Fisker Inc Stock Intrinsic Value – Fisker Strengthens Service with Customer-Driven Enhancements

December 20, 2023

☀️Trending News

Fisker Inc ($NYSE:FSR)., a renowned manufacturer of luxury electric vehicles, has recently taken steps to strengthen their service capabilities in response to customer feedback. This move demonstrates the company’s commitment to offering the best possible experience to all of its customers. Their groundbreaking electric vehicles are one of the most advanced on the market, integrating cutting-edge technology and luxurious amenities. Through their customer-driven enhancements, Fisker Inc. is ensuring that their customers are receiving the highest level of service. These enhancements include improved customer service response times, personalized customer support, and enhanced communication features. Fisker Inc. has also taken steps to streamline their vehicle repairs and maintenance activities, making them more efficient and cost-effective.

Additionally, they have invested in new technology that helps them respond faster to customer needs. These improvements are evidence of Fisker Inc.’s commitment to providing excellent service and a positive customer experience. The customer-driven enhancements made by Fisker Inc. demonstrate the company’s dedication to providing a superior service experience. Their commitment to listening to customer feedback and making the necessary adjustments to ensure their customers are satisfied will undoubtedly lead to long-term customer loyalty. Fisker Inc. is dedicated to providing the highest quality service and products to its customers, and these enhancements are proof of that commitment.

Share Price

On Tuesday, Fisker Inc. (FISKER) opened at $1.6 and closed at the same price after experiencing a slight decrease of 2.5% from its closing price the day before. This news highlights the strength of FISKER’s service, as recent customer-driven enhancements have allowed the company to stay competitive in its market. FISKER has taken several measures to ensure its customers have an optimal experience, such as shortening wait times and increasing its staff size to better serve customer needs. The company has also invested in technology to keep up with modern trends, allowing customers to access services more quickly and conveniently.

These customer-driven developments have resulted in an overall improved service for FISKER, making them a preferred choice for many. The company is looking to further increase its customer base by expanding its product offerings, and by introducing new services and features that will benefit customers. FISKER is dedicated to providing excellent customer service, and will continue to strive for excellence in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fisker Inc. More…

| Total Revenues | Net Income | Net Margin |

| 73.13 | -464.22 | -663.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fisker Inc. More…

| Operations | Investing | Financing |

| -419.27 | -71.96 | 506.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fisker Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.39k | 2.05k | 1.24 |

Key Ratios Snapshot

Some of the financial key ratios for Fisker Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -606.0% |

