Raymond James Financial Services Advisors Invests in Sixth Street Specialty Lending, on NYSE

January 18, 2023

Trending News 🌥️

Raymond James Financial Services Advisors Inc. has recently invested in Sixth Street Specialty ($NYSE:TSLX) Lending, Inc., which is listed on the New York Stock Exchange (NYSE). The company acquired 71041 shares of the specialty lending firm, a move that has generated a lot of buzz in the investment community. Sixth Street Specialty Lending, Inc. is an alternative asset management company that focuses on providing customized debt solutions to companies in the middle market. The company specializes in providing private debt financing to companies that have limited access to traditional debt markets. They offer a full range of services including syndicated credit facilities, mezzanine debt and equity capital, and advisory services. The firm has a team of experienced professionals with a deep knowledge of the market and an extensive network of contacts in the industry.

They are committed to providing customized solutions that meet the needs of their clients. Their goal is to provide their customers with the best possible financing solution for their unique situation. This move can help the company position itself as a leader in the industry, as well as increase its visibility in the financial markets. With this new capital injection, Sixth Street Specialty Lending, Inc. can continue to provide innovative solutions and create value for their clients.

Share Price

At the time of writing, media exposure for the company has been mostly positive. On Thursday, SIXTH STREET SPECIALTY LENDING stock opened at $18.9 and closed at $18.9, up by 0.8% from its prior closing price of 18.8. This indicates a positive trend in the stock market for the company and suggests that Raymond James’ investment has been a wise decision. Given the positive outlook of the stock market, Sixth Street Specialty Lending, Inc. has the potential to become a successful company in the future. The company is currently focusing on providing specialty lending services to small and medium-sized businesses, allowing them to access capital quickly and easily.

It is expected that the company will continue to receive positive media attention as it grows and expands its services in the coming years. As the company continues to gain recognition in the stock market, its stock prices are likely to increase further. Investors are optimistic that the investment in Sixth Street Specialty Lending, Inc. will be a profitable one in the long-term, as the company continues to make strides in the specialty lending sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TSLX. More…

| Total Revenues | Net Income | Net Margin |

| 123.26 | 103.61 | 89.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TSLX. More…

| Operations | Investing | Financing |

| -352.28 | – | 364.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TSLX. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.86k | 1.53k | 16.36 |

Key Ratios Snapshot

Some of the financial key ratios for TSLX are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.7% | – | – |

