Fisker Secures Funding to Accelerate Electric Vehicle Production

April 14, 2023

Trending News ☀️

Fisker Inc ($NYSE:FSR)., an American electric vehicle manufacturer, has recently secured funding to accelerate its electric vehicle production. This marks an exciting turning point for the company and their mission to provide clean and efficient vehicles that reduce global carbon emissions. With this latest influx of capital, Fisker Inc. aims to increase production, providing more vehicles to meet the rising demand. The funding will be used to reduce manufacturing costs, improve battery technology, and launch a new subscription-based model that gives customers access to a variety of vehicles. This will be a huge step forward in the company’s mission to provide innovative transportation solutions that are both affordable and reliable.

The company has also announced plans to expand its workforce by creating thousands of new jobs in the US as well as overseas. Fisker Inc. has made tremendous progress in the past few years and this investment will help them to continue their growth and success. By investing in electric vehicle production, Fisker Inc. is taking a proactive step towards creating a more sustainable future for all. With this new funding, the company is well positioned to become a leader in the electric vehicle market.

Stock Price

FISKER INC’s stock opened at $5.5 and closed at the same price, up by 0.9% from last closing price of 5.4. The company has seen steady growth in its stock price, making this a welcomed news for investors. This new funding will enable FISKER INC to not only expand its production capabilities but also accelerate their plans for the development of new electric vehicles. The additional funds will also help the company to further refine its current line of electric vehicles and make them even more efficient. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fisker Inc. More…

| Total Revenues | Net Income | Net Margin |

| 0.34 | -547.5 | -157484.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fisker Inc. More…

| Operations | Investing | Financing |

| -452.54 | -200.99 | 187.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fisker Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.52k | 1.03k | 1.5 |

Key Ratios Snapshot

Some of the financial key ratios for Fisker Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -154644.7% |

