SEI INVESTMENTS Reports Fourth Quarter FY2022 Earnings Results on December 31 2022

February 5, 2023

Earnings report

On December 31 2022, SEI INVESTMENTS ($NASDAQ:SEIC), a leading provider of innovative investment, technology, and administration solutions, reported their earnings results for the fourth quarter of the FY2022 year, which ended on January 25 2023. The company’s total revenue for the quarter amounted to USD 112.2 million, a decrease of 22.8% when compared to the same period of the previous year. Net income for the quarter was USD 456.6 million, representing a year-over-year decrease of 9.0%. SEI INVESTMENTS is a publicly-traded company that provides investment services and solutions to institutions, financial advisors, and individual investors. It has offices throughout the United States, Europe, and Asia. The company’s fourth quarter results show a decrease in both revenues and net income year-over-year. This is due mainly to lower average assets under management and lower average fee rates on assets under management. SEI INVESTMENTS also experienced higher operating expenses as a result of increased investments in technology and infrastructure.

This decrease was mainly due to market volatility caused by the coronavirus pandemic. Despite the decrease in assets under management, SEI INVESTMENTS managed to maintain its market share in the institutional asset management industry. In order to improve their overall performance, SEI INVESTMENTS has focused on increasing efficiency and reducing costs. The company has also invested heavily in digital transformation initiatives in order to better meet the needs of their clients. SEI INVESTMENTS is confident that these strategies will help them achieve better results in the future. Overall, SEI INVESTMENTS reported mixed results for their fourth quarter of FY2022. Despite challenging market conditions, the company managed to keep their total assets under management steady and increase their efficiency, which will help them continue to grow in the future.

Market Price

The company’s stock opened at $61.8 and closed at $63.0, up 0.8% from the last closing price of $62.6. The company has managed to generate strong returns in the fourth quarter despite the pandemic and economic uncertainty. This was attributed to their focus on technology-enabled solutions to help clients manage assets and investments effectively. The company is expected to benefit further as the economy recovers in the coming quarters. With its strong financial performance, SEI Investments is well positioned to take advantage of any positive market conditions and further expand its asset base.

The company is also looking to increase its product offering and expand into new markets, which will help it grow its customer base and revenue. Overall, SEI Investments has reported strong fourth quarter FY2022 earnings results, showing the company’s resilience in the face of pandemic-related uncertainties. With its strong financial performance and focus on technology-enabled solutions, the company is expected to benefit further as the economy recovers in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sei Investments. More…

| Total Revenues | Net Income | Net Margin |

| 1.99k | 475.47 | 24.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sei Investments. More…

| Operations | Investing | Financing |

| 577.74 | -164.88 | -422.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sei Investments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.38k | 429.73 | 14.32 |

Key Ratios Snapshot

Some of the financial key ratios for Sei Investments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.5% | 1.1% | 30.6% |