| FCF Margin | ROE | ROA |

| -661.2% | -65.3% | -11.6% |

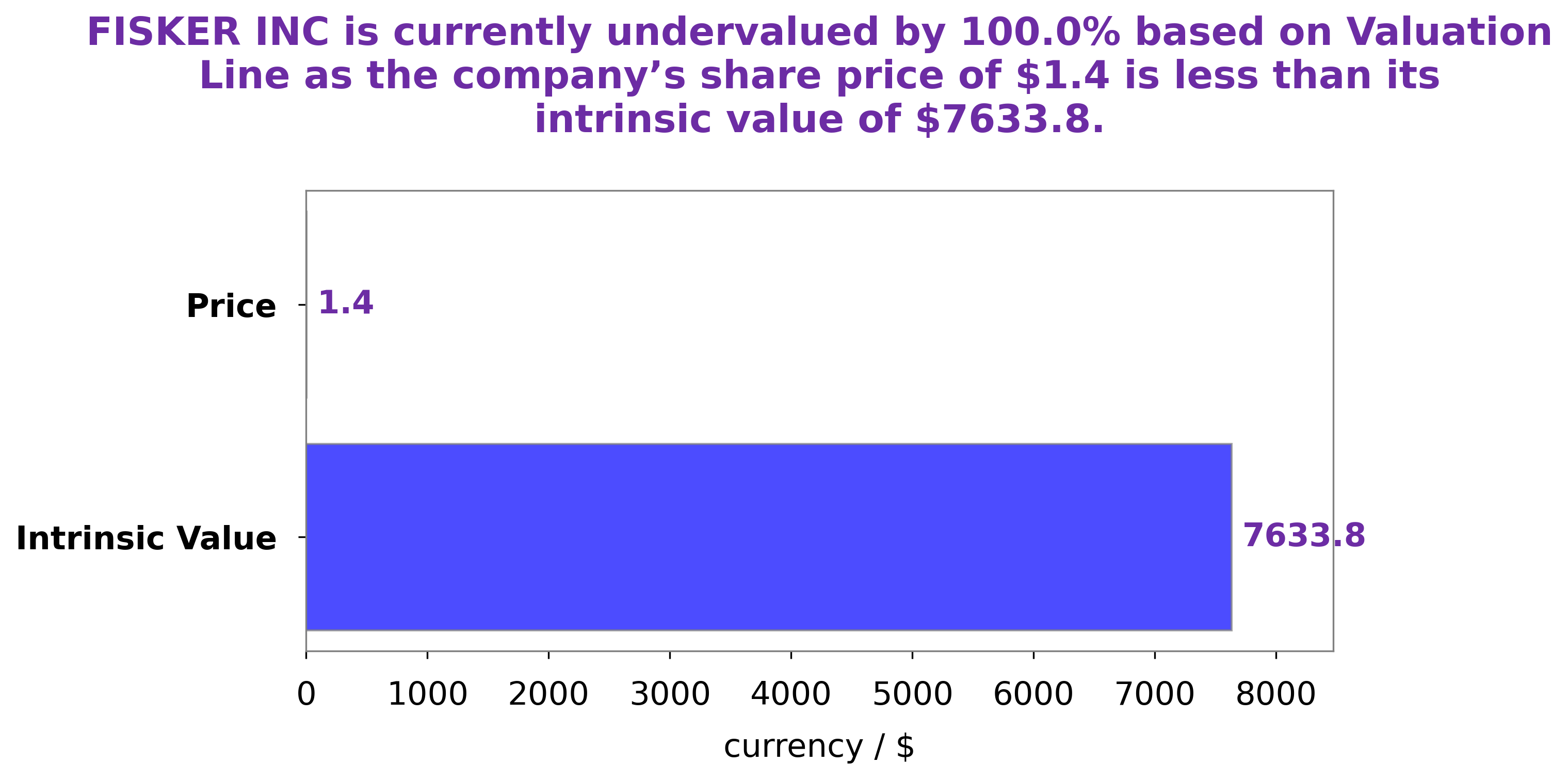

Analysis – Fisker Inc Stock Intrinsic Value

At GoodWhale, we have conducted an evaluation of FISKER INC‘s fundamentals. After assessing various factors such as profitability, asset base, liquidity and capital structure, we have determined the fair value of FISKER INC share to be around $7971.9. This value was determined using our proprietary Valuation Line. At present, FISKER INC stock is traded at $1.6, which is significantly lower than its fair value and represents an undervaluation by 100.0%. More…

Peers

The competition in the electric vehicle market is heating up, with new entrants Tesla, Lordstown Motors Corp, and Canoo Inc all vying for a piece of the pie. Fisker Inc, an early pioneer in the space, is no stranger to competition, but it remains to be seen if they can hold onto their market share.

– Tesla Inc ($NASDAQ:TSLA)

Tesla, Inc. is an American multinational corporation that specializes in electric vehicles, energy storage, and solar panel manufacturing. Based in Palo Alto, California, Tesla’s mission is to accelerate the world’s transition to sustainable energy. Tesla’s market cap as of 2022 is 687.33B and its ROE is 27.88%. The company’s products include electric cars, batteries, solar panels, and home energy systems.

– Lordstown Motors Corp ($NASDAQ:RIDE)

Founded in 1954, Lordstown Motors Corporation is an American electric vehicle manufacturer. The company’s flagship product is the Endurance, an all-electric pickup truck. Lordstown Motors is headquartered in Lordstown, Ohio, and has a production facility in Mexico.

As of 2022, Lordstown Motors Corporation has a market cap of 369.92 million and a return on equity of -63.07%. The company’s flagship product, the Endurance, is an all-electric pickup truck that is manufactured in Mexico. Lordstown Motors is working to establish itself as a leader in the electric vehicle market, and its market cap and return on equity reflect this goal.

– Canoo Inc ($NASDAQ:GOEV)

Canoo Inc. is a publicly traded company with a market capitalization of 409.99 million as of 2022. The company has a return on equity of -258.12%. Canoo Inc. is a designer and manufacturer of electric vehicles. The company was founded in 2015 and is headquartered in Los Angeles, California.

Summary

Fisker Inc, a leading electric vehicle company, has made significant investments in improving their service capabilities. In response to customer feedback, Fisker has focused on expanding customer service, developing more efficient repair processes, and providing more comprehensive vehicle maintenance options. Additionally, they have invested in advanced technology to create better diagnostics and remote vehicle monitoring capabilities. These improvements are expected to improve customer satisfaction and help Fisker maintain its position as a leader in the electric vehicle industry.

Recent Posts