| FCF Margin | ROE | ROA |

| -188165.5% | -61.7% | -21.8% |

Analysis

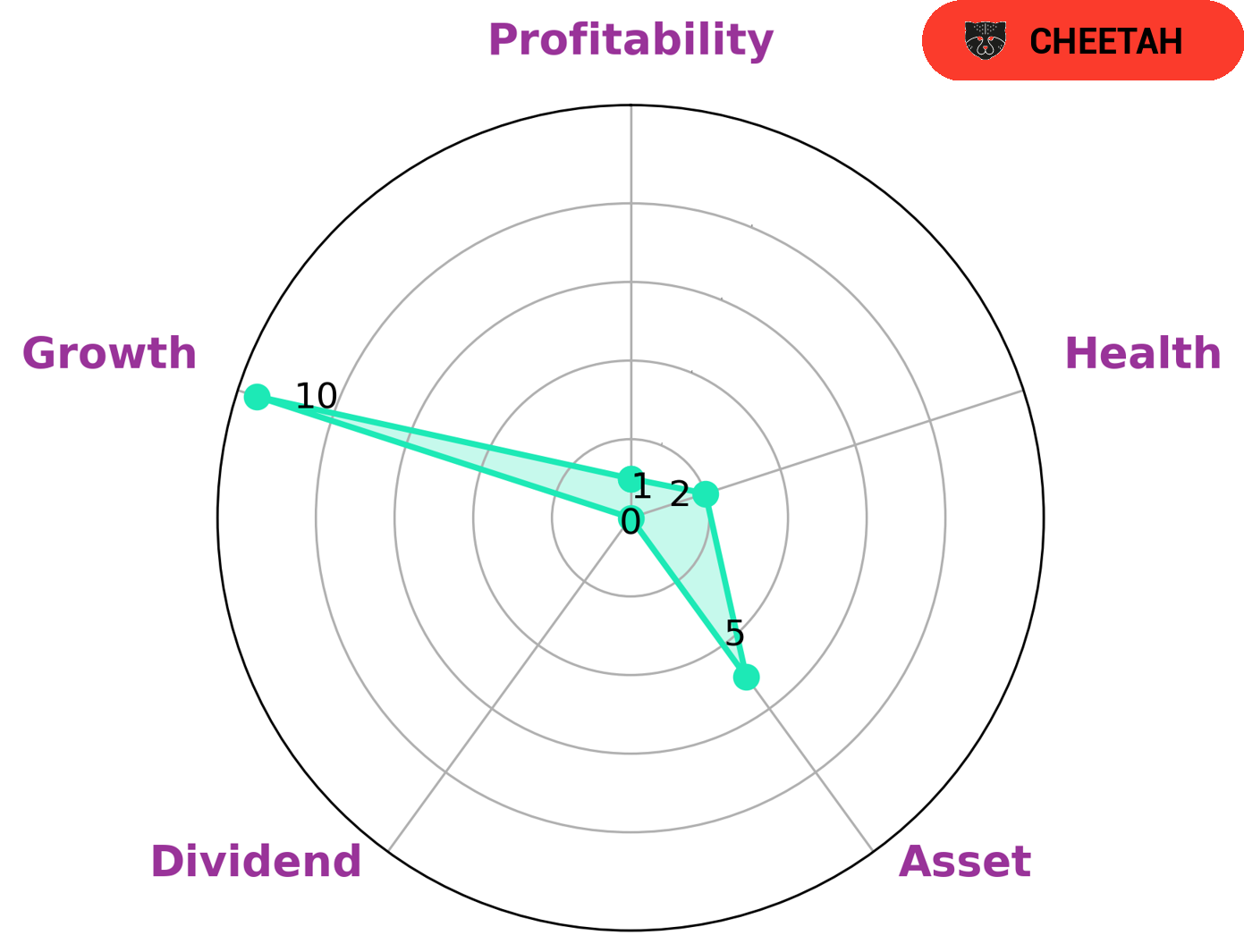

GoodWhale performed an analysis of FISKER INC‘s financials, and the results are not looking promising. According to our Star Chart, FISKER INC has a low health score of 2/10 when considering its cashflows and debt, making it less likely to be able to pay off debt and fund future operations. The company is strong in growth, medium in assets, and weak in dividends and profitability. Consequently, we classify the company as a ‘cheetah’, meaning that it achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this information, we recommend that investors consider this company with caution. FISKER INC may be attractive to those looking for high growth potential as well as those who are comfortable taking on a higher risk for potential reward. However, investors should be aware of the risks associated with investing in such a company, such as their ability to pay down debt or fund future operations. More…

Peers

The competition in the electric vehicle market is heating up, with new entrants Tesla, Lordstown Motors Corp, and Canoo Inc all vying for a piece of the pie. Fisker Inc, an early pioneer in the space, is no stranger to competition, but it remains to be seen if they can hold onto their market share.

– Tesla Inc ($NASDAQ:TSLA)

Tesla, Inc. is an American multinational corporation that specializes in electric vehicles, energy storage, and solar panel manufacturing. Based in Palo Alto, California, Tesla’s mission is to accelerate the world’s transition to sustainable energy. Tesla’s market cap as of 2022 is 687.33B and its ROE is 27.88%. The company’s products include electric cars, batteries, solar panels, and home energy systems.

– Lordstown Motors Corp ($NASDAQ:RIDE)

Founded in 1954, Lordstown Motors Corporation is an American electric vehicle manufacturer. The company’s flagship product is the Endurance, an all-electric pickup truck. Lordstown Motors is headquartered in Lordstown, Ohio, and has a production facility in Mexico.

As of 2022, Lordstown Motors Corporation has a market cap of 369.92 million and a return on equity of -63.07%. The company’s flagship product, the Endurance, is an all-electric pickup truck that is manufactured in Mexico. Lordstown Motors is working to establish itself as a leader in the electric vehicle market, and its market cap and return on equity reflect this goal.

– Canoo Inc ($NASDAQ:GOEV)

Canoo Inc. is a publicly traded company with a market capitalization of 409.99 million as of 2022. The company has a return on equity of -258.12%. Canoo Inc. is a designer and manufacturer of electric vehicles. The company was founded in 2015 and is headquartered in Los Angeles, California.

Summary

Fisker Inc has been making waves in the electric vehicle (EV) market, and their financial performance is looking strong. The company is flush with cash as EV sales are poised to increase. Analysts are particularly bullish on Fisker’s future prospects, given the growing demand for electric vehicles and their commitment to developing cutting-edge technology.

In terms of valuation, Fisker Inc’s stock is currently trading above its historical average, reflecting the potential for strong returns. Several factors make investing in Fisker a particularly attractive option, including the potential for high revenue growth, their commitment to innovation and their ability to generate substantial customer loyalty.

Recent Posts