MAIN dividend yield – Main Street Capital Increases Dividend by 2.2% and Pays Supplementary Dividend of $0.225

May 3, 2023

Trending News 🌥️

Main Street Capital ($NYSE:MAIN) Corporation (MAIN STREET CAPITAL) recently announced a 2.2% increase in its monthly dividend rate. The new rate will be $0.23 per share, as well as an additional one-time dividend of $0.225. This marks the 10th consecutive year that Main Street Capital has increased its dividend rate, demonstrating its commitment to providing shareholders with above-average returns and growing income. Main Street Capital is a publicly traded business development company that provides long-term debt and equity capital to small and lower middle-market companies in the United States.

It also offers customized portfolio solutions for investors seeking exposure to private equity investments in small and lower middle-market companies. The dividend increase and supplemental dividend come as good news for shareholders, as it enables them to benefit from Main Street Capital’s impressive growth and consistent dividend payments. This increase in the dividend rate underscores Main Street Capital’s commitment to delivering above-average returns and growing income for its investors.

Dividends – MAIN dividend yield

This is the third consecutive year that MAIN STREET CAPITAL has issued an annual dividend per share of 2.62 USD. With an average dividend yield of 6.11%, MAIN STREET CAPITAL has proven itself to be a dependable long-term dividend stock. In addition to the increase in its annual dividend, MAIN STREET CAPITAL has also issued a supplementary dividend of 0.225 USD. This is the third consecutive year that MAIN STREET CAPITAL has issued a supplementary dividend, providing additional returns to its shareholders.

For investors looking for income, MAIN STREET CAPITAL could be a suitable option. With a dividend yield of 6.11%, it offers reliable dividends over the long term and additional returns with the supplementary dividends.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MAIN. More…

| Total Revenues | Net Income | Net Margin |

| 331.15 | 241.61 | 73.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MAIN. More…

| Operations | Investing | Financing |

| -246.94 | – | 263.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MAIN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.24k | 2.13k | 26.87 |

Key Ratios Snapshot

Some of the financial key ratios for MAIN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.8% | – | – |

| FCF Margin | ROE | ROA |

| -74.6% | 8.1% | 3.9% |

Stock Price

The company’s stock opened at $40.4, in line with its previous closing price of $40.5, and closed at $40.4, representing a modest 0.4% drop from the previous day’s closing price. This marks the second consecutive quarter in which MAIN STREET CAPITAL has increased its dividend rate, indicating a commitment to delivering value back to shareholders. With this dividend increase and supplementary payment, shareholders now have access to even more cash flow generated by MAIN STREET CAPITAL’s operations. Live Quote…