| FCF Margin | ROE | ROA |

| 25.6% | 19.6% | 16.0% |

Analysis

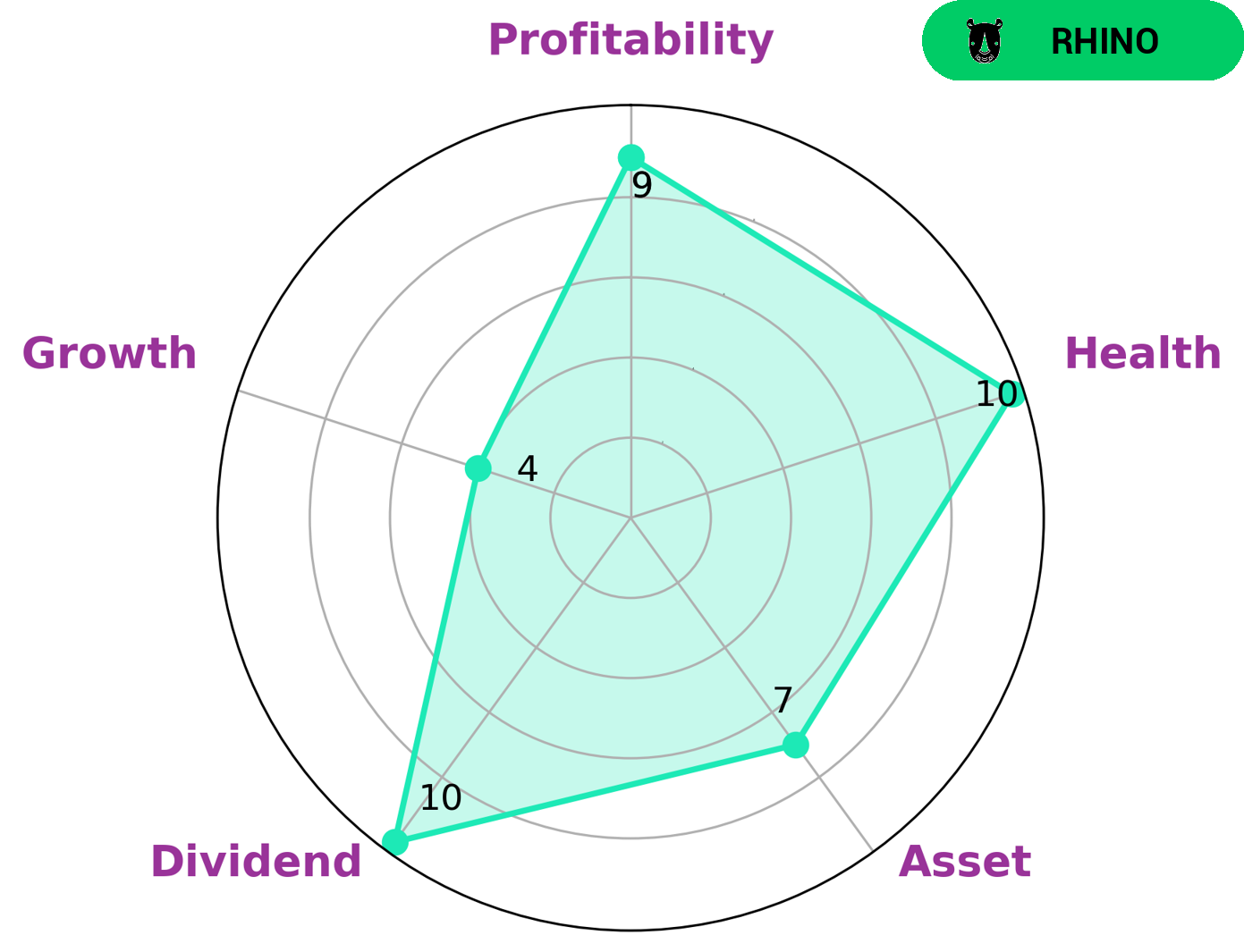

GoodWhale’s analysis of SEI INVESTMENTS shows that the company has a high health score of 10/10, indicating its ability to pay off debt and fund future operations. SEI INVESTMENTS is classified as a “rhino”, which is a type of company that has achieved moderate revenue or earnings growth. SEI INVESTMENTS is strong in assets, dividends, and profitability, and medium in growth, making it an attractive investment opportunity for investors. Investors who are interested in companies with solid financials and a long-term growth potential should consider SEI INVESTMENTS. The company has a high health score, indicating it is capable of paying off debt and funding future operations. Moreover, SEI INVESTMENTS is classified as a “rhino”, providing investors with moderate revenue growth and earnings potential. SEI INVESTMENTS has strong assets, dividends, and profitability. This makes it a great option for investors who are looking for an established company with a strong foundation and potential for future growth. Additionally, the company has medium growth, which allows investors to purchase stock at a low price and benefit from potential future growth. Overall, SEI INVESTMENTS is an attractive investment opportunity for investors who are looking for a company with solid financials and long-term growth potential. GoodWhale’s analysis shows that the company has a high health score and is classified as a “rhino”. It also has strong assets, dividends, and profitability, and medium growth, making it an attractive option for investors. More…

Peers

The company’s clients include financial institutions, corporations, and high-net-worth individuals. SEI Investments Co. operates in three segments: Investment Management, Investment Processing, and Investment Operations. SEI Investments Co. competes with Vontobel Holding AG, Ninety One PLC, and CI Financial Corp. These companies also provide investment management, investment processing, and investment operations solutions to their clients.

– Vontobel Holding AG ($OTCPK:VONHF)

As of 2022, Vontobel Holding AG has a market cap of 3.11B. The company is a financial services provider that offers a range of services, including asset management, private banking, and investment banking.

– Ninety One PLC ($LSE:N91)

Ninety One PLC is a publicly traded company with a market capitalization of 1.63 billion as of 2022. The company has a Return on Equity of 66.37%. Ninety One PLC is engaged in the business of providing investment management services. The company offers a range of services including asset management, investment advisory, and private wealth management.

– CI Financial Corp ($TSX:CIX)

CI Financial Corp is a wealth management company headquartered in Toronto, Canada. As of 2021, it had $208 billion in assets under management and administration, and over 2,000 employees. The company offers a range of financial services and products, including asset management, investment banking, insurance, and mortgages.

Summary

SEI Investments reported their earnings results for the fourth quarter of FY2022, showing a decrease in total revenue and net income when compared to the same period of the previous year. The total revenue for the quarter amounted to USD 112.2 million, down 22.8% from the corresponding period of the previous year. Net income for the quarter was USD 456.6 million, a decrease of 9.0% from the same period of the previous year. Investing analysts are likely to take a closer look at SEI Investments’ quarterly performance and try to identify what factors may have contributed to their decreased revenue and net income. Analysts may consider factors such as changes in the macroeconomic environment, shifts in industry dynamics, or changes in SEI’s competitive landscape.

Additionally, analysts will be looking at the company’s balance sheet and cash flow statements to understand how SEI managed their expenses and deployed capital. Given SEI’s decreased performance in the fourth quarter of FY2022, analysts will be closely monitoring the company’s performance in the current fiscal year and evaluating its ability to improve its financial results. They will also be looking for any signs of a potential turnaround in the company’s operations and prospects for growth in future periods.

Recent Posts