NEWTEKONE INC Reports Fourth Quarter FY2022 Financial Results on February 27 2023

March 25, 2023

Earnings Overview

Newtekone Inc ($BER:1N31) announced their financial results for the fourth quarter of FY2022 on February 27 2023, with the period ending on December 31 2022. Their total revenue for the reported quarter was USD -2.2 million, a decrease of 111.1% compared to the same period in the prior year. Additionally, their net income was reported as USD 23.6 million, a decrease of 36.3% from the year before.

Market Price

The company’s stock opened the day at €18.4 and closed at €18.1, representing a 0.3% increase from the previous closing price of €18.1. The company also reported that their overall financial performance was in line with the previous year and that they were able to reduce their operating expenses by 3%. Overall, NEWTEKONE INC reported a strong fourth quarter FY2022 financial performance and investors remain optimistic about the future of the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newtekone Inc. More…

| Total Revenues | Net Income | Net Margin |

| 105.17 | 32.31 | 30.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newtekone Inc. More…

| Operations | Investing | Financing |

| -138.37 | 0 | -5.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newtekone Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 998.9 | 623.54 | 15.25 |

Key Ratios Snapshot

Some of the financial key ratios for Newtekone Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.8% | – | – |

| FCF Margin | ROE | ROA |

| -131.6% | 6.3% | 2.4% |

Analysis

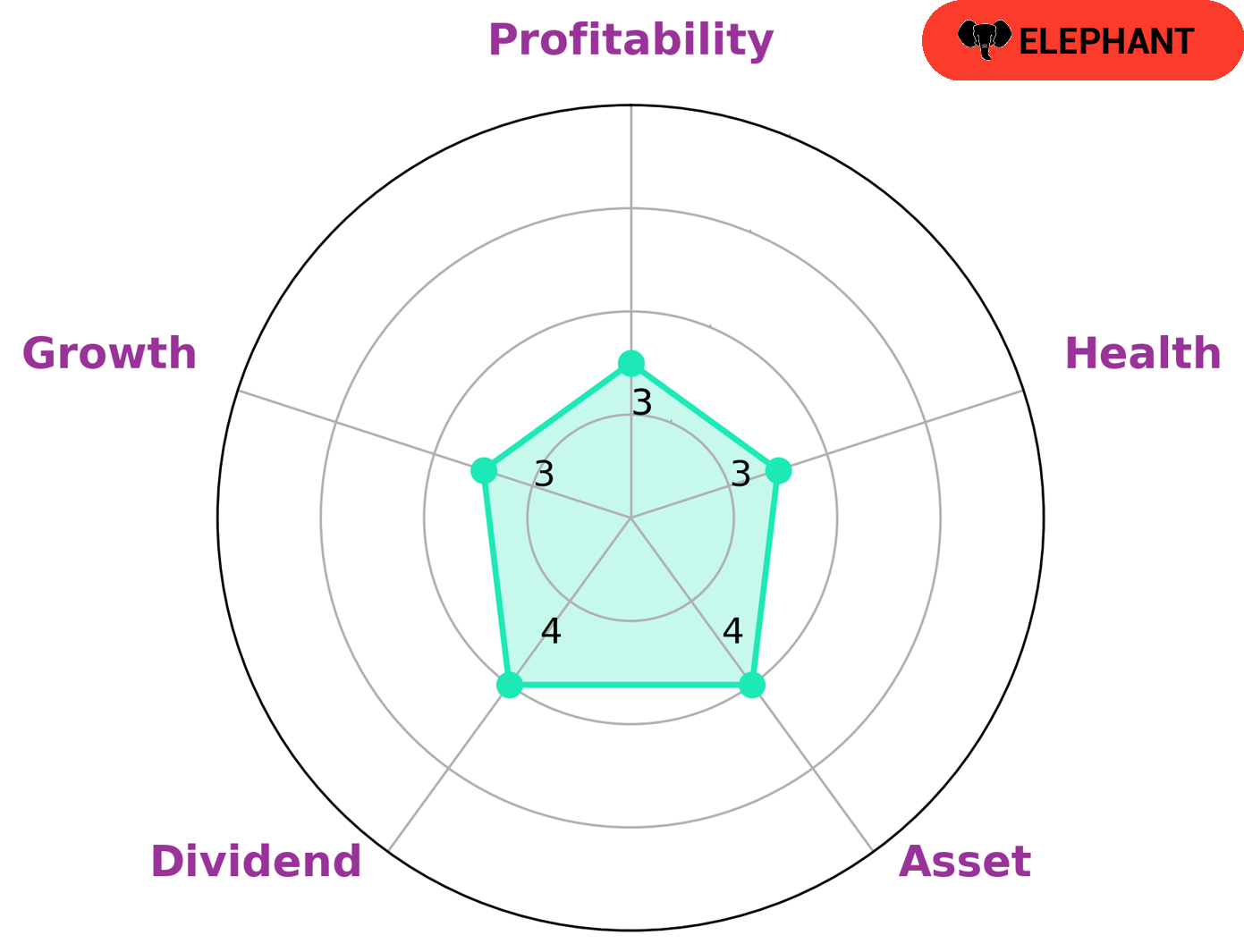

At GoodWhale, we perform comprehensive analyses of company’s wellbeing to help investors form an informed opinion. We recently looked into the wellbeing of NEWTEKONE INC and based on our Star Chart analysis, we concluded that the company has a low health score of 3/10 considering its cashflows and debt, making it less likely to sustain future operations in times of crisis. Our analysis classified NEWTEKONE INC as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. We concluded that the company is strong in medium in asset, dividend and weak in growth, profitability. With such qualities, Newtekone Inc may be of particular interest to investors looking to make long-term investments or those looking for a stable, yet profitable income stream. More…

Summary

NEWTEKONE INC reported a significant decrease in total revenue and net income for their fourth quarter of FY2022, ending on December 31 2022. Total revenue decreased 111.1% from the same period of the previous year and net income decreased 36.3%. This suggests that investing in NEWTEKONE INC may not be a profitable decision at this time. Investors should monitor the company’s performance closely over the coming quarters to determine if the trend of decreasing financials can be reversed.

Recent Posts