Group One Trading L.P. Significantly Reduces Stake in Burford Capital Limited

June 2, 2023

🌧️Trending News

Burford Capital ($NYSE:BUR) Limited, a publicly traded company listed on the London Stock Exchange, is a global finance and investment management firm that specializes in providing litigation finance and other legal finance solutions. Recently, Group One Trading L.P. filed a disclosure with the U.S. Securities and Exchange Commission (SEC) indicating that it had significantly reduced its stake in Burford Capital Limited. It is unclear why Group One Trading L.P. reduced its stake in Burford Capital Limited, but the news sent shockwaves through the markets as investors reacted to the news.

Despite the news of Group One Trading L.P.’s decreased stake, Burford Capital Limited’s stock price has remained relatively stable in the wake of the disclosure. This could be attributed to investors’ continued faith in the company’s long-term prospects, as well as its ability to weather market volatility and remain a trusted provider of litigation finance and other legal finance solutions.

Stock Price

On Tuesday, Burford Capital Limited (BURFORD CAPITAL) stock opened at $13.4 and closed at $13.1, down by 2.8% from previous closing price of 13.5. While the exact reasons for the sale have not been made public, it is likely that Group One Trading L.P. is attempting to diversify its portfolio and reduce its exposure to BURFORD CAPITAL. The news of the sale sent shockwaves through the markets, leading to the drop in BURFORD CAPITAL’s stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Burford Capital. More…

| Total Revenues | Net Income | Net Margin |

| 158.09 | 30.51 | 19.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Burford Capital. More…

| Operations | Investing | Financing |

| -466.1 | -0.41 | 399.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Burford Capital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.29k | 1.9k | 7.97 |

Key Ratios Snapshot

Some of the financial key ratios for Burford Capital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -21.6% | – | – |

