Aviva PLC Increases Lucid Group Holdings by 40.1% in Q4

June 1, 2023

🌥️Trending News

Lucid Group ($NASDAQ:LCID), Inc. is a rapidly growing healthcare marketing and communications agency based in the United Kingdom. They provide a range of services to pharmaceutical companies such as advertising, medical writing, digital solutions, market access, and market research. The company has also been expanding into international markets in recent years with offices in the United States, Canada, and Europe. Aviva PLC has taken notice of the growth of Lucid Group and recently increased their share of the company by 40.1% reported in a filing with the Securities and Exchange Commission. This marks a major investment in the company and is a sign of confidence in its future prospects.

The new investment from Aviva PLC is likely to bring further growth opportunities to Lucid Group as well as provide additional funds for expansion into new markets. This could mean even more success for the company and increased profits for shareholders. It also serves as an endorsement of Lucid Group’s innovative approach to healthcare marketing and communications.

Analysis

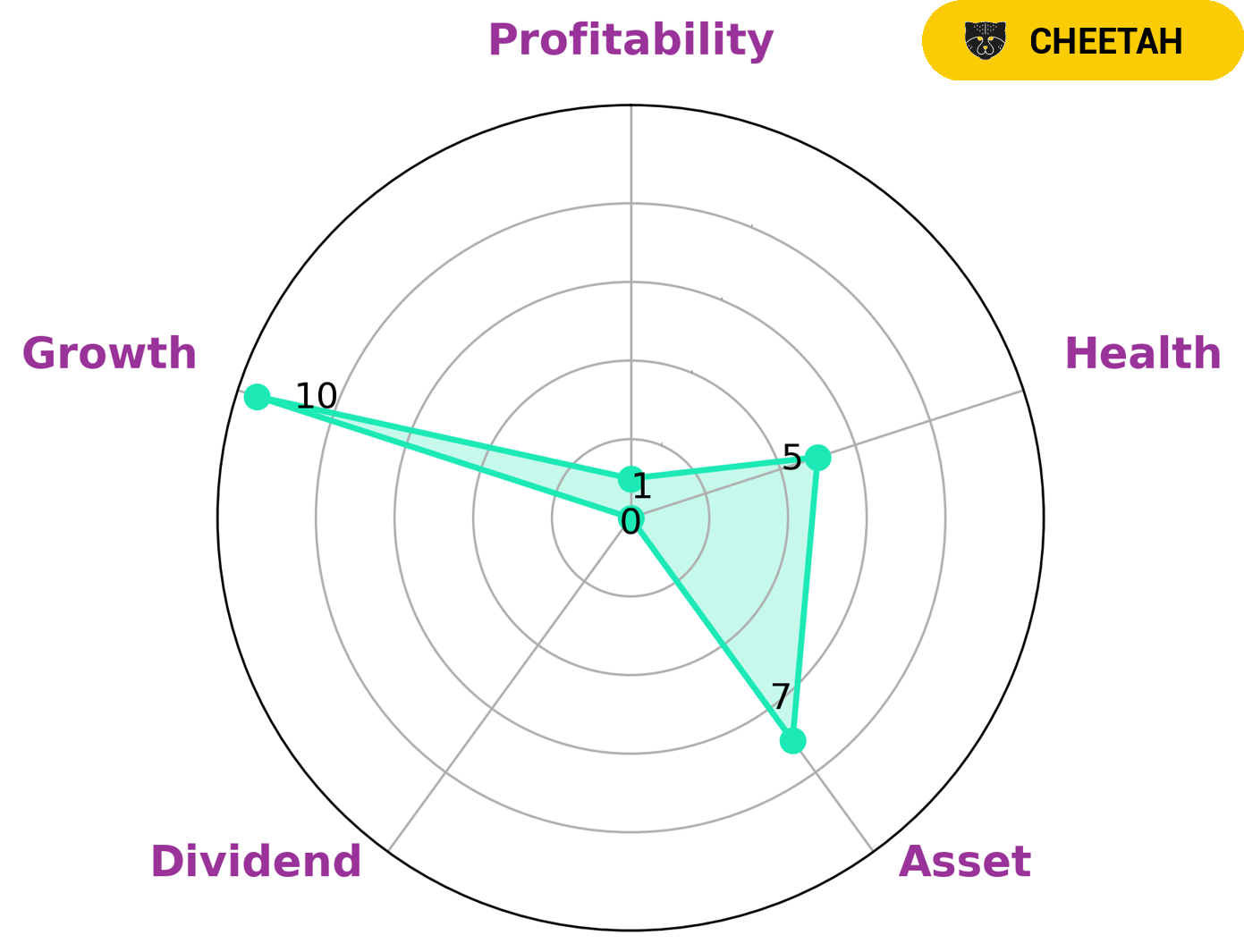

At GoodWhale, we recently conducted an analysis to measure the wellbeing of LUCID GROUP. Based on our Star Chart, we found that LUCID GROUP is strong in asset and growth, yet weak in dividend and profitability. Upon further examination, we determined that LUCID GROUP has an intermediate health score of 5/10 with regard to its cashflows and debt, indicating that it may be able to pay off debt and fund future operations. After evaluating the company’s performance, we classified LUCID GROUP as a ‘cheetah’, meaning that it achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the company’s profile, we can conclude that investors who are looking for a high-growth, yet less-stable investment may be particularly interested in LUCID GROUP. However, we also advise potential investors to conduct further research and make an informed decision before investing. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lucid Group. More…

| Total Revenues | Net Income | Net Margin |

| 699.94 | -2k | -343.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lucid Group. More…

| Operations | Investing | Financing |

| -2.53k | -3.53k | 1.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lucid Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.26k | 3.63k | 1.98 |

Key Ratios Snapshot

