Louisiana State Employees Retirement System Invests in Affiliated Managers Group,

January 5, 2023

Trending News 🌥️

Affiliated Managers ($NYSE:AMG) Group, Inc. (AMG) is a publicly traded asset management company headquartered in Massachusetts. The investment in AMG is a long-term strategic move that will allow LASERS to benefit from AMG’s financial expertise and long-term performance record. The new investment in AMG will allow LASERS to diversify its portfolio, reduce risk, and benefit from the growth potential offered by the asset management firm. Furthermore, the new investment will provide LASERS with access to AMG’s global network of asset managers and financial advisors. The new investment in AMG will also provide LASERS with an opportunity to benefit from AMG’s innovative products and services.

These include customized investment solutions that are tailored to meet each client’s needs and risk tolerance, as well as a wide range of services such as portfolio construction, asset allocation, and financial planning. The new investment in Affiliated Managers Group, Inc. shows LASERS’ commitment to diversifying its portfolio and taking advantage of the potential offered by the asset management firm. The new investment will open up a variety of opportunities for LASERS to benefit from AMG’s expertise and long-term performance record.

Stock Price

AMG’s stock opened at $160.9 and closed at $160.6, a 1.3% increase from the previous closing price of $158.4. This investment is a major vote of confidence in the company and shows AMG is well positioned to take advantage of the current market conditions. The company provides asset management services to a wide range of clients, including institutional investors, governments, financial institutions, and high net worth individuals. The company has offices in the United States, Europe, and Asia Pacific, as well as strategic partnerships with leading global financial institutions. In addition to providing asset management services, AMG also provides advisory services to its clients, such as portfolio management and retirement planning.

The Louisiana State Employees Retirement System’s investment in AMG is a sign that the company is well positioned for growth in the future. It is a major vote of confidence from one of the leading pension funds in the US and shows that AMG is a reliable partner for long-term investments. This could be a major boost for AMG’s future success and could open up new opportunities for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Affiliated Managers. More…

| Total Revenues | Net Income | Net Margin |

| 2.48k | 546.4 | 21.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Affiliated Managers. More…

| Operations | Investing | Financing |

| 1.16k | -672.5 | -951.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Affiliated Managers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.43k | 4.29k | 68.81 |

Key Ratios Snapshot

Some of the financial key ratios for Affiliated Managers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | 9.6% | 47.1% |

