Ark Invest Predicts Tesla’s Cybertruck Could Reach Model Y Popularity

May 31, 2023

☀️Trending News

It is one of the most successful electric vehicle companies in the world, and has been at the forefront of the electric vehicle revolution. The truck has been praised for its high performance capabilities, along with its range of features such as bulletproof windows, and air suspension. Ark Invest believes that the Cybertruck will prove to be a great success for Tesla ($NASDAQ:TSLA), and could even surpass the popularity of their Model Y SUV, which has become one of the company’s most successful vehicles. As Tesla continues to make strides with their revolutionary vehicle offerings, this prediction could prove to be accurate.

Price History

On Tuesday, Tesla stock opened at $200.1 and closed at $201.2, up by 4.1% from last closing price of 193.2. This surge in stock prices was likely due to the recent prediction by Ark Invest that the Cybertruck could reach popularity levels similar to Tesla’s popular Model Y. Ark Invest, an investment firm specializing in disruptive innovation, believes that the Cybertruck’s unique design and features have the potential to make it a popular choice among Tesla fans. They are confident that the Cybertruck will follow the same trajectory as the Model Y, which has become one of the most popular electric vehicles ever. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tesla. More…

| Total Revenues | Net Income | Net Margin |

| 86.03k | 11.78k | 13.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tesla. More…

| Operations | Investing | Financing |

| 13.24k | -12.29k | -1.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tesla. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 86.83k | 37.6k | 15.16 |

Key Ratios Snapshot

Some of the financial key ratios for Tesla are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 49.0% | 148.4% | 15.2% |