Analysis

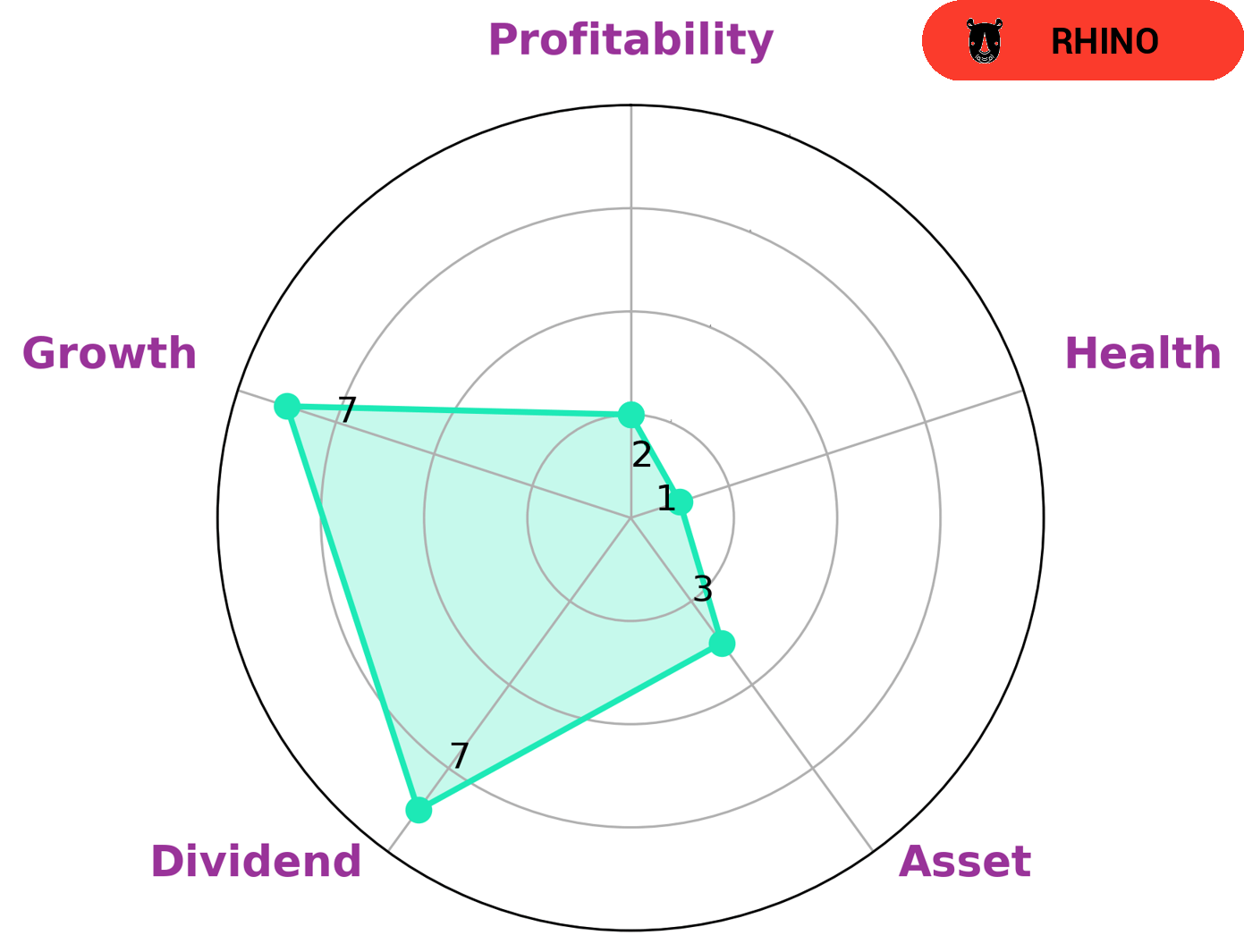

GoodWhale recently conducted an analysis of MAIN STREET CAPITAL’s wellbeing and according to our Star Chart, MAIN STREET CAPITAL has a low health score of 1/10 when it comes to its cashflows and debt. This score indicates that MAIN STREET CAPITAL is less likely to sustain future operations in times of crisis. We have classified MAIN STREET CAPITAL as a ‘rhino’ type of company, meaning that it has achieved moderate revenue or earnings growth. Investors who may be interested in such a company may be those looking for a strong dividend yield, as well those looking to capitalize on the moderate growth potential. However, the company may not be attractive to those seeking asset accumulation or high profitability. More…

Peers

The competition between Main Street Capital Corp and its competitors is fierce. Carlyle Secured Lending Inc, Sierra Income Corp, and BlackRock TCP Capital Corp are all vying for a piece of the pie, and each company has its own unique strengths and weaknesses. Main Street Capital Corp has a strong reputation and a long history of success, but its competitors are not far behind. Carlyle Secured Lending Inc has a more diversified portfolio and a higher risk tolerance, while Sierra Income Corp has a more conservative approach and a focus on income-producing investments. BlackRock TCP Capital Corp is the newest player on the scene, but it has already made a name for itself with its innovative investment strategies.

– Carlyle Secured Lending Inc ($NASDAQ:CGBD)

Carlyle Secured Lending Inc is a US based company that focuses on providing secured loans to borrowers. The company operates in two segments, Carlyle Lending and Carlyle Asset Management. Carlyle Lending offers loans to borrowers using real estate as collateral while Carlyle Asset Management provides loans against other types of collateral. As of 2022, Carlyle Secured Lending Inc had a market cap of 658.55M and a ROE of 7.86%.

– Sierra Income Corp ($NASDAQ:TCPC)

BlackRock TCP Capital Corp is a publicly traded business development company that focuses on providing financing solutions to middle market companies in the United States. The company has a market cap of 687.43 million as of 2022 and a return on equity of 4.28 percent. BlackRock TCP Capital Corp was founded in 1997 and is headquartered in Santa Monica, California.

Summary

Main Street Capital (MAIN) recently announced a hike of 2.2% in its monthly dividend to $0.23 and a supplementary dividend of $0.225. This marks MAIN’s fifth consecutive year of dividend increases, demonstrating the company’s commitment to enhancing shareholder value. MAIN’s portfolio is diversified across a variety of industries, with a focus on mid-market businesses that are undervalued or are undergoing a period of transition. With prudent capital allocation and disciplined capital management, MAIN has positioned itself to benefit from the long-term prospects of its portfolio companies and continue to deliver attractive returns for investors.

Recent Posts