Ford Motor’s Fourth-Quarter Earnings Widely Disappoint, Resulting in 8% Stock Price Drop.

February 12, 2023

Trending News 🌧️

Last week, the company reported its fourth-quarter earnings and the results were well below expectations. The company fell short of its own adjusted EBIT forecast for FY 2022 by a full billion, primarily due to weak performance and supply chain difficulties. Furthermore, the outlook for free cash flow in FY 2023 was highly underwhelming, leading to a significant 8% drop in the company’s stock price on Friday. The weak results from Ford ($NYSE:F)’s fourth-quarter earnings have raised serious concerns about the future of the automotive giant. Analysts point to a number of factors that may have contributed to the disappointing performance, including the ongoing pandemic, which has caused disruptions in the supply chain and put pressure on the automotive industry as a whole.

Additionally, there is increased competition from other carmakers, such as Tesla and Volkswagen, which have taken advantage of the current situation to gain a larger market share. In response to the poor results, Ford has committed to taking a number of steps to improve its performance, such as cutting costs, streamlining operations, and investing in new technologies. The company is also focusing on improving customer experience, launching new models and expanding its presence in new markets. These measures should help Ford regain its footing in the coming quarters and increase its value in the long-term. Despite the disappointing fourth-quarter earnings, Ford remains one of the best-known and most trusted car brands in the world. The company has been able to weather multiple crises in the past, and it is expected that it will be able to do so again. With its emphasis on innovation and customer centricity, Ford should be able to overcome this setback and get back on track in the near future.

Share Price

On Monday, FORD MOTOR reported fourth-quarter earnings that widely disappointed investors, resulting in an 8% drop in its stock price. Media exposure has been mostly mixed, though the stock opened that day at $13.2 and closed at $13.1, down 0.7% from its previous closing price. Despite this, the company still managed to generate positive cash flow of $6 billion.

Furthermore, the auto maker suffered from higher costs associated with restructuring activities and investments in new technology. While the company has plans to reduce costs and invest in electric vehicles, it remains to be seen if these efforts will be enough to turn around its fortunes in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ford Motor. More…

| Total Revenues | Net Income | Net Margin |

| 158.06k | -1.98k | 2.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ford Motor. More…

| Operations | Investing | Financing |

| 6.85k | -4.35k | 2.51k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ford Motor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 255.88k | 212.72k | 10.85 |

Key Ratios Snapshot

Some of the financial key ratios for Ford Motor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.5% | 8.3% | 3.0% |

