Faraday Future Intelligent Electric [FFIE] Sees Price Target Cut by The Benchmark Company

April 27, 2023

Trending News ☀️

The Benchmark Company has recently reduced their price target for Faraday Future Intelligent ($NASDAQ:FFIE) Electric Inc. (NASDAQ: FFIE), which closed the 04/21/23 trading session at $0.22. The Benchmark Company’s decision to reduce their price target for Faraday Future Intelligent Electric Inc. was based on a number of factors, including increased competition in the electric vehicle market and uncertainty over the company’s financial position. The Benchmark Company believes that the company’s current financials are not strong enough to justify their previous price target assessment, which could put additional downward pressure on FFIE stock prices.

Given the increasing competition in the electric vehicle market and the uncertain financial outlook, investors may find that the risk of investing in FFIE stock is too great. It is important for investors to weigh the potential rewards of investing in FFIE against the risks before making any decisions.

Stock Price

FFIE opened the day at $0.2 and closed the day’s trading session at $0.2, marking a decrease of 1.8% from its previous closing price of 0.2. This news is a setback for the electric car company, which had seen much success following its IPO back in February. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FFIE. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -552.07 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FFIE. More…

| Operations | Investing | Financing |

| -383.06 | -123.22 | -6.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FFIE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 510.29 | 327.54 | 0.31 |

Key Ratios Snapshot

Some of the financial key ratios for FFIE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -143.8% | -66.2% |