Some of the financial key ratios for Lucid Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 409.8% | – | -281.8% |

| FCF Margin | ROE | ROA |

| -523.5% | -30.9% | -17.0% |

Peers

Lucid Group Inc is an American automotive company founded in 2007 by Bernard Tse and Sam Weng. The company’s first car, the Lucid Air, was unveiled in December 2016. Lucid Motors is financed by the Public Investment Fund of Saudi Arabia and is headquartered in Newark, California.

Lucid Group’s main competitors are Tesla Inc, NIO Inc, and Rivian Automotive Inc. Tesla Inc is an American electric vehicle and clean energy company based in Palo Alto, California. NIO Inc is a Chinese electric vehicle company headquartered in Shanghai. Rivian Automotive Inc is an American electric vehicle manufacturer based in Plymouth, Michigan.

– Tesla Inc ($NASDAQ:TSLA)

Tesla, Inc. is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla’s market cap as of 2022 is 689.96B with a ROE of 27.88%. The company specializes in electric vehicle manufacturing, battery energy storage from home to grid scale, solar panel manufacturing, solar roof tiles, and related products and services.

– NIO Inc ($SEHK:09866)

NIO Inc is a Chinese electric vehicle and technology company headquartered in Shanghai. The company was founded in 2014 by William Li. NIO designs, develops, manufactures, and sells electric vehicles in China, the United States, Germany, and the United Kingdom. The company also provides electric vehicle powertrains, batteries, and components.

NIO Inc has a market cap of 154.77B as of 2022. The company has a Return on Equity of -13.53%. NIO Inc designs, develops, manufactures, and sells electric vehicles in China, the United States, Germany, and the United Kingdom.

– Rivian Automotive Inc ($NASDAQ:RIVN)

Rivian Automotive Inc is an American electric vehicle manufacturer. Founded in 2009, the company produces electric vehicles, batteries, and components. Rivian’s market cap is 28.86B as of 2022 and its ROE is -23.66%. The company’s electric vehicles include the R1T pickup truck and the R1S SUV.

Summary

Aviva PLC has increased its holdings in Lucid Group, Inc. by 40.1%. This is a positive sign for Lucid Group investors, as a large institutional investor is showing confidence in the company. Analysts suggest that this move may indicate the company’s strong financial position, as well as potential for future growth. Investors should further investigate potential opportunities that may arise from Aviva PLC’s increased holdings, as well as any other related investments in the near future.

Recent Posts