Main Street Capital Reports Positive Q1 Private Loan Portfolio Activity

April 14, 2023

Trending News ☀️

Main Street Capital ($NYSE:MAIN) Corporation (MAIN STREET CAPITAL) has reported positive Q1 private loan portfolio activity. MAIN STREET CAPITAL is a principal investment firm that specializes in providing long-term debt and equity capital to lower middle market companies. The firm also invests in these businesses through structured finance, including junior subordinated debt, senior debt, preferred equity and common stock.

MAIN STREET CAPITAL also reported that they had managed to maintain strong asset quality in their private loan portfolio. MAIN STREET CAPITAL continues to focus on providing capital to lower middle market companies and will continue to monitor the private loan portfolio activity closely.

Market Price

The stock opened at $39.4 and closed at $39.2, only a slight decrease from the previous closing price of $39.2. This suggests that investors remain confident in the company’s ability to deliver strong returns in the future. Main Street Capital’s private loan portfolio contains a variety of loans, ranging from corporate finance to venture capital, and the company has been able to consistently generate profits from these investments over the past year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MAIN. More…

| Total Revenues | Net Income | Net Margin |

| 331.15 | 241.61 | 73.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MAIN. More…

| Operations | Investing | Financing |

| -246.94 | – | 263.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MAIN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.24k | 2.13k | 26.87 |

Key Ratios Snapshot

Some of the financial key ratios for MAIN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.8% | – | – |

