LCS stock dividend – Brompton Lifeco Split Corp Declares 0.075 Cash Dividend

March 19, 2023

Dividends Yield

On February 25 2023, Brompton Lifeco Split ($TSX:LCS) Corp announced a 0.075 cash dividend for its shareholders. This new dividend follows the trend of annual dividends per share over the past 3 years which totaled 0.75 CAD, 0.82 CAD and 0.15 CAD. The dividend yields from 2020 to 2022 were 11.33%, 12.98% and 2.31%, respectively, with an average dividend yield of 8.87%.

Price History

On Monday, the stock opened at CA$6.0 and closed at CA$6.1, representing a 1.2% increase from its previous closing price of CA$6.0. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LCS. More…

| Total Revenues | Net Income | Net Margin |

| -13.81 | -19.54 | 112.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LCS. More…

| Operations | Investing | Financing |

| -62.99 | – | 63.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LCS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 124.33 | 91.97 | 1.3 |

Key Ratios Snapshot

Some of the financial key ratios for LCS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 38.3% | – | – |

| FCF Margin | ROE | ROA |

| 456.2% | -81.6% | -7.8% |

Analysis

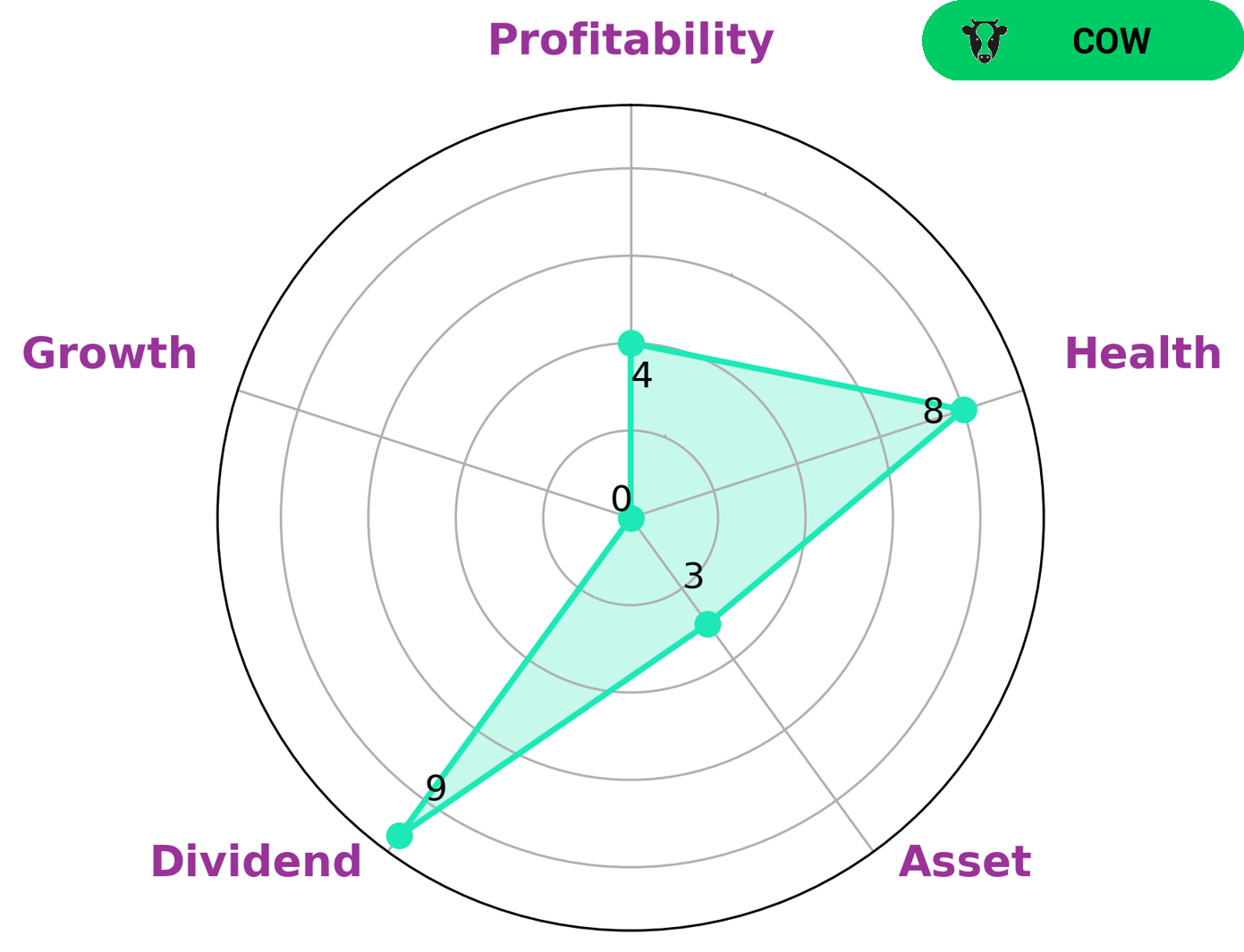

As part of our analysis of BROMPTON LIFECO SPLIT’s wellbeing, we broke down the company into different metrics using the Star Chart. We classified BROMPTON LIFECO SPLIT as a ‘cow’, which implies that it has a track record of paying out consistent and sustainable dividends. This makes BROMPTON LIFECO SPLIT an attractive stock for investors who prioritize dividend yield. Furthermore, BROMPTON LIFECO SPLIT scored strong in dividend, medium in profitability and weak in asset growth. GoodWhale also assessed the company’s health score of 8/10, with regard to cashflows and debt. This indicates that BROMPTON LIFECO SPLIT is capable of paying off its debt and funding future operations. More…

Peers

The competition between Brompton Lifeco Split Corp and its competitors is fierce, as these companies vie for the attention of investors seeking a reliable income stream. Life & Banc Split Corp, Dividend 15 Split Corp II, and Brompton Split Banc Corp all offer innovative solutions to meet the needs of their customers, allowing them to make informed investments decisions and grow their wealth. Each company offers a unique set of services and products, catering to different types of investors and their individual needs.