| FCF Margin | ROE | ROA |

| 6.7% | 17.6% | 9.4% |

Analysis

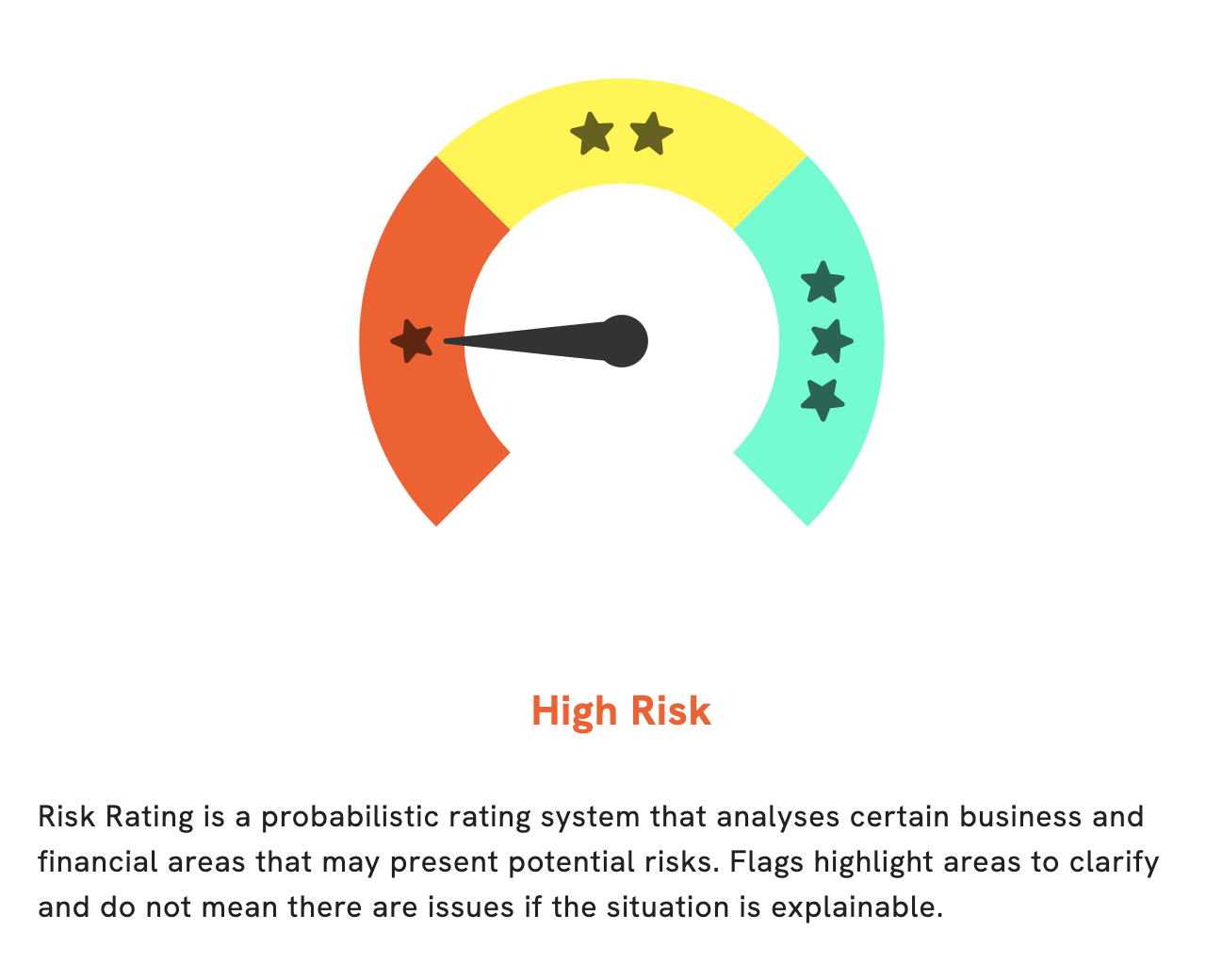

At GoodWhale, we have conducted a thorough analysis of TESLA’s fundamentals. After careful consideration, we have concluded that TESLA is a high risk investment when considering financial and business aspects. We have identified three risk warnings in the income sheet, balance sheet, and non-financial areas. To explore these further and learn more about our assessment, please become a registered user with GoodWhale. Teslas_Cybertruck_Could_Reach_Model_Y_Popularity”>More…

Peers

Tesla Inc is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla’s current products include electric cars, battery energy storage from home to grid scale, solar panels and solar roof tiles, and related products and services. Some of Tesla’s notable competitors in the electric vehicle space include NIO Inc, XPeng Inc, and Li Auto Inc.

– NIO Inc ($SEHK:09866)

NIO Inc. is a Chinese electric vehicle manufacturer headquartered in Shanghai. The company was founded in 2014 and has since become one of the leading EV manufacturers in China. NIO produces a range of electric vehicles, including the ES8 SUV, the ES6 SUV, and the EC6 sedan. The company also offers a range of services, including the NIO Power battery-swapping service and the NIO Pilot autonomous driving system. NIO Inc. has a market cap of 154.77B as of 2022 and a Return on Equity of -13.53%. The company is one of the leading EV manufacturers in China and offers a range of electric vehicles and services.

– XPeng Inc ($SEHK:09868)

As of 2022, YPeng Inc has a market capitalization of 54.52 billion dollars and a return on equity of -11.13%. YPeng Inc is a Chinese multinational conglomerate holding company headquartered in Beijing. The company was founded in 1988 and has since grown to become one of the largest companies in China. YPeng Inc is involved in a wide variety of businesses, including but not limited to: e-commerce, retail, transportation, logistics, and financial services.

– Li Auto Inc ($SEHK:02015)

NIO Inc is a Chinese electric vehicle company headquartered in Shanghai. The company was founded in 2014 and is listed on the New York Stock Exchange. NIO Inc designs, manufactures, and sells electric vehicles in China, the United States, and Europe. The company has a market cap of 140.12B as of 2022 and a return on equity of -0.27%.

Summary

Tesla Inc (TSLA) has seen its stock price increase following the announcement of their new Cybertruck. This electric pickup truck is expected to become as popular as the firm’s Model Y SUV, according to Ark Invest. In this context, investors are advised to consider the potential for the Cybertruck to contribute to the company’s revenue going forward. Analysts suggest paying attention to the company’s performance in the coming quarter, as well as its financial and operational metrics.

They also suggest looking closely at the potential risks associated with Tesla’s operations, such as the possibility of supply chain disruption or increasing competition. Ultimately, investors should remain mindful of the risks and opportunities associated with Tesla’s stock before making any decisions.

Recent Posts