Sparx Group dividend – SPARX Group Co Ltd Declares 60.0 Cash Dividend

March 23, 2023

Dividends Yield

SPARX Group Co Ltd has recently announced its dividend plans for the upcoming fiscal year. On March 1 2023, the company declared a cash dividend of 60.0 JPY per share. For investors looking for dividend stocks, SPARX GROUP ($TSE:8739) is worth considering. The company has maintained a consistent dividend payout over the past three years with annual dividends of 60.0, 60.0, and 55.0 JPY per share. This translates to an average dividend yield of 4.83%.

This yield is higher than the industry average and likely to remain so given the company’s prospects and current valuation. The ex-dividend date for SPARX GROUP is March 30 2023, meaning all shareholders who are eligible to receive the dividend will need to purchase shares before that date in order to receive the dividend payment. All in all, SPARX GROUP is an attractive dividend stock option for investors looking for both current income and long-term capital gains.

Stock Price

Despite the announcement, the stock opened at JP¥1581.0 and closed at JP¥1585.0, a decrease of 0.8% from its previous closing price of 1598.0. This news shows that investors are not as confident in the dividend announcement as they might have been. It remains to be seen if the stock value will further decrease or if this was merely a temporary blip in the market for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sparx Group. More…

| Total Revenues | Net Income | Net Margin |

| 13.42k | 3.51k | 26.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sparx Group. More…

| Operations | Investing | Financing |

| 3.98k | -1.18k | -2.48k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sparx Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.62k | 13.02k | 617.14 |

Key Ratios Snapshot

Some of the financial key ratios for Sparx Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.9% | 8.7% | 42.5% |