| FCF Margin | ROE | ROA |

| -0.0% | 7.0% | 1.2% |

Analysis

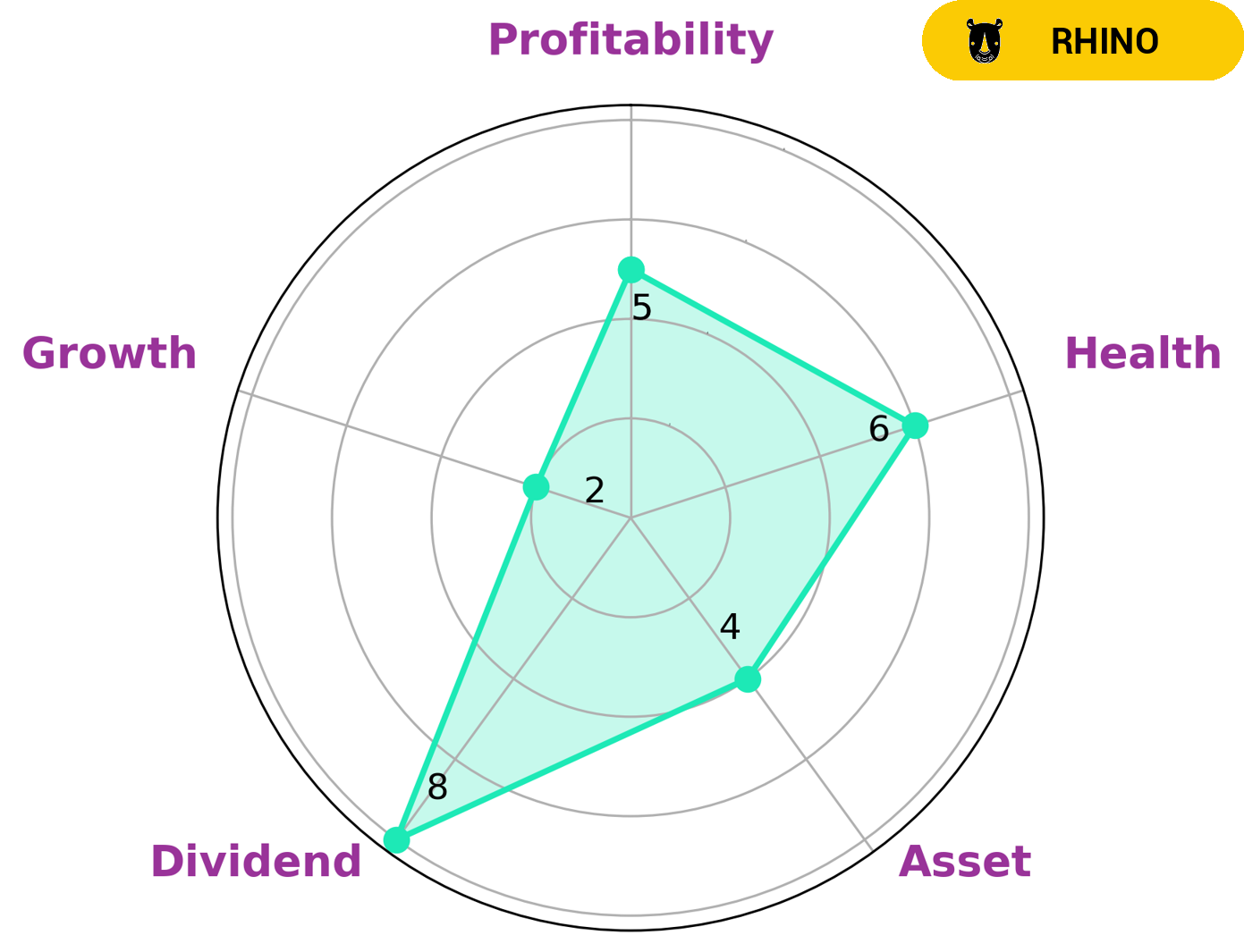

GoodWhale has conducted an analysis of FORD MOTOR‘s financials and found it to be classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This company could be of interest to a number of different types of investors, depending on their investment goals. Investors looking for a reliable dividend may be drawn to FORD MOTOR, as it has a strong dividend score. Additionally, FORD MOTOR has an intermediate health score of 6/10, indicating that it may be able to sustain future operations in times of crisis. The company is also medium in asset, profitability and weak in growth. In terms of risk management, FORD MOTOR could be an appropriate investment for those seeking an investment with balanced risk and return. Since the company has achieved moderate revenue or earnings growth, it is likely to provide a steady rate of return over time. Furthermore, its intermediate health score indicates that it is more likely to remain financially stable even in the event of economic downturns or other external shocks. Overall, FORD MOTOR could be a good fit for investors who are looking for a relatively safe investment with a moderate rate of return. The company’s relatively balanced risk-return profile could be attractive to those seeking to diversify their portfolios or those looking to invest for the long-term. Furthermore, its dividend score and health score make it a more secure option than some other investments. More…

Peers

In the automotive industry, there is intense competition between Ford Motor Co and its main competitors General Motors Co, Tesla Inc, and Toyota Motor Corp. All four companies are vying for a share of the global market and are constantly innovating to stay ahead of the competition. Ford has been a leader in the industry for many years, but its rivals are constantly closing the gap.

– General Motors Co ($NYSE:GM)

General Motors Co is an American multinational corporation headquartered in Detroit that designs, manufactures, markets, and distributes vehicles and vehicle parts, and sells financial services. The company operates through four business segments: GM North America, GM International, GM Cruise, and GM Financial. The company was founded in 1908 by William C. Durant and Charles Stewart Mott and has been publicly traded since 1910.

General Motors Co has a market capitalization of $49.94 billion as of 2022 and a return on equity of 10.52%. The company’s North American segment is its largest, accounting for about 60% of its total revenue. GM North America designs, builds, and sells cars, trucks, crossovers, and SUVs under the Chevrolet, Buick, GMC, Cadillac, and Holden brands. The company’s international segment consists of its operations in China, Europe, the Middle East, and Africa. GM Cruise is the company’s autonomous vehicle subsidiary. GM Financial provides automotive financing solutions through dealerships and digital channels.

– Tesla Inc ($NASDAQ:TSLA)

Founded in 2003, Tesla, Inc. is an American multinational corporation that specializes in electric vehicles, energy storage, and solar panel manufacturing. Based in Palo Alto, California, the company operates multiple production and assembly plants, notably Gigafactory 1 near Reno, Nevada, and its main vehicle manufacturing facility at Tesla Factory in Fremont, California. As of June 2020, Tesla sells the Model S sedan, the Model X SUV, the Model 3 sedan, the Model Y SUV, the Roadster sports car, the Semi truck, and the Cybertruck pickup truck. Tesla also offers vehicle service centers, supercharger stations, and Destination Charging stations.

Tesla’s market cap is $687.33B as of 2022. The company has a Return on Equity of 27.88%.

– Toyota Motor Corp ($TSE:7203)

Toyota Motor Corp is a Japanese multinational automotive manufacturer. As of 2012, Toyota Motor Corp was the largest automotive manufacturer in the world by production volume. The company produces vehicles under five brands, including the Toyota brand, Hino, Lexus, Ranz, and Daihatsu. It also has a majority stake in Subaru and minority stakes in Isuzu, Mazda, and Suzuki. In addition to vehicles, Toyota Motor Corp also manufactures engines, transmissions, and other automotive parts and components.

The company’s market capitalization is 27.48T as of 2022. Its return on equity is 11.32%.

Toyota Motor Corp is a leading manufacturer of automobiles. The company’s products include passenger cars, trucks, buses, and SUVs. Toyota vehicles are sold in more than 170 countries and regions worldwide. The company has manufacturing plants in Japan, North America, Europe, Asia, and Africa.

Summary

Investing in Ford Motor is a complicated decision, with mixed reviews from the media. The company reported a wide miss on its fourth-quarter earnings, resulting in an 8% stock price drop. This has caused uncertainty among investors regarding the company’s long-term prospects. Analysts have noted the company’s debt levels, operational inefficiencies and high costs as potential warning signs.

On the other hand, the company is still a leader in areas such as autonomous vehicles and has a strong presence in many markets. It is important that investors assess the company’s long-term prospects and make informed decisions before investing.

Recent Posts