Strong Market Performance Boosts AllianceBernstein AUM by 2% in March

April 13, 2023

Trending News ☀️

ALLIANCEBERNSTEIN ($NYSE:AB): In March, AllianceBernstein experienced an increase of 2% in its Assets Under Management (AUM). The strong market performance boosted the company’s AUM, allowing for continued growth and expansion. This rise in assets was a positive development for AllianceBernstein, especially considering that their assets had dipped slightly earlier in the year due to difficult market conditions. The company is continuing to focus on delivering tailored investment solutions to its clients.

With the increase in AUM, AllianceBernstein is well-positioned to continue providing top-tier solutions going forward. They are also positioned to benefit from the strength of the markets, which bodes well for continued success.

Market Price

AllianceBernstein Holding L.P, commonly known as AB, had a strong market performance in March, boosting their assets under management (AUM) by 2%. On Wednesday, AB stock opened at $35.8 and closed at $34.2, a 3.7% drop from its closing price of 35.5 the day before. Despite the slight drop, AB’s overall AUM growth was largely driven by a strong performance of its funds and products, with a ten percent rise in equity assets and a five percent rise in fixed income assets. Moreover, the company’s positive market performance and increased asset base allows it to continue to provide innovative products and services to its clients. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AB. More…

| Total Revenues | Net Income | Net Margin |

| 305.5 | 274.17 | 89.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AB. More…

| Operations | Investing | Financing |

| 362.61 | -1.77 | -360.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AB. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.07k | 1.62 | 18.22 |

Key Ratios Snapshot

Some of the financial key ratios for AB are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | – | – |

| FCF Margin | ROE | ROA |

| 118.7% | 10.5% | 9.2% |

Analysis

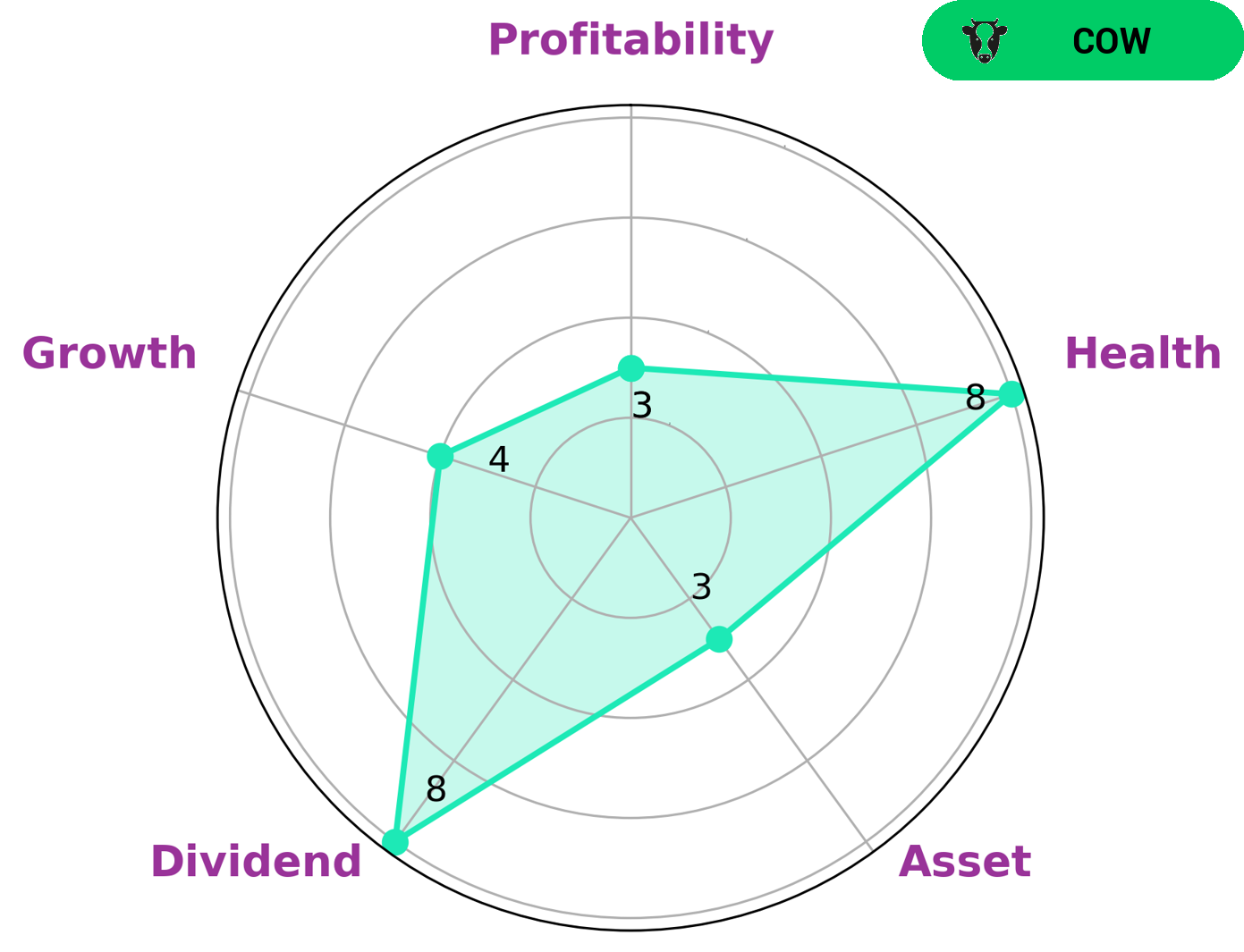

GoodWhale conducted an analysis of ALLIANCEBERNSTEIN HOLDING L.P.’s wellbeing and found it to be classified as a ‘cow’ type of company. This means that we concluded that they have the track record of paying out consistent and sustainable dividends. Investors interested in such a company are likely looking for steady returns and a steady income, as well as some growth potential. When we look at the Star Chart, ALLIANCEBERNSTEIN HOLDING L.P is strong in dividend, medium in growth and weak in asset, profitability. However, the good news is that despite this, its health score is an 8/10 due to its strong cashflows and debt. This score implies that the company is capable of safely riding out any crisis without the risk of bankruptcy. More…

Peers

The company competes with WisdomTree Investments Inc, Ashmore Group PLC, and Onex Corporation. All four companies offer a wide range of investment products and services.

– WisdomTree Investments Inc ($NASDAQ:WETF)

Ashmore Group PLC is a United Kingdom-based investment management company. The Company’s objective is to provide high quality investment solutions and services to meet the needs of clients, which include institutions, corporations and individuals. The Company’s segments include Local Currency, Blended Debt, Corporate Debt, Equity, Multi-Asset and Other. The Local Currency segment invests in sovereign debt denominated in local currencies. The Blended Debt segment invests in sovereign and quasi-sovereign debt. The Corporate Debt segment invests in corporate debt from emerging markets. The Equity segment invests in stocks of companies in emerging markets. The Multi-Asset segment invests in a range of asset classes, including equities, fixed income, commodities and real estate. The Other segment includes the Company’s cash and cash equivalents.

– Ashmore Group PLC ($LSE:ASHM)

Onex Corporation is a private equity and investment management firm with a market cap of 5.84B as of 2022. The company has a Return on Equity of 5.95%. Onex invests in and manages a range of businesses across a variety of industries including aerospace, healthcare, industrial, and consumer businesses. The company has a global reach with operations in North America, Europe, and Asia.

Summary

AllianceBernstein Holding L.P. recently reported a 2% gain in its assets under management for the month of March, which is attributed to the overall market strength. Despite this, the company’s stock price dropped on the same day. This could be due to investors taking profits from the stock, or expectations that AllianceBernstein’s gains may not be sustainable in the future. Investors can track the company’s stock performance over time to determine whether their investment thesis is still valid.

Additionally, they should research AllianceBernstein’s other products and services to ensure they are properly diversified with their holdings.

Recent Posts