| FCF Margin | ROE | ROA |

| 29.6% | 14.7% | 9.5% |

Analysis

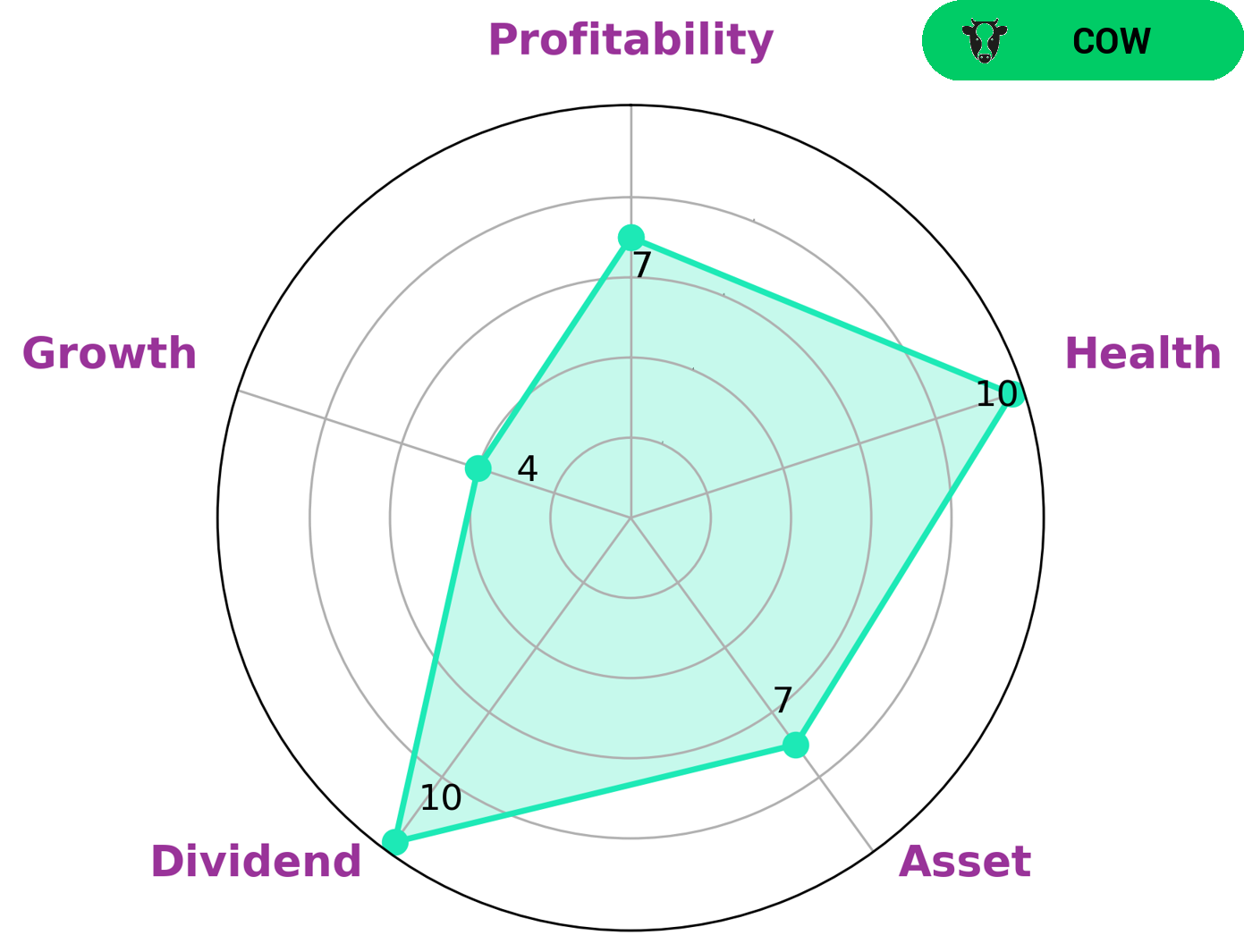

GoodWhale conducted an analysis of the fundamentals of the SPARX GROUP, and based on our Star Chart, we concluded that the company has a high health score of 10/10 with regard to its cashflows and debt, which suggests that it is capable of paying off debt and funding future operations. We have also classified SPARX GROUP as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. Given these strong fundamentals and the attractive dividend yield, we believe that investors who are looking for steady income or those seeking long-term capital appreciation will be interested in investing in SPARX GROUP. This is reinforced by its strong performance across asset, dividend, profitability and medium growth metrics. More…

Peers

The competition between SPARX Group Co Ltd and its competitors, Anima Holding SpA, Diamond Hill Investment Group Inc, and Brookfield Asset Management Ltd, is fierce. All companies are striving to stay ahead of the competition and maintain their competitive edge in the market. With a variety of strategies and tactics, each company is working to gain an advantage in the competition.

– Anima Holding SpA ($BER:124)

Anima Holding SpA is an Italian-based company that specializes in asset management and private equity. As of 2023, the company has a market cap of 1.26 billion and a Return on Equity (ROE) of 10.83%. The market cap of Anima reflects its strong financial performance and ability to generate returns for its shareholders. The 10.83% ROE is an indication of the company’s ability to maximize returns from its investments and operations. Anima has continued to demonstrate its ability to grow its business over the years despite challenging economic conditions, making it a leader in the asset management and private equity space.

– Diamond Hill Investment Group Inc ($NASDAQ:DHIL)

Diamond Hill Investment Group Inc is a publicly traded company that provides investment management services to institutional and individual clients. The company’s market cap as of 2023 is 561.49M, which is a reflection of the company’s solid financial performance. The company has an impressive Return on Equity (ROE) of 26.64%, which is higher than the industry average and indicates that the management team is doing a good job of utilizing the capital they have access to. This strong ROE indicates that the company is generating strong returns from its investments and is an attractive investment opportunity.

Summary

The SPARX Group is an attractive investment for those seeking to benefit from dividend stocks. Over the past three years, the annual per-share dividend has been consistently around 60 JPY (4.14%-6.21%) which translates to an average dividend yield of 4.83%. This makes the SPARX Group a reliable source of income for investors looking to benefit from consistent returns. For those interested in investing in the SPARX Group, analysis of current market trends and the company’s performance history are recommended to ensure a successful outcome.

Recent Posts