| FCF Margin | ROE | ROA |

| 46.2% | 26.5% | 8.7% |

VI Analysis

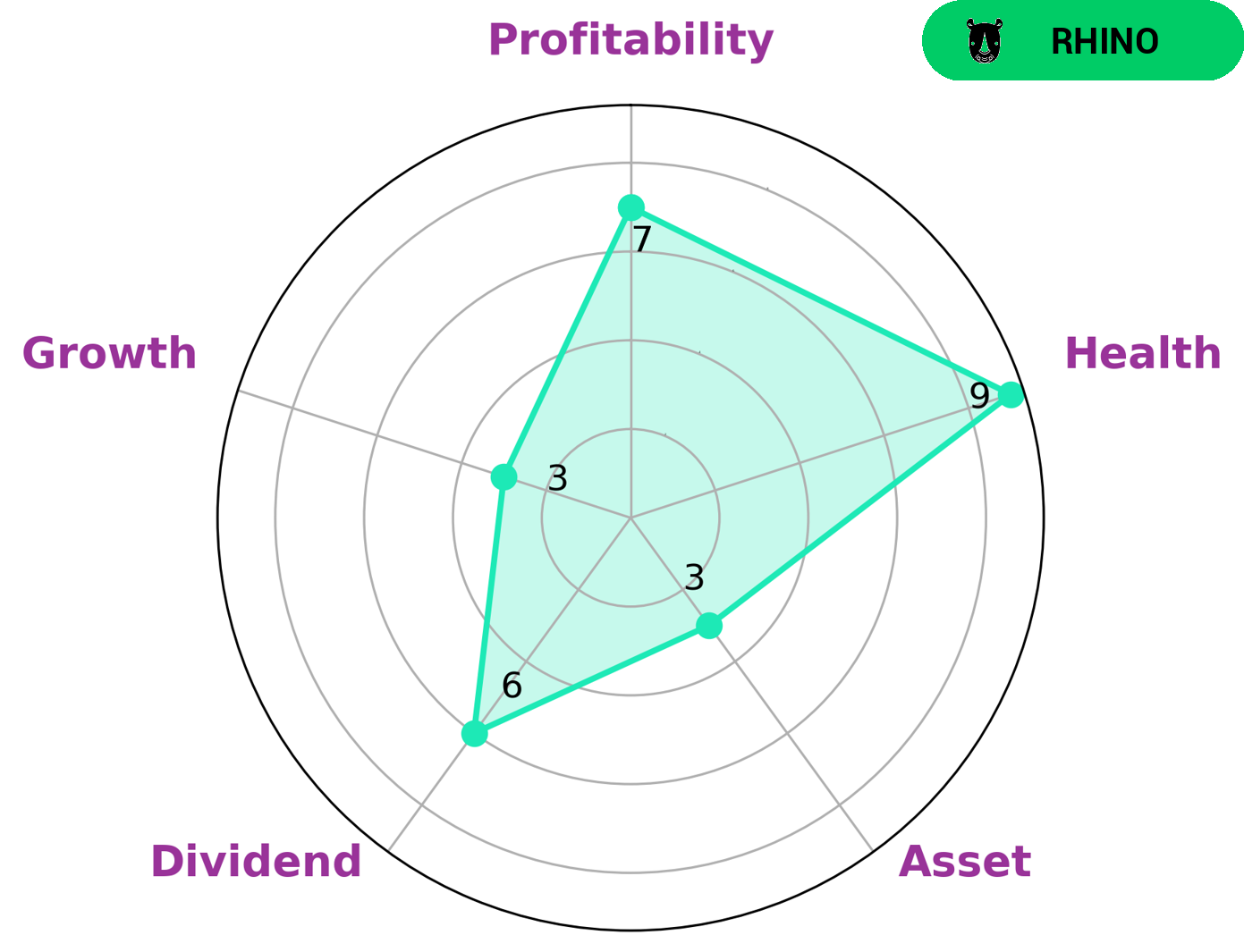

Investors interested in a company with a strong cashflow and debt base may be interested in AFFILIATED MANAGERS. According to the VI Star Chart, AFFILIATED MANAGERS has a high health score of 9/10, reflecting that the company is capable of sustaining future operations in times of crisis. In terms of profitability, AFFILIATED MANAGERS has a strong score, while its dividend and asset growth are both only medium. This indicates that the company is likely to generate steady profits, but may not be able to grow substantially over time. AFFILIATED MANAGERS is classified as a ‘rhino’ company, which means that it has achieved moderate revenue or earnings growth. This type of company may appeal to investors who seek steady returns without expecting significant appreciation of the stock price. Overall, the fundamentals of AFFILIATED MANAGERS reflect its long-term potential, and investors looking for a stable stock with moderate growth may find it an attractive option. More…

VI Peers

Its competitors are BlackRock Inc, CI Financial Corp, and Pinnacle Investment Management Group Ltd.

– BlackRock Inc ($NYSE:BLK)

BlackRock Inc is a publicly traded company with a market capitalization of $90.05 billion as of early 2021. The company operates as an investment management firm and has a strong focus on exchange-traded funds (ETFs). As of early 2021, BlackRock managed nearly $8 trillion in assets on behalf of its clients. The company has a return on equity (ROE) of 12.63%.

BlackRock was founded in 1988 and has grown to become one of the largest asset managers in the world. The company is headquartered in New York City and has offices in dozens of countries around the globe. BlackRock serves a wide range of clients, including institutional investors, financial advisors, and individual investors.

– CI Financial Corp ($TSX:CIX)

As of 2022, CI Financial Corp has a market cap of 2.54B and a Return on Equity of 30.25%. The company is a leading provider of financial services in Canada, with a focus on asset management and wealth management. The company has a strong track record of delivering superior performance for its clients and shareholders.

– Pinnacle Investment Management Group Ltd ($ASX:PNI)

Pinnacle Investment Management Group Ltd is a global asset management firm with over $1.67 billion in assets under management. The company offers a wide range of investment products and services to institutional and retail investors across the globe. Pinnacle is headquartered in Sydney, Australia and has offices in London, New York, Hong Kong, and Singapore.

Summary

The Louisiana State Employees Retirement System (LASERS) has recently made an investment into Affiliated Managers Group, Inc. (AMG). AMG is a publicly traded asset management company that specializes in investing in boutique firms that manage investments for clients across a variety of sectors. The investment from LASERS is seen as a sign of confidence in the company and its ability to generate long-term returns for investors.

AMG has a track record of strong performance, with a focus on risk management and diversification. It is expected that the investment from LASERS will further strengthen AMG’s position in the asset management industry and help it to capitalize on potential opportunities in the future.

Recent Posts