| FCF Margin | ROE | ROA |

| -74.6% | 8.1% | 3.9% |

Analysis

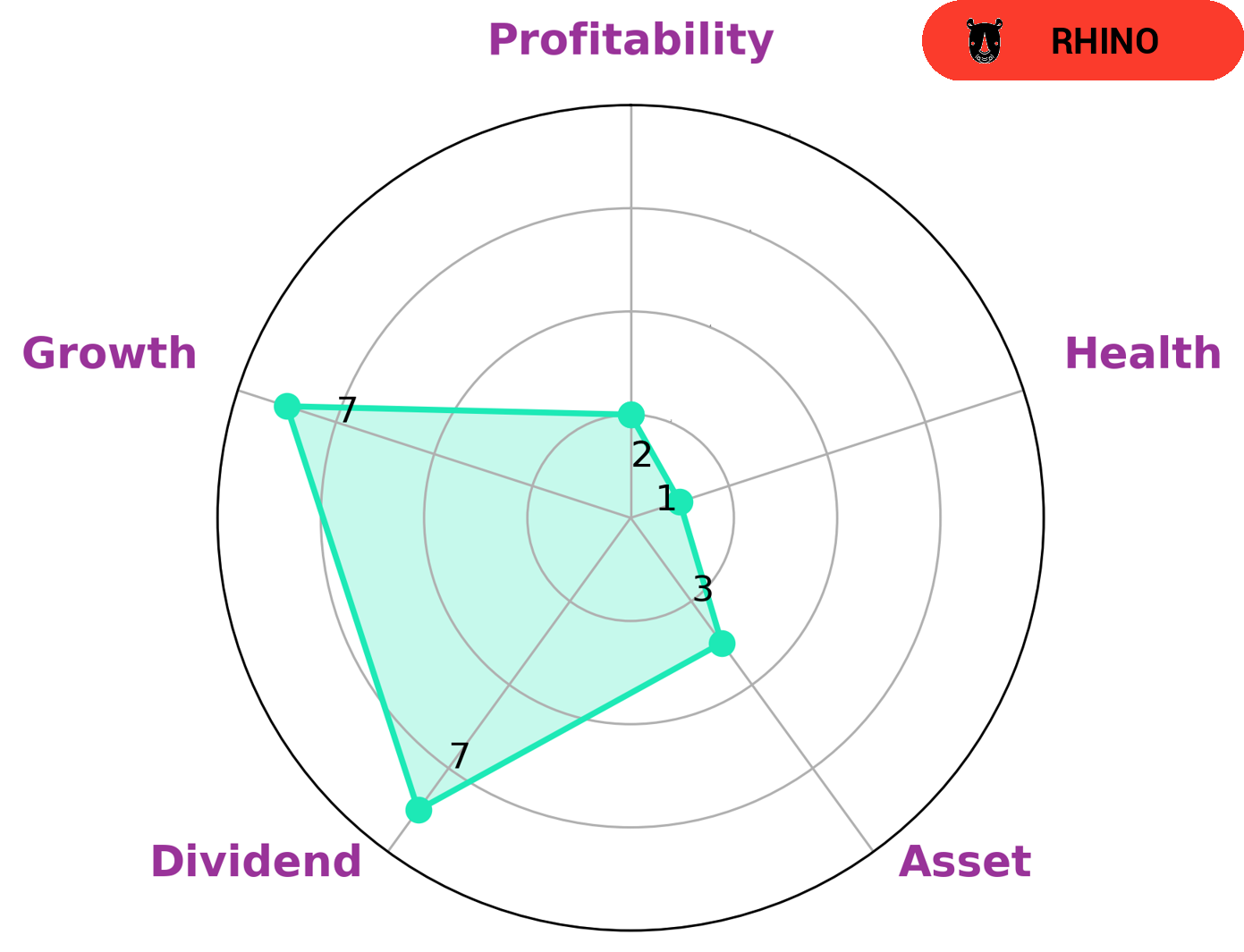

At GoodWhale, we offer our clients an analysis of the financials of MAIN STREET CAPITAL. Our assessment of the company’s financial situation was not favorable, as indicated on our Star Chart. Our analysis suggested that MAIN STREET CAPITAL has a low health score of 1 out of 10, suggesting that the company is less likely to sustain future operations in the event of a crisis. We classify MAIN STREET CAPITAL as a ‘rhino’ type of company, meaning that they have achieved moderate revenue or earnings growth. While MAIN STREET CAPITAL is strong in dividend, and growth, it is weak in asset and profitability. This makes the company an interesting prospect for investors looking for a steady dividend yield and potential future growth but who are willing to take on a certain amount of risk, such as value investors or aggressive dividend investors. More…

Peers

The competition between Main Street Capital Corp and its competitors is fierce. Carlyle Secured Lending Inc, Sierra Income Corp, and BlackRock TCP Capital Corp are all vying for a piece of the pie, and each company has its own unique strengths and weaknesses. Main Street Capital Corp has a strong reputation and a long history of success, but its competitors are not far behind. Carlyle Secured Lending Inc has a more diversified portfolio and a higher risk tolerance, while Sierra Income Corp has a more conservative approach and a focus on income-producing investments. BlackRock TCP Capital Corp is the newest player on the scene, but it has already made a name for itself with its innovative investment strategies.

– Carlyle Secured Lending Inc ($NASDAQ:CGBD)

Carlyle Secured Lending Inc is a US based company that focuses on providing secured loans to borrowers. The company operates in two segments, Carlyle Lending and Carlyle Asset Management. Carlyle Lending offers loans to borrowers using real estate as collateral while Carlyle Asset Management provides loans against other types of collateral. As of 2022, Carlyle Secured Lending Inc had a market cap of 658.55M and a ROE of 7.86%.

– Sierra Income Corp ($NASDAQ:TCPC)

BlackRock TCP Capital Corp is a publicly traded business development company that focuses on providing financing solutions to middle market companies in the United States. The company has a market cap of 687.43 million as of 2022 and a return on equity of 4.28 percent. BlackRock TCP Capital Corp was founded in 1997 and is headquartered in Santa Monica, California.

Summary

Main Street Capital recently announced their Q1 private loan portfolio activity, providing investors with an overview of their investments in the first quarter of the year. Overall, Main Street Capital’s Q1 private loan portfolio activity provided investors with an encouraging update on their investments.

Recent Posts