TROW dividend – T. Rowe Price Group Inc Announces 1.22 Cash Dividend

March 23, 2023

Dividends Yield

On March 1 2023, T. Rowe Price ($NASDAQ:TROW) Group Inc announced a 1.22 cash dividend per share. This makes the company an attractive option for dividend stock investors, as it has issued an annual dividend per share of 4.8 USD for the past three years, yielding 3.81% in each of those years. With an average dividend yield of 3.81%, investors will be able to benefit from a stable dividend income stream.

The ex-dividend date for this dividend is March 14 2023. Therefore, investors who purchase the stock on or after this date will not be eligible to receive the dividend.

Share Price

The stock opened at $111.8 and closed at $111.1, down 1.0% from the previous closing price of 112.3. As one of the leading asset managers in the world, T. ROWE PRICE Group Inc is dedicated to providing long-term and reliable returns to its shareholders in addition to offering a wide range of quality investment products and services. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TROW. More…

| Total Revenues | Net Income | Net Margin |

| 6.49k | 1.52k | 30.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TROW. More…

| Operations | Investing | Financing |

| 2.36k | -41.5 | -2.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TROW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.64k | 1.96k | 39.41 |

Key Ratios Snapshot

Some of the financial key ratios for TROW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | 1.5% | 38.5% |