– Life & Banc Split Corp ($TSX:LBS.PR.A)

Life & Banc Split Corp is a mutual fund company that specializes in providing income solutions to investors. The company’s market cap of 316.76M as of 2023 reflects the value of the company and its ability to generate profits for shareholders. Life & Banc Split Corp has a Return on Equity (ROE) of -11.18%, indicating that it is not generating enough profit from its investments to cover its costs. The company’s performance indicates that it needs to make changes to improve its profitability and increase shareholder value.

– Dividend 15 Split Corp II ($TSX:DF)

Dividend 15 Split Corp II is a publicly traded corporation that invests in a portfolio of dividend-paying stocks. The company’s market cap of 146.89M as of 2023 reflects the overall performance and potential of the company. It has a Return on Equity (ROE) of 23.18%, which is an indication of the company’s ability to generate profits relative to its shareholders’ equity. The company’s focus on dividend-paying stocks provides investors with a steady income stream, as well as potential capital appreciation over time.

– Brompton Split Banc Corp ($TSX:SBC)

Brompton Split Banc Corp is a financial services company that provides banking, asset management, and related services. With a market cap of 191.75M as of 2023, the company is performing relatively well despite its low Return on Equity of -7.39%. Although this Return on Equity is below the industry average, it indicates that the company is still generating a profit from its investments. The company’s market cap indicates that investors are confident in the company’s ability to generate returns in the future.

Summary

Investing in BROMPTON LIFECO SPLIT could be a viable option for investors looking to earn dividend income. Over the past three years, the company has paid annual dividends per share of 0.75 CAD, 0.82 CAD and 0.15 CAD, resulting in average dividend yields of 11.33%, 12.98% and 2.31%, respectively. These yields are higher than the industry average and are indicative of solid dividend-paying capacity. As such, investors looking to generate solid income from dividend payments should consider investing in BROMPTON LIFECO SPLIT.

Recent Posts