vehicles in China, the United States, Germany, and the United Kingdom. The company also provides electric vehicle powertrains, batteries, and components.

NIO Inc has a market cap of 154.77B as of 2022. The company has a Return on Equity of -13.53%. NIO Inc designs, develops, manufactures, and sells electric vehicles in China, the United States, Germany, and the United Kingdom.

– Rivian Automotive Inc ($NASDAQ:RIVN)

Rivian Automotive Inc is an American electric vehicle manufacturer. Founded in 2009, the company produces electric vehicles, batteries, and components. Rivian’s market cap is 28.86B as of 2022 and its ROE is -23.66%. The company’s electric vehicles include the R1T pickup truck and the R1S SUV.

Summary

Revenues of $149.43 million also fell short of expectations, missing by $62.1 million. Analysts have commented that these results indicate a slowdown in the sales growth of Lucid Group‘s products. Despite this, investors have remained optimistic about the company’s future prospects, noting that the company’s innovative product portfolio should enable Lucid Group to continue to grow and remain competitive in the long-term.

Recent Posts