| FCF Margin | ROE | ROA |

| -295.1% | 4.1% | 1.6% |

Analysis

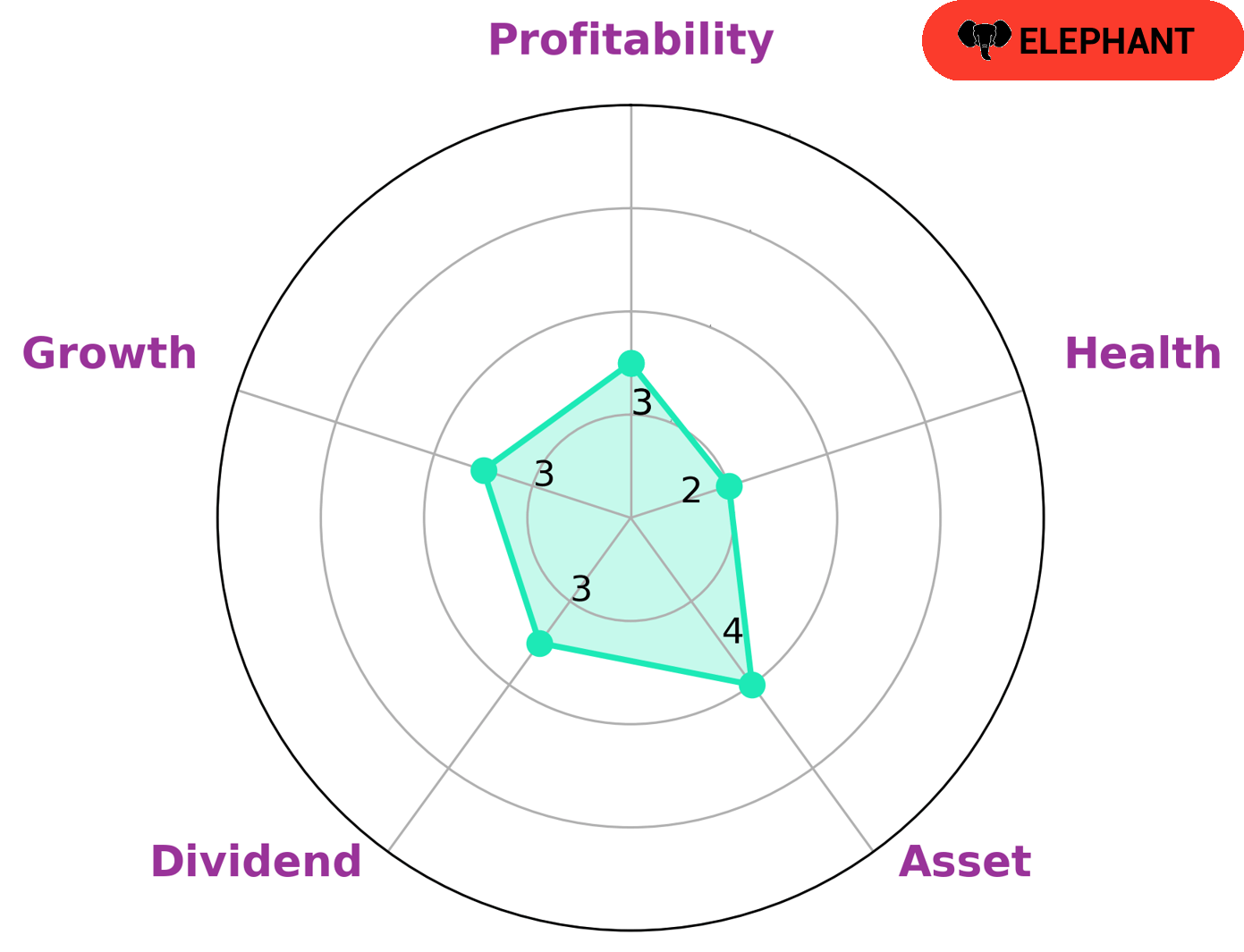

GoodWhale has conducted an analysis of BURFORD CAPITAL‘s financials and generated a star chart to provide an overall assessment of the company. The star chart indicates that BURFORD CAPITAL has a low health score of 2/10 with regard to its cashflows and debt. This suggests that BURFORD CAPITAL is less likely to pay off debt and fund future operations. In terms of company classification, BURFORD CAPITAL is categorized as an ‘elephant’, defined as a company with more assets than liabilities. Therefore, investors interested in such companies may include those seeking security from their investment with the assurance of a return over the long-term. Moreover, the star chart shows that BURFORD CAPITAL is strong in liquidity, medium in asset strength and weak in dividend, growth, and profitability. Investors should consider these data points and weigh them against their own financial goals when making decisions about whether to invest in BURFORD CAPITAL. More…

Peers

The company has a strong market position and is well-positioned to compete against its competitors: Prime Financial Group Ltd, Legal & General Group PLC, Blue Owl Capital Inc.

– Prime Financial Group Ltd ($ASX:PFG)

Since its establishment in 1992, Prime Financial Group has been providing a range of financial services to clients in Australia and New Zealand. These services include home loans, personal loans, credit cards, and investment products. The company has a market capitalization of $47.27 million and a return on equity of 8.53%. Prime Financial Group is a publicly listed company on the Australian Securities Exchange and has a strong presence in the Australian financial services industry.

– Legal & General Group PLC ($LSE:LGEN)

As of 2022, Legal & General Group PLC has a market capitalization of 13.66 billion and a return on equity of 15.54%. The company is a financial services provider that offers a range of products and services, including life insurance, annuities, investments, and retirement products. It has operations in the United Kingdom, the United States, and Europe.

– Blue Owl Capital Inc ($NYSE:OWL)

Blue Owl Capital Inc. is a publicly traded company with a market capitalization of $3.95 billion as of 2022. The company has a negative return on equity of -10.74%. Blue Owl Capital is a leading provider of financial services and products to individuals, businesses, and institutions. The company offers a wide range of services, including investment banking, asset management, capital markets, and advisory services.

Summary

Burford Capital Limited is a publicly traded firm specializing in litigation finance and professional services. This move indicates a shift in investor sentiment towards the company. Analysts suggest that investors should monitor the company’s performance and financials closely to determine if their holdings should be adjusted accordingly. With such a drastic reduction in holdings, Burford Capital Limited may be at risk of underperforming market expectations.

Recent Posts