| FCF Margin | ROE | ROA |

| 32.7% | 17.6% | 13.4% |

Analysis

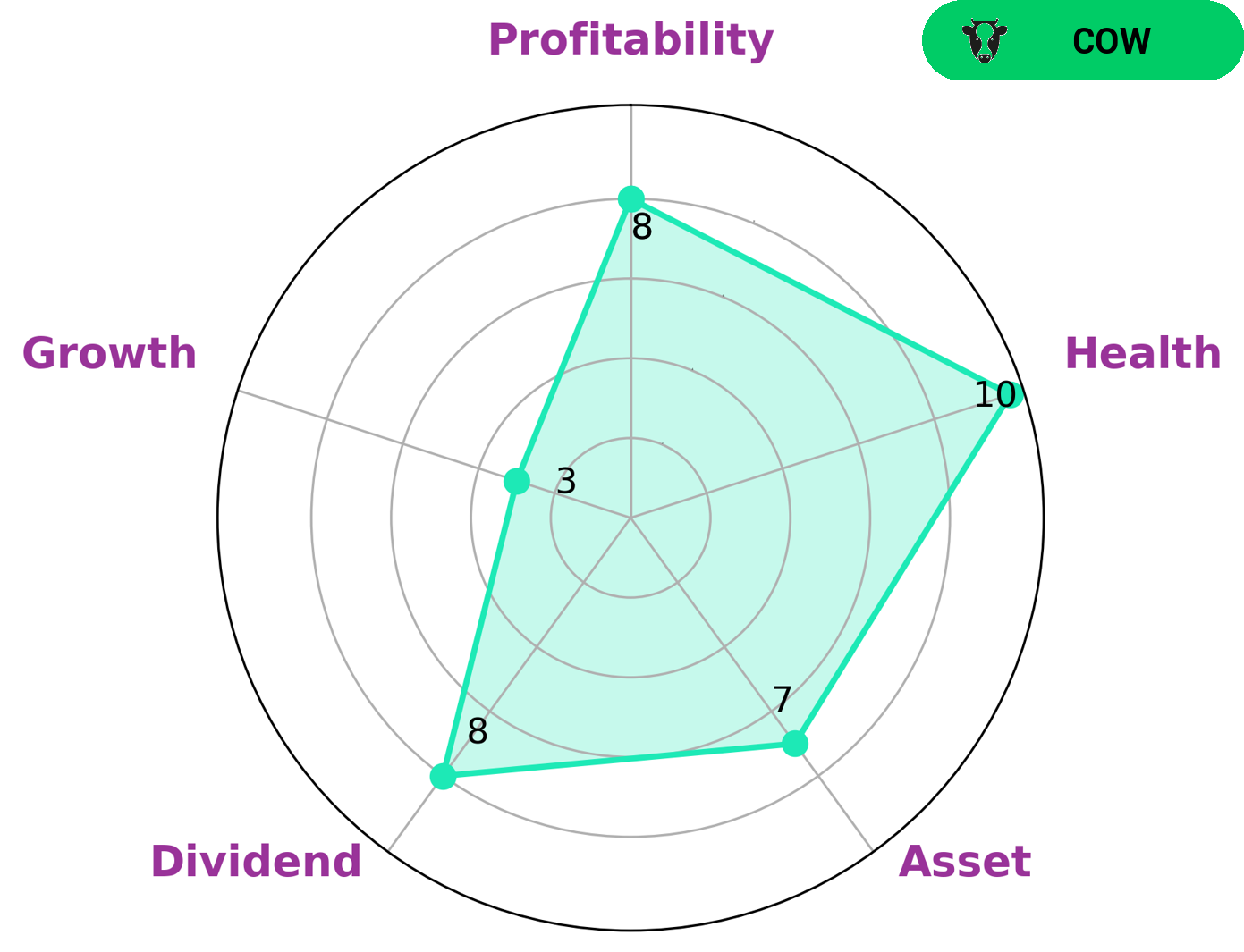

GoodWhale recently conducted an analysis of T. ROWE PRICE’s wellbeing. Based on the Star Chart, we have concluded that T. ROWE PRICE has a high health score of 10/10 considering its cashflows and debt, making it capable of sustaining its operations in times of crisis. We classified T. ROWE PRICE as a ‘cow’, a company with a track record of paying out consistent and sustainable dividends. Given its strengths in asset, dividend, and profitability, we believe that investors who are looking for steady and reliable dividends to supplement their income may be interested in T. ROWE PRICE. However, due to its weak growth prospects, investors who are looking for potential long-term capital gains may not find T. ROWE PRICE suitable for their investment strategies. More…

Peers

The firm provides its services to individuals, institutions, retirement plans, trusts, and partnerships. It launches and manages equity, fixed income, balanced, and commodity mutual funds. The company was founded in 1937 and is headquartered in Baltimore, Maryland. As of December 31, 2017, T. Rowe Price Group Inc had $934.2 billion in assets under management (AUM). Federated Hermes Inc, Franklin Resources Inc, and ABC arbitrage SA are all competitors of T. Rowe Price Group Inc. Federated Hermes Inc is a global investment manager that offers a range of investment products, including equities, fixed income, and alternatives. As of December 31, 2017, Federated Hermes Inc had $590.6 billion in AUM. Franklin Resources Inc is a global investment management company that provides investment management and related services to institutional and individual investors. As of June 30, 2018, Franklin Resources Inc had $737.2 billion in AUM. ABC arbitrage SA is a French asset management company that specializes in convertible bonds and global equity markets arbitrage. As of December 31, 2017, ABC arbitrage SA had €5.4 billion in assets under management.

– Federated Hermes Inc ($NYSE:FHI)

Federated Hermes Inc. is a publicly traded company with a market capitalization of $2.86 billion as of 2022. The company has a return on equity of 22.41%. Federated Hermes Inc. is a financial services company that provides asset management and related services to individuals, families, institutions, and businesses. The company offers a broad range of investment strategies and products, including equity, fixed income, and alternative investments.

– Franklin Resources Inc ($NYSE:BEN)

Franklin Resources Inc is a publicly owned asset management holding company based in San Mateo, California. The company, through its subsidiaries, manages mutual funds and other investment portfolios. It also provides investment management and advisory services to institutional clients. As of December 31, 2020, Franklin Resources Inc had $744.2 billion in assets under management.

The company’s market cap is 11.69B as of 2022. The company has a return on equity of 12.45%. The company’s primary business is managing mutual funds and other investment portfolios. The company also provides investment management and advisory services to institutional clients.

– ABC arbitrage SA ($LTS:0OPJ)

ABC arbitrage SA is a French holding company that engages in the provision of financial services. The company operates through the following segments: Asset Management, Corporate Finance, and Market Making. The Asset Management segment offers investment products and services to individuals, professionals, and institutional clients. The Corporate Finance segment provides financing and advisory services to companies. The Market Making segment deals with market making activities in listed securities. ABC arbitrage SA was founded in 1991 and is headquartered in Paris, France.

Summary

T. ROWE PRICE is an attractive option for dividend stock investors, with a steady and consistent annual dividend per share of 4.8 USD over the past three years, yielding an average of 3.81%. Its reliability and stability make it a safe bet for investors looking to maximize their returns with dividend stocks. It should be noted, however, that T. ROWE PRICE’s dividend yield may not be the highest compared to other stocks in the market, and investors should consider other factors such as the company’s financial health and performance when deciding whether to invest.

Recent Posts