| FCF Margin | ROE | ROA |

| -285.8% | 5.1% | 2.3% |

VI Analysis

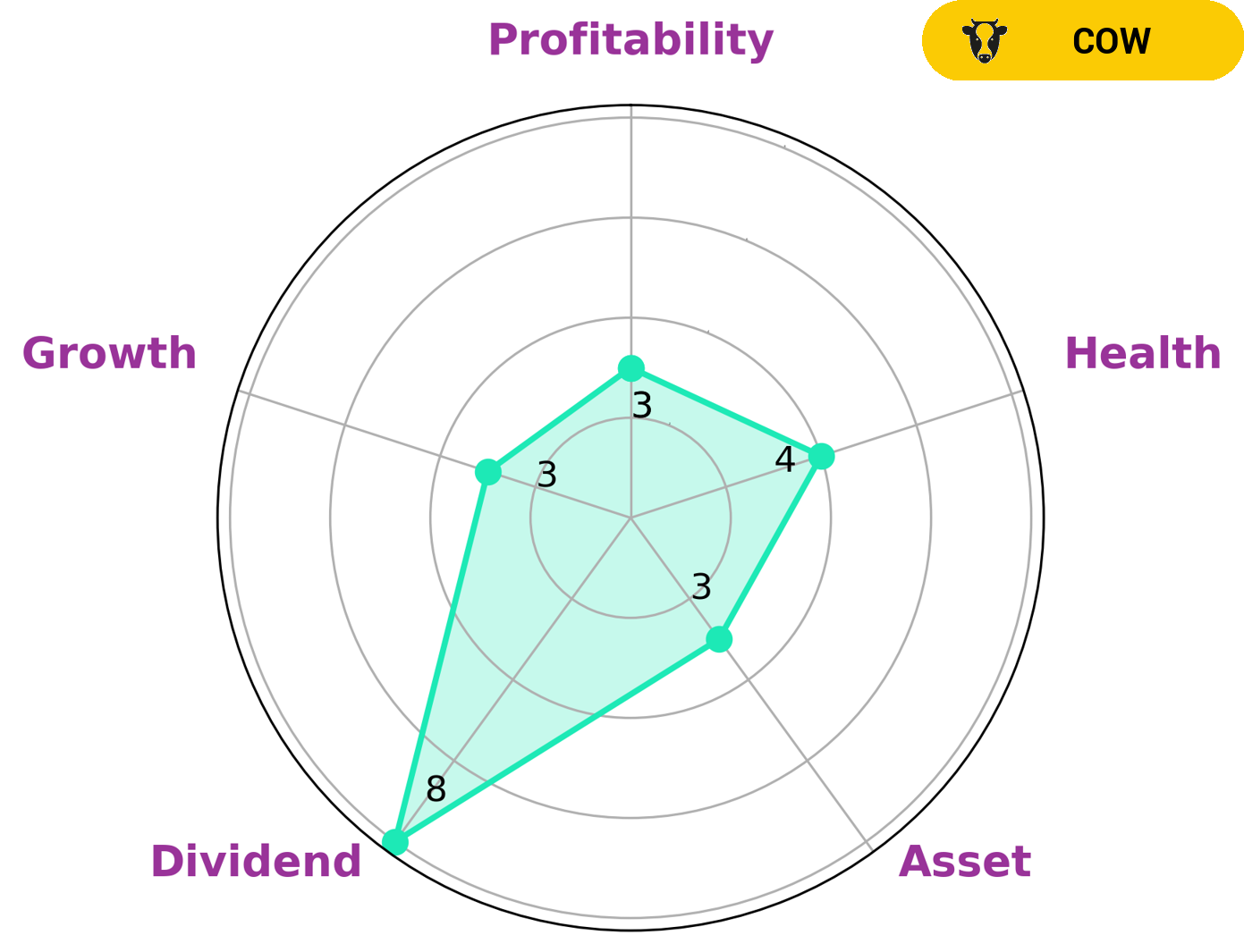

SIXTH STREET SPECIALTY LENDING is a company whose fundamentals reflect its long term potential. According to the VI Star Chart, the company has an intermediate health score of 4/10 considering its cashflows and debt, indicating that it is likely to pay off debt and fund future operations. While SIXTH STREET SPECIALTY LENDING is strong in dividend, it is weak in asset, growth and profitability. The company is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes it an attractive prospect for investors who are looking for an income stream from their investments. Furthermore, SIXTH STREET SPECIALTY LENDING also offers capital appreciation potential due to its healthy cash flows and debt management. Value investors may be interested in this company due to its low valuation and potential for growth. Additionally, dividend investors may benefit from the stability and sustainability of the dividends paid out by the company. Furthermore, long-term investors may also benefit from SIXTH STREET SPECIALTY LENDING’s potential for capital appreciation due to its low valuation and healthy financials. In conclusion, SIXTH STREET SPECIALTY LENDING is a company with strong fundamentals that offers potential for both income and capital appreciation. Its low valuation makes it attractive to value investors, while its healthy dividends make it appealing to dividend investors. Long-term investors may also benefit from its potential for capital appreciation. More…

VI Peers

It competes in the specialty lending space with other companies such as Golub Capital BDC Inc, Portman Ridge Finance Corp, and OFS Capital Corp. All four companies strive to provide innovative and tailored financial solutions to meet the needs of their customers.

– Golub Capital BDC Inc ($NASDAQ:GBDC)

Golub Capital BDC Inc is a business development company (BDC) that provides middle-market companies with flexible financing solutions. As of 2023, it has a market cap of 2.25 billion and a Return on Equity of 3.77%. The company’s market capitalization is an indication of its financial strength and market presence, while its ROE shows its ability to generate profits from its invested capital. As an investment firm, Golub Capital BDC Inc has the ability to provide customized financing solutions to its clients and has proven its worth in the middle-market financing space.

– Portman Ridge Finance Corp ($NASDAQ:PTMN)

Portman Ridge Finance Corp is an asset management company that specializes in providing capital solutions to financial institutions and corporations. The company has a market capitalization of 214.28M as of 2023, which represents the total market value of its outstanding stock. The company has a negative return on equity (-1.97%) which is indicative of the low profitability of its investments. Portman Ridge Finance Corp is facing challenges in its ability to generate profits on its investments, which is impacting its overall market capitalization.

– OFS Capital Corp ($NASDAQ:OFS)

OFS Capital Corp is a publicly traded business development company that provides debt and equity capital to lower middle-market companies. It acts as an alternative source of financing for companies that may not be able to access traditional bank financing in the current market. As of 2023, OFS Capital Corp has a market capitalization of 133.66M, which is a measure of the company’s total value based on the current market price of its shares. Additionally, its Return on Equity (ROE) is 2.34%, which measures the company’s profitability by assessing how much profit it has earned on its shareholders’ equity over a certain period of time.

Summary

Sixth Street Specialty Lending, Inc. (NYSE: SIX) is an alternative asset management firm focused on providing capital solutions to the middle market. It specializes in providing debt financing solutions to companies with complex capital structures and challenging credit profiles. The company’s investment strategy is to provide customized financing solutions to support the growth and operations of these businesses. Raymond James Financial Services Advisors Inc. recently invested in SIX, indicating their confidence in the company’s potential.

The company has a strong balance sheet, good liquidity, and healthy cash flows, making it a relatively safe investment choice. With its solid fundamentals, SIX looks poised for growth and could be a good long-term investment for those who are looking for a reliable and secure return.

Recent Posts