Analysis

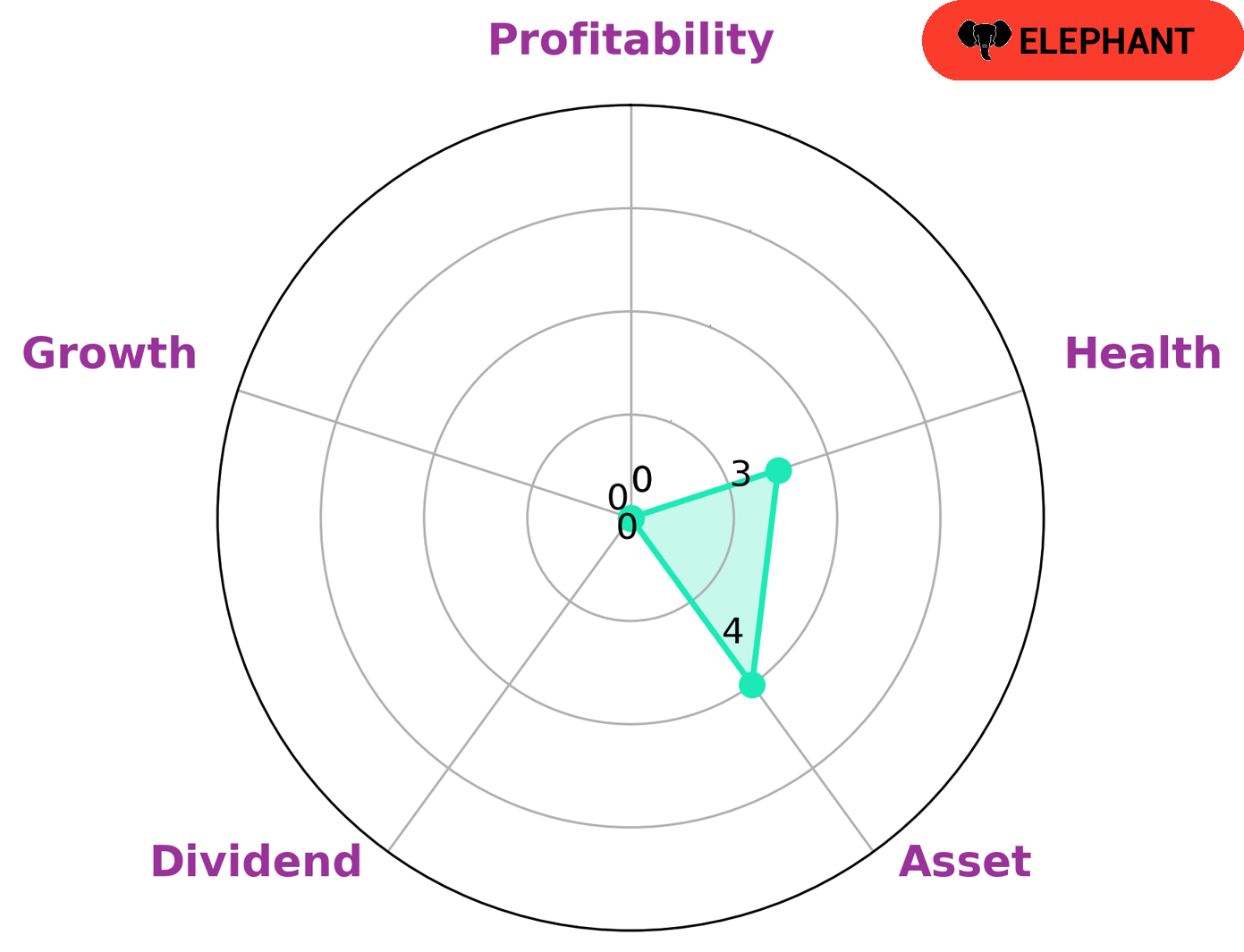

As an analyst at GoodWhale, I have conducted an analysis of Faraday Future Intelligent Electric’s financials. Based on the Star Chart classification of ‘elephant’, it is clear that Faraday Future is a company rich in assets after deducting off liabilities. Given Faraday Future’s low health score of 3/10 with regard to its cashflows and debt, investors who are looking for a stable long-term investment are likely to be hesitant to invest in this company. Furthermore, Faraday Future is strong in market, medium in asset and weak in dividend, growth and profitability, which also serves to discourage certain types of investors. On the other hand, those looking for more unique opportunities, such as venture capitalists or specialised private equity firms, may still find Faraday Future to be an attractive investment prospect. With their expertise and resources, such investors may be able to identify potential areas for growth and profitability within Faraday Future. More…

Peers

The competition in the electric vehicle market is heating up as companies jockey for position. Faraday Future, BAIC BluePark New Energy Technology Co Ltd, SAIC Motor Corp Ltd, and Arrival are all vying for a share of the market. Each company has its own strengths and weaknesses, and it will be interesting to see how the competition plays out.

– BAIC BluePark New Energy Technology Co Ltd ($SHSE:600733)

BAIC BluePark New Energy Technology Co Ltd is a Chinese state-owned enterprise and one of the largest automakers in China. The company has a market cap of 25.81B as of 2022 and a Return on Equity of -31.42%. BAIC BluePark New Energy Technology Co Ltd manufactures and sells electric vehicles and batteries. The company also provides vehicle financing, leasing, and fleet management services.

– SAIC Motor Corp Ltd ($SHSE:600104)

SAIC Motor Corp Ltd is a Chinese multinational automotive manufacturing company headquartered in Shanghai, China, with over 80,000 employees. The company sells passenger cars, trucks, buses and coaches under the SAIC, MG, Roewe and Maxus brands. In 2016, SAIC Motor had the largest sales volume of any Chinese automaker and the seventh largest sales volume worldwide.

The company has a market cap of 164.04B as of 2022 and a ROE of 7.19%. SAIC Motor is one of the leading automakers in China and is quickly expanding its reach globally. The company is committed to innovation and providing quality products and services to its customers.

– Arrival ($NASDAQ:ARVL)

Arrival is a technology company that designs and manufactures electric vehicles. The company has a market cap of $485.12 million and a return on equity of -6.58%. Arrival was founded in 2015 and is headquartered in London, United Kingdom.

Summary

This could be attributed to the company’s weak market performance, which saw its stock close at $0.22 in trading on 04/21/23. Investors should take caution when considering FFIE as an investment, as the company’s stock has been highly volatile over the past year. Analysts are also concerned about FFIE’s low liquidity and lack of profitability, which could lead to further declines in the stock’s value. Despite the negative sentiment surrounding FFIE’s stock, long-term investors may still find value if FFIE can turn its financials around and deliver sustained growth.

Recent Posts